Missing a Mining Opportunity

Challenges and opportunities with renewable adoption in mining industry

Guest author Matthew Cullinen is a Carbon War Room alum.

My parents still use America Online (AOL) and they’re not alone. Though many have made the switch to “modern” services like Gmail, others have steadfastly clung to comfortable, old, “easy” ways of doing things. That same dynamic is before us today in a very different realm: traditional industries such as mining are failing to see a massive opportunity staring right at them—the sun in the sky and the wind blowing—that could provide the answer to their energy woes. Overall global energy demand at mines is set to grow 36 percent by 2035, and the industry is facing ever-greater energy price increases and volatility. This roughly tracks the IEA’s projected growth rate for global energy demand—40 percent by 2040—in the recently released World Energy Outlook 2014.

Yet growth in mining energy consumption will track with new extraction, which is often at the geographic periphery of civilization, while global energy demand overall closely tracks with population centers in the world’s largest emerging economies. Thus energy generation assets will continue to be closer to major population load pockets and far from where mining firms operate, failing to solve existing challenges with supply and fueling further competition for energy.

Despite this challenge, the industry has been slow to look for alternatives to existing supply, which tends to be either diesel (which has to be trucked in) or electricity from the grid (which can be unreliable). Renewables therefore represent an opportunity for mines to save money and boost reliability, but it’s also a new market for renewable energy producers and investors looking for long-term infrastructure investments.

LESSONS FROM AN EARLY ADOPTER

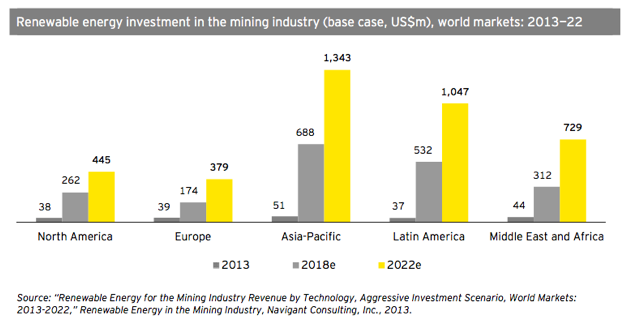

Investment in renewable energy for mining is growing, projected to total $2Bn annually by 2018, and $3.9Bn by 2022, with revenues projected at just over $3Bn and $6Bn in 2018 and 2022, respectively, according to a 2013 study by Navigant Consulting. Meanwhile, in recent years the price of solar and wind energy have declined dramatically. Today the cost of a solar panel is on average $0.63 per watt, and it’s expected to drop to 30 cents by 2030, according to new estimates by Fortune. Total installed costs have also dropped substantially. For mines, this is a tremendous opportunity. The unsubsidized LCOE for utility-scale solar and wind easily beats diesel gensets, and some early adopters are starting to take notice.

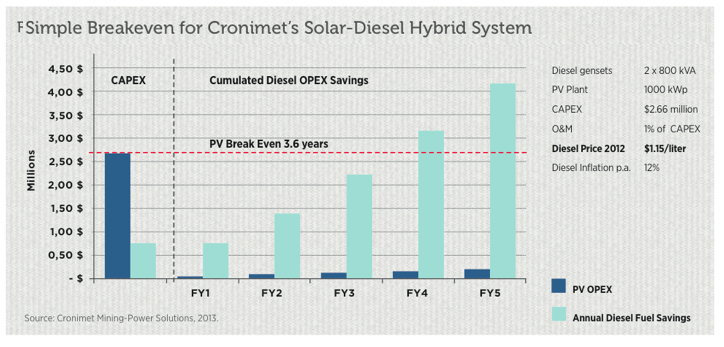

Cronimet chrome mine in Thabazimi, South Africa (250 km northwest of Johannesburg), is an example of an innovator in this field. Cronimet holds a 30-year lease on a site with proven reserves amounting to over 17 million metric tons of chromium ore. This site however had no access to the South African utility grid. In order to run the mine, Cronimet would have to truck in fuel to run captive diesel-fired generators to supply the 1.6 MW of energy needed 24 hours a day. The firm’s German management team, already familiar with renewable energy project financing, immediately sought ways to lower diesel consumption through installation of solar PV.

By working with solar developer Solea Renewables, Cronimet was able to build a solar-diesel hybrid system that reduces diesel consumption by 450,000 litres (119,000 gallons) a year. Overall, the project had a 3.6-year simple payback, and in the long term a net-present value of $2.3 million (see below). For regions with high insolation, payback on solar-diesel hybrid systems is as low as one to two years today, according to SMA, a German solar energy equipment supplier, who produced the ‘Fuel Save’ controller used for the Cronimet hybrid system.

RENEWABLES A GOOD OPERATIONAL MATCH FOR MINES?

Adjusting to new technology can be difficult, including a learning curve for mines shifting from either captive diesel generators or grid-supplied (though often unreliable) power to partial reliance on renewable energy. For mining firms, one of the biggest challenges has been building and operating a hybrid solar-diesel system with seamless integration of the two generation assets, or grid integration through net metering, which is often not a clear-cut proposition in many of the areas where mines operate.

Even if the system is designed and installed by a reliable third-party solar project developer, the on-site power systems manager (who is not always an electrical engineer) still needs to understand how to operate and maintain the system, or create a situation where maintenance is outsourced. While the economics are clearly compelling, lack of technical capacity to operate these systems has given some mine operators pause.

While unwarranted, a perception of lowered reliability has also caused challenges for project developers who report a lack of confidence in a system that at least in part relies on weather patterns. More needs to be done to prove to potential adopters that these factors are easily predicted and accounted for. Solar project developers are able to make guarantees and offer insurance products that protect against productivity loss resulting from drop in power failure, since these systems are designed with the understanding that outages are an unacceptable operating risk.

THE CAPEX VS. OPEX DILEMMA

Mining firms are reticent to pay for capital improvements to existing mines, even if they will boost productivity or reduce the final cost of extracted gems or minerals, because simply opening a new site is still a far more productive use of internal capital. Even if building a solar plant can bring down operating expenses to the point where there are significant competitive advantages on extraction costs, competition for the firm’s balance sheet will continue to be a big challenge for a self-generation model.

While the firms that have been the innovators on the adoption curve for distributed renewable energy for mining have relied on a self-generation model, whereby they own and operate the generation asset, accelerating adoption will require a different approach.

Financing approaches such as power purchase agreements and leasing have helped to lower barriers for purchasing renewable energy, creating opportunities for consumers (whether a homeowner or a large corporation) to procure from renewable sources without the high upfront cost of buying the generation asset. Now similar models are being tested for mining firms with off-grid operations, challenging entrenched business practices and expectations about energy infrastructure in a very traditional industry.

Several international solar developers and smaller niche firms are beginning to offer ‘solar as a service,’ not just for mining firms, but for other companies in other heavy industrial segments, as well as diesel and heavy fuel oil (HFO) power plant operators. They are convincing early adopters that they can save them money, and enough training support services (often a year of training) that the on-site power systems manager will be able to operate and maintain the system for years to come.

To accelerate even further and build an early majority, the value chain will need to work together to standardize contracts and diligence approaches, as well as ensure procurement processes are quick and effective.

WHERE DO WE GO FROM HERE?

By 2022 there will be over 1.4 GW of installed renewable energy capacity, built specifically to power the mining industry. Wind power will account for a slight majority (516 MW vs. 493 MW projected for solar), and the Asia Pacific region will see the highest level of renewable capacity added for mines (with 505 MW) as projected by Navigant Research. Deployment of hybrid systems more generally is also rapidly growing—at a nine percent compound annual growth rate (CAGR), with the biggest opportunities in India, China, Myanmar, Brazil, and South Africa, according to Frost & Sullivan.

While there has been great progress in recent years, this represents only the innovators like Cronimet and Rio Tinto’s Diavik mine (home to a 9 MW wind farm), as well as some early adopters. Renewable energy is only projected to account for five percent of the mining industry’s total energy consumption by 2022. This is still a significant amount of annual investment over today’s baseline(see figure above), but the real opportunity is much greater—perhaps as high as a one-third of the industry’s total energy use.

While it is clear that the mining industry is only beginning its journey along the technology adoption curve for renewable energy, in some ways the pace and scale at which it embraces these solutions will influence the adoption curve for other industries and population segments in some important ways. In addition to being a smart business move for mining firms, adoption of solar and wind energy will also help to grow local renewable energy production and installation capacities in the parts of the world that most desperately lack basic access to energy.

And in business models currently being tested in Africa, mines can also serve as ‘anchor demand’ for broader mini-grids that supply power to local communities and create economies of scale that will benefit both miners and the people who live in the regions where they operate. That could be a true win-win that improves labor relations and shines a sunny spotlight on an industry often maligned as ‘dirty’ but which also supplies raw materials for today’s and tomorrow’s clean energy technologies.

Images courtesy of Shutterstock.