RMI’s new Battery Circular Economy Initiative Dashboard can help EV battery stakeholders make data-driven planning and investment decisions.

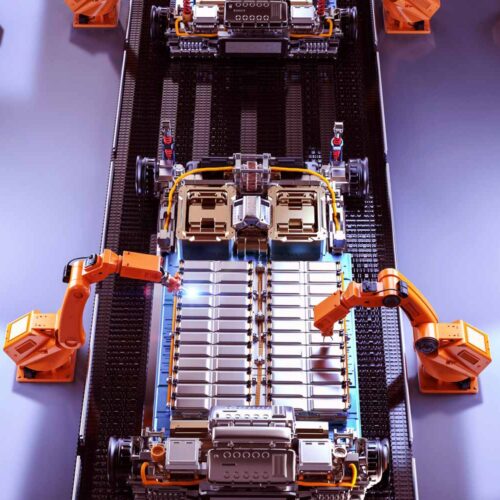

3d rendering group of electric cars with pack of battery cells module on platform in a row

Battery Circular Economy Initiative

Spotlight

RMI’s Battery Circular Economy Initiative (BCEI) is designed to help strengthen the electric vehicle (EV) battery supply chain and meet growing demand for EVs.

A circular battery economy — one in which end-of-life (EOL) batteries are either reused or recycled — not only creates a resilient supply chain, it also lessens our dependence on the virgin materials that go into EV batteries (EVBs) and the harmful mining practices used to extract them.

Below, we outline the challenges facing today’s EVB supply chain, how a circular battery economy can help address these challenges, and what the BCEI is doing to realize the potential of such an economy.

• The challenges facing today’s EV battery supply chain

• How a circular battery economy can help address these challenges

• Barriers to a circular battery economy

• What the BCEI is doing to advance the creation of a circular battery economy

Challenges Facing Today’s EV Battery Supply Chain

Today’s EVB supply chain is:

- Vulnerable to disruption from:

- Geopolitics

- Changing trade alliances between countries or regions

- Supplier consolidation: Currently, there are just a few big players that oversee most of the supply chain; if one or more of these companies experiences a disruption, the whole supply chain is affected

- Extreme weather (e.g., hurricanes, tornadoes, and earthquakes that impact energy inputs and disrupt infrastructure like pipelines and shipping routes)

- Too geographically concentrated: Mining, refining, processing, and battery assembly take place in just a few countries. The disruptions mentioned above can result in bottlenecks and negatively affect the rest of the battery supply chain. They can also impact economies, cause delays for suppliers, increase transportation costs, force employers to cut jobs, discourage investment, and hinder transportation decarbonization.

- Too geographically dispersed: On the other hand, the supply chain is too dispersed because in order to produce a battery, the minerals that go into it must travel an average of 50,000 miles, producing avoidable emissions.

- Connected to human rights abuses and the degradation of local economies and environments: The EV battery supply chain, especially its upstream portion (mining), is linked to human rights abuses, including the use of child and forced labor. Many mines also lack basic worker safety measures — endangering workers’ lives — and extraction often comes with an environmental cost. Mining practices often cause surface and groundwater depletion, soil contamination, biodiversity loss, and other negative consequences that can last for centuries. Local economies also suffer; for instance, mining’s effects on local water supplies can negatively affect agriculture and its related economic activities, depriving local communities of their livelihoods.

In addition to their negative effects on the environment, economy, and workers’ lives, these challenges threaten to hinder EV adoption, significantly impeding the world’s ability to decrease its transportation-related emissions and avoid, or at least mitigate, the disastrous effects of a warming planet.

How a circular battery economy can help

In a circular battery economy, batteries are first reused or repurposed, which involves using the battery again in an EV or for another energy storage application, and then recycled, which involves dismantling the battery and extracting the materials to be used again in a new battery.

The advantages of a circular battery economy are many. Recycling and reusing EVBs can:

- Help meet mineral supply gaps: As RMI’s BCEI Dashboard shows, today’s supply chain will not be able to provide the lithium, nickel, cobalt, and other minerals that go into EVBs in the quantities necessary to meet increased demand. Recovering minerals from EOL EVBs can help reduce the need for additional extraction and address these supply gaps. Note: It’s important to remember that there are enough minerals to meet current and future EV demand; however, today’s supply chain is not strong enough to extract and refine these minerals.

- Strengthen the domestic and global EVB supply chain: As noted above, a small number of countries dominate the EVB supply chain. A circular battery economy can bolster countries’ and regions’ supply chains, making them better able to withstand disruption. The global EVB supply chain also benefits; if one country’s production falters, others can step in to mitigate possible negative domino effects.

- Lessen the harms associated with mining: A circular battery economy reduces the supply chain’s dependence on virgin minerals and the mining practices often used to extract them.

Barriers to a circular battery economy

In the United States, collecting and processing EOL batteries and using the materials in new EVBs is not possible at the scale needed due to inadequate infrastructure and logistical challenges that negatively affect the midstream, downstream, and end-of-life portions of the supply chain in the following ways:

- Midstream (processing and refining): When a recycling facility processes an EOL battery, it first crushes and shreds battery cells, creating what’s referred to as “black mass,” a mixture of valuable metals including lithium, manganese, cobalt, and nickel. The black mass is then sent to processing facilities that recover these materials and give them new life. Unfortunately, there are not enough processors and refiners in the United States who can use black mass in new applications, so it is often exported, resulting in an inefficient system, logistical issues, and an increased carbon footprint. A stronger midstream would help create a domestic market for black mass, advancing a circular battery economy.

- Downstream (assembly): Manufacturers and automakers depend on a steady and reliable supply of EVBs in order to make EVs at the speed needed to meet growing demand for EVs. A robust downstream manufacturing environment along with domestic consumption would provide production scrap as well as EOL feedstock for recycling companies.

- EOL battery collection, logistics, and recycling infrastructure: Today, the collection, transportation, and disassembly networks are not yet developed to handle the number of EOL batteries expected in the years ahead. We need to further build out recycling infrastructure today to be able to handle the increased volume of EOL batteries in the coming decades.

Learn more about the EVB supply chain here.

Today, the rate of EVBs reaching their EOL is relatively modest. In the coming years, however, their number will increase significantly, as shown in the graph below. Given that it takes several years to establish new battery recycling facilities, it’s important to start advancing a circular battery economy today. EVB stakeholders must:

- Centrally aggregate and analyze disparate sources of data to forecast the supply and demand of EVB materials globally through the next decade;

- Convene the private and public sectors to come to a shared understanding of the challenges facing the EVB supply chain and ways in which to address them;

- Develop and implement robust data-driven policies to provide clear direction to market players; and

- Invest in efforts to foster a circular infrastructure and by extension strengthen the EVB supply chain.

The BCEI’s work

Creating a circular battery economy requires intense stakeholder engagement with local, regional, national, and international governments; original equipment manufacturers; automakers; and many other private and public actors. As they work together, these stakeholders will need data and analysis to make informed and effective decisions.

Data and analysis

The BCEI provides stakeholders with the following tools and information to help them make effective decisions:

- The BCEI Dashboard: This user-interactive tool gives EVB stakeholders critical insights on today’s and tomorrow’s supply gaps. With this information, stakeholders can make informed decisions to ensure the supply chain can meet increasing demand for EVs while also enabling circularity from the outset. The BCEI Dashboard synthesizes disparate sources of information into a central repository to derive data-driven insights and enable insight-driven decision-making.

- Market and investment guidance: Our data-driven analysis focuses on directing investment dollars to close critical infrastructure gaps and linking private sector environmental, social, and governance goals to infrastructure development opportunities, in order to foster a circular economy for battery materials.

- An assessment of the return on investment in circularity: This analysis will quantify system-level returns on investment from circularity, with an initial focus on EVB recycling, by incorporating environmental and social metrics to return calculations and providing an investment roadmap to maximize the overall benefits of circularity.

Stakeholder engagement

BCEI engages with a wide variety of stakeholders throughout the EVB value chain, both through direct, one-on-one engagement and through associations such as NAATBatt, Li-Bridge, and the Global Battery Alliance, of which RMI is a member. BCEI actively engages with these organizations to ensure that environmental and social priorities are elevated by participating in committees and working groups, presenting our research at conferences and convenings, and directly engaging with members to gather input into BCEI’s research and thought leadership.

Learn more about EV batteries and the EV battery supply chain by reading the articles below.

A circular EV battery economy can help strengthen the US EV battery supply chain and meet the nation’s growing demand for EVs. Here’s how to get there.

Learn about the five critical elements that can help mitigate the risks associated with battery production while strengthening the EV battery supply chain.

RMI’s paper sheds light on the state of today’s EVB supply chain and can inform investment and policy decisions; it can also clarify how much of the battery supply is expected to qualify for IRA incentives in the future by presenting a methodology for quantifying the gap between supply and demand of inputs and subcomponents along all major stages of the EVB supply chain.

This primer includes an overview of the steps involved in the EV battery supply chain, the challenges it faces, and opportunities to improve it. Local and national governments, policymakers, and private and public sector actors can use it as a starting-point resource to further explore these important issues.

Strengthening the EV Battery Supply Chain's Midstream Will Be Critical to Transportation Electrification

RMI's Battery Circular Economy Initiative (BCEI) Dashboard gives EV battery stakeholders critical insights on today and tomorrow's supply chain gaps. With this information, they can advance a circular battery economy and make informed decisions to ensure the supply chain can meet increasing demand for electric vehicles

The Great Lakes region is well poised to compete in the emerging EV and battery supply chain industries if the proper policy choices are made.