workers and machinery in a solar panel manufacturing industry factory.

A Bull Is Loose in the Energy Shop, and Tariffs Are a Weak Lasso

Yesterday, the U.S. government presented a new challenge for the clean energy industry. The confused logic of the solar PV import tariff challenges all reason: intended to boost the domestic manufacturing of cells and modules—which currently employs less than 38,000 people—and add some jobs while reducing imports, the tariff also stands to threaten more jobs than it creates and improve financial returns for foreign-owned employers who prompted the trade case. In addition, it threatens to raise the cost of electricity for solar customers all across the nation and slow the biggest boom in solar deployment in U.S. history.

But the tariff will not successfully rein in the bull in the global coal shop: the Chinese ramp-up in cell and module manufacturing that has driven cost declines and global market disruption now appears primarily intended to meet domestic Chinese demand, which totaled 100 GW installed in the past three years—three times that seen in the United States. Meanwhile, the Indian government recently decided to cancel 16 GW of coal plants due to lack of interest among its constituent states, driven by attractive prices of renewables.

RMI expects any negative impacts on industry growth caused by the tariff will largely be mitigated by a combination of current global trends and innovation. In collaboration with industry stakeholders, Rocky Mountain Institute has identified a new wave of cost reduction that would mitigate the impact of the tariff for ground-mount systems, consistent with the industry’s history of ingenuity and sustained improvements throughout the value chain. As a result, RMI is optimistic that solar PV’s growth trajectory in the U.S. will continue in the years to come.

Recent Reductions Achieve Grid Parity

As demonstrated by Lazard’s market price tracking and recent smaller-scale projects in New Mexico, the much-harkened dream of solar cost parity with the U.S. grid is becoming a reality.

Over the last ten years, levelized solar contract prices have dropped by more than 70 percent in the U.S., no doubt fueled by federal and state regulatory support and scale-up in global industrial capacity. More recently, competition in the U.S. market and downstream business innovations have driven average annual cost reductions of 12 percent per year, inviting billions of dollars of investment and placing solar among the fastest-growing industries in the U.S.

The resulting cost competitiveness has stirred a hunger in every customer segment for cost-effective and clean electricity supply that is putting pressure on regulators, utilities, and energy retailers to pass through the solar savings or potentially lose their customers.

While the industry is currently in a state of growth, the attempt by the current administration is untimely as it risks breaking momentum just as the U.S. solar industry approaches a cycle of truly self-reinforcing growth.

New Approaches Will Offset the Tariff and Build Sustainable Jobs

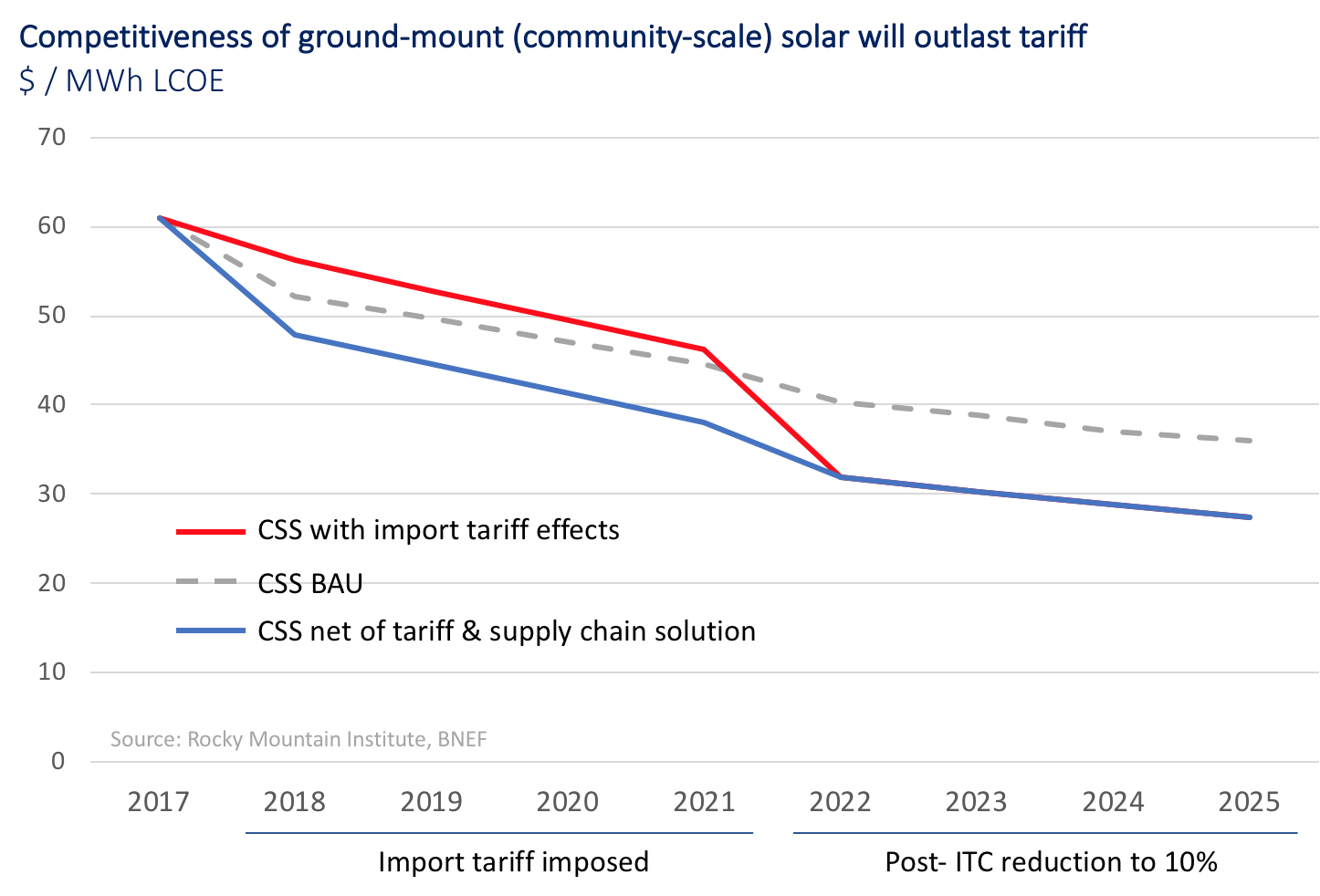

This slowing momentum need not become reality, despite a range of projections that the import tariff (at $.10/Wp in 2018 and falling to $.04/Wp through 2021) will cut annual U.S. solar additions by 5–11 percent per year. RMI analysis suggests the tariff can be offset for ground-mount systems through U.S.-based cost reductions, which have not been incorporated into cost forecasts.

More specifically, continued industry-wide improvements in technical system design, supply chain orientation, and deployment will improve the economics of solar projects, and in particular for smaller ground-mount systems drive out up to twice as much cost as that incurred by the tariff at its start. RMI is currently working with industry partners to further test, develop, and commercialize one such integrated solution in the next eighteen months.

This solution will also increase growth by serving the nascent but rapidly growing distribution- or community-scale solar segment. Whereas the module cost impact will be most dearly felt in the utility-scale sector, community-scale solar markets (1–10MW in scale) are historically untapped and do not face the same constraints on growth as utility-scale solar. While the historical year-on-year growth rates of close to 200 to 400 percent for community-scale solar are not sustainable, the innovative value propositions available to customers in this segment today, with improved cost structures tomorrow, can pivot this opportunity into the next growth engine of the U.S. solar industry.

A solution standardized at its core will enable access to large economies of scale and mass customization. In so doing, it will reverse the diminishing returns traditionally experienced by distributed solar segments—and for some of them, render the implications of the tariff irrelevant.

Revamping Growth, 2018–2021 and Beyond

Technology-agnostic policy support that has played a role in bringing new technology and innovation to market is being phased out at the same time as the new import tariff is imposed, creating unprecedented pressure for continued cost reduction on solar PV systems. However, the industry has a track record of outperforming analyst forecasts both in terms of cost and deployment and the rearview mirror shows a relentlessly effective pursuit of efficiencies and design improvements. Incorporating all these dynamics, the levelized cost of energy (LCOE) for buyers of solar power will continue on its downward trend.

Furthermore, the solutions developed by RMI, its industry collaborators, and others show an even more attractive cost trajectory than analysts forecast, also when taking the tariff into account. Not only would this drive additional market demand of 1 to 2 GW per year, channeling billions of investment dollars, but it would also move solar farther below the grid parity threshold and position the industry for resilient and continued aggressive growth as the tariff phases out.