Reality Check: Green Hydrogen Can Scale This Decade

A slew of new hydrogen projects in the works, coupled with sky-high fossil energy prices, point to a significant near-term role for green hydrogen.

The Myth: Green hydrogen will have a limited impact on global decarbonization during this decade.

The Reality: Green hydrogen is ready to play a major role in global emissions reductions by 2030.

No one could have anticipated the rate at which green hydrogen has established itself as a necessary part of our clean energy toolbox. This fuel and feedstock, produced using renewable energy, will be critical to decarbonizing large swaths of industry. Year after year, organizations have continually increased their projections of how much global electrolysis capacity will be online to produce hydrogen from electricity in 2030. Projections made this year are orders of magnitude greater than those from prior years (Exhibit 1).

Since 2019, over 34 countries have developed national strategies around hydrogen. In just the past six months, the EU’s green hydrogen targets for 2030 have quadrupled to 10 million metric tons (MMt), equivalent to roughly 100 GW of electrolyzer capacity, via the REPowerEU transition strategy. Given green hydrogen’s key role in decarbonizing industry and heavy transport, enabling domestic energy security, and stabilizing consumer prices, the world has acknowledged that we need green hydrogen at scale — and we need it faster than we ever thought.

Exhibit 1: Historic estimations of electrolysis capacity in 2030. Sources: Hydrogen Council, DNV Hydrogen Forecast to 2050; DNV Energy Transition Outlook 2020 and 2021; ETC, Making the Hydrogen Economy Possible

The question has now become: will green hydrogen be able to scale to make a meaningful reduction in emissions this decade?

All signs are pointing to a resounding yes — green hydrogen is ready to scale this decade. Its growth does not hinge on breakthroughs, but rather on the backbone of presently available and commercially mature technologies. The public and private sector are coming together to incentivize early adoption, with projects currently moving from megawatts to gigawatts. Real commitments and action are happening today.

Off-Taker Ambition Turns to Action

First-mover companies, keen to maintain their competitive edge in a world turning increasingly toward zero-emissions products and processes, are getting serious about transitioning to green hydrogen.

In steel manufacturing, a differentiated market for “green steel” is motivating project development today because a body of consumers are willing to pay the costs of a fully decarbonized product. Brad Davey, Executive Vice President of the global steel giant ArcelorMital, recently said that the company “foresee[s] a lot of demand for green steel — it is needed and it is wanted,” highlighting the automotive industry as an initial driver of demand. ArcelorMittal plans to produce 1.6 MMt of green steel by 2025. Henrik Henriksson, CEO of H2 Green Steel, a rapidly growing new player in the steel industry, said that “we already see demand for our green steel product growing faster than we can build out our commercial assets.” H2 Green Steel and Iberdrola are building a green hydrogen plant with an electrolysis capacity of 1 GW and a steel ore reduction process capacity of around 2 MMt that the companies plan to have in operation by 2025.

Emissions-conscious consumer-product companies, freight movers, and ports are charting the course for green hydrogen-derived marine shipping fuels. Major cargo contributors like Amazon, Unilever, and IKEA are driving demand for products transported with zero emissions and have called for full decarbonization of their freight by 2040 through participation in the Cargo Owners for Zero Emission Vessels (coZEV) alliance. A.P. Moller-Maersk, the world’s second largest container shipping fleet, has committed to halving emissions of each container shipped by 2030 and has already purchased twelve large container vessels powered by methanol, a derivative of hydrogen. Ports including the Port of Rotterdam, are keen to scale the port-side infrastructure required to supply these green fuels.

Fertilizer giant Yara signed the first commercial agreement for fossil-free green fertilizer with Lantmännen, a northern European agricultural cooperative. The project will replace fertilizer production’s typical fossil-based hydrogen feedstock with that of green hydrogen to produce an initial 60,000 to 80,000 tons of green fertilizer at a plant in Herova, Norway come 2024.

Many of these first-mover companies are banding together to aggregate demand and foster collaboration across the value chain. One global coalition hosted by RMI, the Green Hydrogen Catapult, has committed to bring 45 GW of electrolyzers to financial investment decision by 2026.

Manufacturing Capacity Grows

Manufacturing capacity is increasing worldwide, diversifying across electrolyzer types and suppliers. Automated manufacturing for high-throughput, low-cost production is common among new production facilities, many of them capable of gigawatt-scale production volumes. For example, NEL recently developed a 0.5 GW factory in Norway that can readily be scaled to 2 GW and is targeting installation of 10 GW per year of capacity by 2025. ITM is developing a 1.5 GW factory in England to add to its existing 1 GW factory, targeting 4 GW per year of production by 2024. Thyssenkrupp also plans to expand its 1 GW of production to 5 GW per year by 2025.

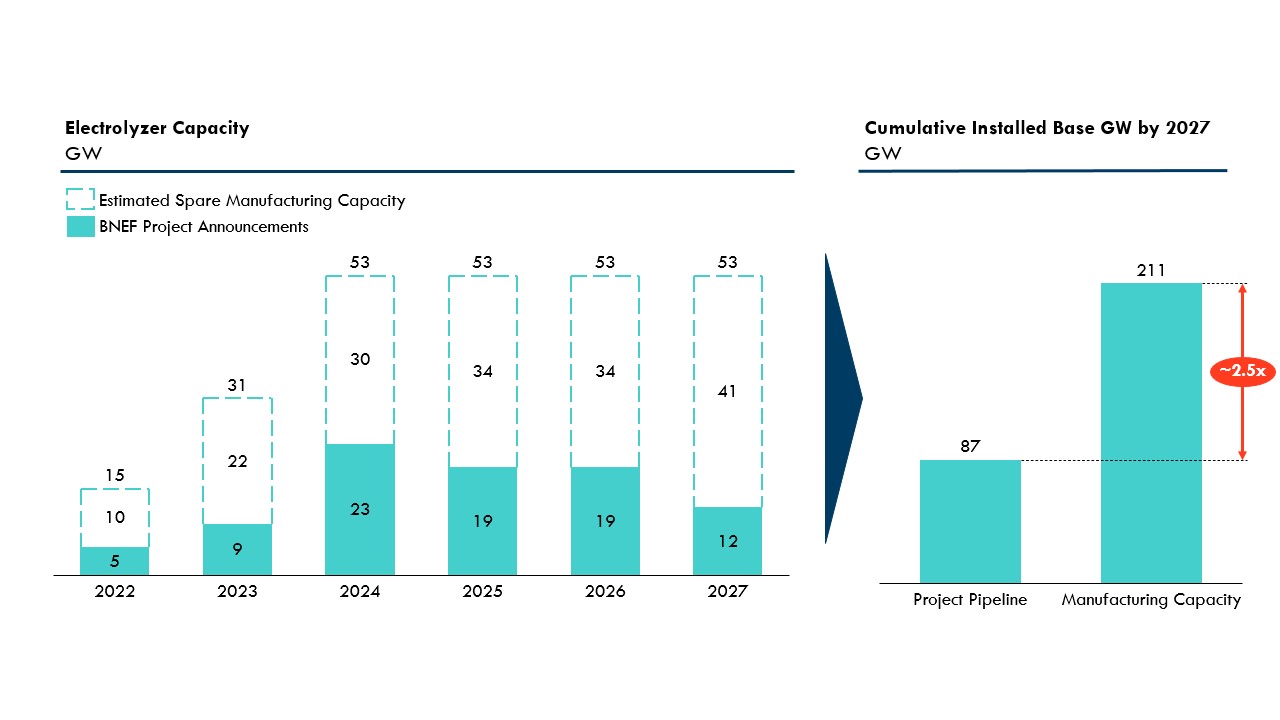

Available and planned manufacturing capacity will be able to supply the needs of an early market. From BNEF’s 2022 survey of announced electrolyzer manufacturing capacity plans, by 2027 the industry could produce a cumulative 210 GW of electrolyzers if manufacturing plants are fully utilized. That manufacturing potential is roughly two and a half times what would be needed to build out the cumulative electrolyzer project pipeline for the same time period.

Exhibit 2: Manufacturing capacity can meet the needs of an early market. Source: BNEF 2H 2022 Hydrogen Market Outlook.

Connecting Supply with Demand

Notably, existing infrastructure can help grow the market. 70 percent of existing natural gas pipelines in Italy are suitable for pure hydrogen, the US Gulf Coast region hosts 2,600 kilometers of existing hydrogen pipelines, and Europe is undertaking a major pipeline retrofit project to equip its infrastructure to carry pure hydrogen. As a bonus, pipelines can also act as storage reserves to ensure that hydrogen is available around the clock.

In efforts to limit costs or early infrastructure requirements, projects are emerging in locations that feature a strong combination of low-cost supply, sizable demand, access to geologic salt caverns for hydrogen storage, and either access to existing transportation networks or limited need to transport hydrogen. These locations — known as “hydrogen hubs” — can help cut costs, accelerate project development timelines, and provide focus to where investments and infrastructure are needed. Similarly, the establishment of “green shipping corridors” — maritime shipping routes using green fuel — is enabling the sector’s transition by localizing new infrastructure development and fuel supply to ports that are motivated to be early adopters.

Green hydrogen is well positioned to play a substantial role in emissions reductions by 2030. Gigawatt-scale projects are happening now, and demand is booming, driven by both the private and public sector. Manufacturing of electrolyzers is growing and will only accelerate as more and more project plans crystallize. Scaling this new technology does not mean starting from scratch, as existing infrastructure can be leveraged to get hydrogen where it needs to go, and early actors are simplifying the path forward through investments in hydrogen hubs or green shipping corridors. Green hydrogen is here — and it is here to stay.