3d rendering group of electric cars with pack of battery cells module on platform in a row

Q&A: Six Charts for Six Solutions to the Battery Mineral Challenge

Our recent webinar received many more questions than we could cover. Here are more answers in the form of six charts — one for each of our six solutions.

In a recent webinar, we discussed the findings and implications of The Battery Mineral Loop report, including six solutions that can help eliminate the need for newly mined battery minerals by 2050. The webinar had a highly engaged audience who asked far more questions than we had time to answer. We have grouped these questions to dive deeper into each of the six solutions, as shown below.

Summary Exhibit: Six solutions to the battery mineral challenge

A. Battery recycling: 10x better than thought, with room to scale

Q: Some sources claim that only 5 percent of lithium-ion batteries are recycled. Can you give more context on the percentage of battery minerals from recycled sources? Does recycling affect the cost or performance of the battery?

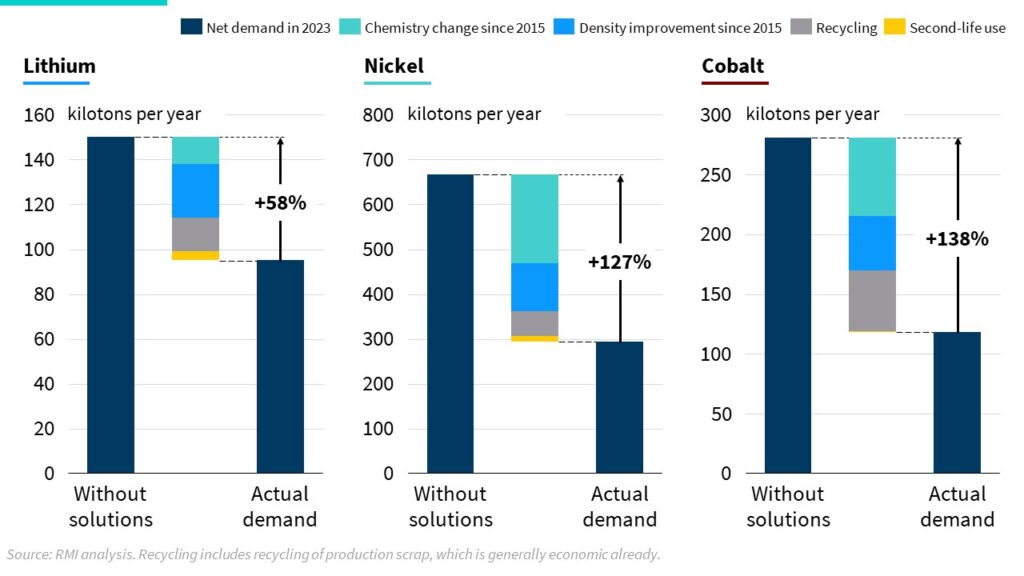

This topic received the most questions by far, so we’ll start here. The 5 percent figure is outdated and has been misconstrued. It actually refers to the quantity of battery minerals recycled versus demanded in a given year, not the recycling rate at the end of a battery’s life. Since battery production is growing exponentially, the recycling that occurs within a given year — determined by battery sales from about a decade earlier — is naturally smaller than current sales. Currently, this percentage stands at 10 percent for lithium and nickel, and 25 percent for cobalt globally.

However, end-of-life recycling rates are more than 10 times higher than the often-quoted 5 percent. A 2023 study led by Argonne National Laboratory found that even in 2019, 59 percent of end-of-life lithium-ion batteries were recycled globally. That number has likely increased, perhaps to as high as 90 percent according to experts at Circular Energy Storage.

Recycling innovations are progressing fast. Recycled minerals meet and can even exceed the purity and performance of mined minerals, and emerging technologies like direct recycling are cutting costs, economically and environmentally. Numerous startups are improving mineral recovery rates, charting a path for even the harder-to-recycle materials such as graphite.

Recycling economics are also improving — but just as in the early days of solar energy or battery manufacturing, support is needed to help scale and drive down cost. Triple-bottom-line accounting shows that there is already a strong argument for recycling investments if we systemically incorporate recycling’s full social and environmental benefits. As webinar attendees noted, we will need policy support to increase targets and certifications for recycled content (such as in China and the EU), as well as companies to incorporate recycling into battery design and manufacturing.

You can find more resources from the RMI Battery Circular Economy Initiative.

Exhibit 1: Recycling has already helped avoid mineral demand

B. Novel chemistries: sodium could change the game for lithium

Q: What about sodium-ion batteries? Are they less energy dense, and are there some applications that are better than others?

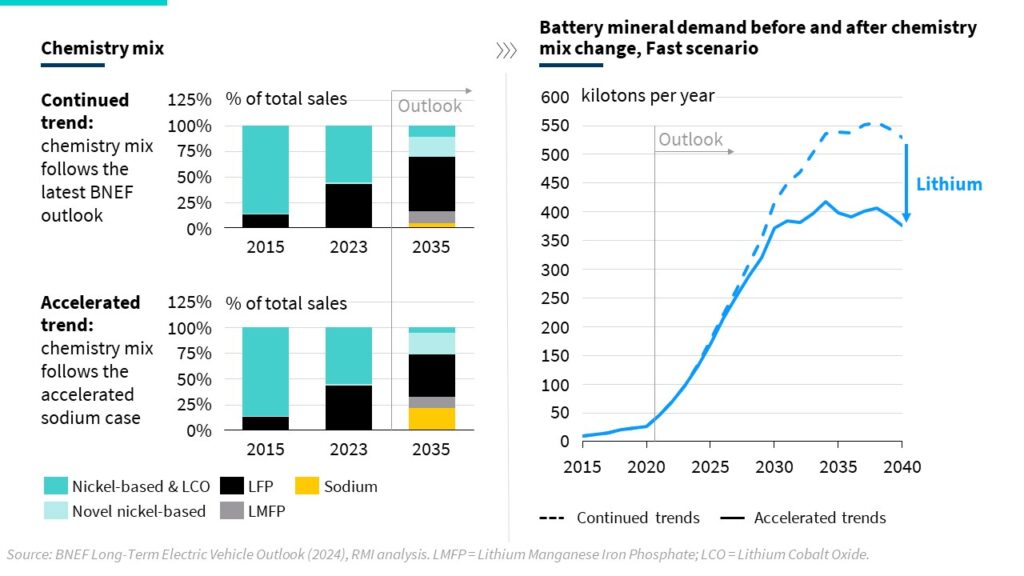

Today, sodium-ion batteries are nascent but have high potential for applications such as grid storage and micromobility, which don’t require very high energy density or charging performance compared to cars and trucks. These sectors are just a fraction of the battery market, and sodium will have to compete there with second-life batteries — but sodium is taking off in cars as well. In just the past year, several battery and car companies made significant product announcements that included sodium-ion batteries.

While the energy density is lower in sodium-ion batteries than lithium-ion, densities are improving across chemistries with ongoing innovation. Sodium-ion densities are already approaching recent levels of the fast-growing lithium iron phosphate (LFP) chemistry.

Adopting sodium will reduce the reliance on lithium — just as LFP has done for nickel and cobalt. Thanks to LFP, we’ve already halved the nickel and cobalt demand per battery in less than a decade.

Exhibit 2: The impact of sodium-ion chemistry change

C. Energy density: the steady march of innovation across chemistries

Q: How will energy density be affected by the changing chemistry mix? And how does this play into your modeling?

We analyzed energy density independent of chemistry. They are interconnected, but we distinguished their separate effects.

After adjusting for chemistry change, we find that energy density has improved by about 4 percent per cumulative doubling of battery demand. That means we’ve seen improvements of about 25 percent in just the past decade, helping to further limit the need for mined minerals.

Our modeling outlooks are rooted in that history of improvement. It is easy to underestimate the pace of progress by assuming static policy or technology. We instead use continued trends, such as density improvements, which are often more accurate — as recent months have shown across several different chemistries. Evolution tends to be cleverer than we are.

Exhibit 3: Density improves as battery sales grow

D. Longer lifetimes: reuse and recycling go hand in hand

Q: How are battery lifetimes changing? Could longer lifetimes delay peak mining by hindering recycling?

Battery lifetimes are getting longer. They vary widely by sector (from high-use trucks to longer-lived cars) but will continue to increase as innovation booms. We are already seeing “million-mile batteries” coming to market, which may well last for multiple decades. Second-life use is also increasing, particularly for grid storage. Europe has strong warranty and repairability laws, and other countries could follow.

Reuse is complementary to recycling. Extended lifetimes can help right-size battery manufacturing investments and reduce a battery’s environmental footprint. This can potentially reduce consumer cost per kWh of energy delivered, particularly in regions like the Global South that may lack access to the required infrastructure today.

Extended lifetimes can save a million tons of mined lithium by 2050. Reuse can delay recycling, but it delays new demand as well, thus reducing the pressure on manufacturing buildout and its environmental impact.

Exhibit 4: The benefits of extending battery lifetimes

E. Efficient vehicles: automotive obesity can be rapidly reversed

Q: What risks do you see with the Jevons paradox: as batteries get cheaper, will demand increase as cars get larger and larger battery packs?

Inefficiency is a real risk. As shown below, the share of EV sales from larger vehicles (such as SUVs and pick-up trucks) has been increasing from 2018 to 2023 across regions. This share has risen seven-fold in the United States and five-fold in Europe, with increases in China and elsewhere as well.

This could delay peak mineral demand and circularity, but there is ample room to reverse these trends. EVs are becoming more affordable in all sizes, and the small and affordable car segment is set to boom. Across our six solutions, efficient vehicles have some of the most immediate benefits — even if we only realize a fraction of the full potential by simply returning to 2018 car size shares. Companies and governments can realize this potential by prioritizing sleek, right-sized vehicles that are more affordable, more efficient, and more enjoyable.

Exhibit 5: Automotive obesity has grown fast but can be reversed

F. Efficient mobility: systemic solutions have the broadest benefits

Q: Extraction continues to have major impacts, from emissions to human rights issues. What more can we do to build a clean and just system?

The impacts of mining are real and far-reaching. For example, global mining is the highest cause of conflict with Indigenous Peoples. More than 200 million tons of mining wastes pollute waterways every year. We should do all we can to limit those impacts, and all six solutions can do so if we accelerate fast. But system solutions are often overlooked — particularly with efficiency in the broader transport system.

A 2023 report describes how efficient mobility could reduce demand for lithium in the United States by 18 to as much as 66 percent. RMI research has found that such improvements are possible, impactful, and necessary to reach climate goals. And as the city of Paris has proved, major progress can come from just a few years of smart policy.

Reducing mineral demand is just the beginning. As shown below, deeper efficiency measures come with greater benefits — across emissions, health, security, and environmental justice. The path to these benefits is clear: it is time to double down on efficiency, innovation, and circularity to grasp the opportunity.

Exhibit 6: Holistic efficiency compounds the benefits