How to Retire Early: Making Accelerated Coal Phaseout Feasible and Just

For over a century, growing presence of coal smokestacks worldwide signified economic development and progress. Coal supplied our homes with electricity and our factories with power. At the same time, this workhorse of the industrial era caused serious harm to our health and the environment. Today, the costs of continuing to operate coal-fired power plants include not only its health and environmental impacts, but also a hit to the wallets of consumers who are paying more for coal power than they would for renewables.

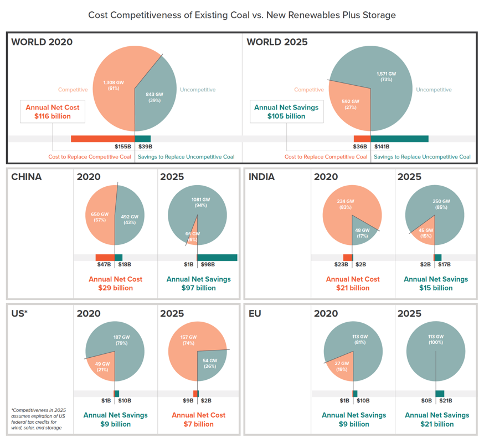

In a new report, Rocky Mountain Institute, the Carbon Tracker Initiative, and the Sierra Club present an analysis of nearly 2,500 coal plants around the world. This analysis shows that the cost of clean energy has fallen so far that new renewables outcompete new coal virtually everywhere. Furthermore, it is cheaper today to build new renewable energy capacity including battery storage than to continue operating 39 percent of the world’s existing coal capacity. And the competitiveness of coal is sinking rapidly elsewhere.

The Cost of Coal

Continuing to run uncompetitive coal plants comes at a cost to consumers and taxpayers. If we were to phase out the share of existing global capacity already uncompetitive with new renewables, we would save $39 billion in 2020. In just five years, 73 percent of the global coal fleet will be uncompetitive with new renewables plus storage, equating to a savings of $141 billion in 2025.

Though global numbers inevitably mask regional variation, our findings hold true across a diverse set of geographies. The United States could help customers save up to $10 billion annually if 79 percent of its currently uncompetitive fleet were phased out today. In other large coal power regions—Europe, China, and India—the percentage of uncompetitive coal plants is rising fast and will average over 90 percent by 2025. Savings for these three regions combined start at $30 billion per year in 2020 and more than quadruple to $136 billion per year in 2025. In a group of other developing economies with aggregate coal capacity similar to that of the United States, 51 percent of the existing coal fleet will become uncompetitive with new renewables plus storage by 2026.

How to Transition

Immediately retiring and replacing uncompetitive coal assets should be a foregone conclusion. However, long-term contracts and noncompetitive tariffs insulate 93 percent of global coal capacity from market competition with cheaper and cleaner renewables. To keep the Paris Agreement’s temperature targets within reach, global coal use must decline by 80 percent below 2010 levels by 2030. This will require rapid transition in OECD countries over the next decade and phase-out in the rest of the world by 2040—long before many of these long-term contracts expire and/or coal plant investors have been fully repaid.

What can be done? Governments and public finance institutions can accelerate coal phaseout for assets with legacy contracts or tariffs through an integrated three-part approach:

- Refinance to fund the coal transition and save customers money on day one;

- Reinvest in clean energy; and

- Provide transition financing for workers and communities.

Our report describes several innovative financial approaches such as ratepayer backed securitization and debt forgiveness via reverse auctions that capture all three elements of the transition. These financing solutions are incentive-based and can be structured as voluntary programs for both governments and asset owners. As such, they can help establish common ground among many stakeholders without precluding complementary policy and regulatory approaches.

Where new renewables plus storage already outcompetes existing coal, the three-part coal phaseout can be achieved without public subsidies. However, in places where coal is still competitive, public subsidy may be needed in the short term to accelerate action. In such cases, governments and public finance institutions—green banks, multilateral and national development banks, and development finance institutions—could create financing packages for three-part coal phaseout as part of their development and climate priorities.

What Comes Next?

By 2025, simply operating nearly three-quarters of the global coal fleet will be more expensive than building brand new renewables and storage. So in 2025, the question is not whether renewables will replace the global coal fleet, but when. And these transitions take time to get right. If we want to stay on track to avert the most disastrous impacts of climate change, and save money while doing so, the time to start is now.

Download How to Retire Early: Making Accelerated Coal Phaseout Feasible and Just