Daybreak. Passenger airplane silhouette on the morning-glow background.

The Low-Carbon Jet Fuel Market Is Cleared for Take-Off

Aviation is essential. It connects cultures. And prior to 2020, it supported over 65 million jobs, generating almost $3 trillion in global economic activity each year. But by 2050, if the industry returns to pre-2020 levels, aviation industry emissions could grow to 20 percent of the 1.5° C carbon budget. This could potentially derail the global goal of limiting global warming to 1.5° C. To meet this target, we need to achieve net-zero carbon emissions by 2050 in all industries.

Air travel has fallen 68 percent compared to 2019 levels due to the global pandemic. Conversely, cargo air shipments are up about 10 percent globally, attributed to changes in buying habits. While we wait for air travel to rebound, we need solutions for the aviation industry to meet increasing demand for low-carbon travel.

There are few low-carbon choices ready today. Aviation requires liquid fuels to power existing fleets. Batteries technology are not yet ready to power longer-distance commercial flights, which is where most of the energy is consumed. Hydrogen could be a viable zero-carbon energy source in coming decades. However, manufacturers need to drive down aircraft operating costs, governments or investors have to invest in hydrogen technology and infrastructure, and at least in the interim long-distance commercial flights still require liquid energy.

Creating a Demand Signal for Sustainable Fuel

Our current best option lies in sustainable aviation fuel (SAF), a proven solution that is already compatible with today’s aircrafts. However, its price point—twice or more that of fossil-based jet fuel, which is often the highest cost for the low-margin aviation industry—weakens demand and investor confidence.

SAF is made from waste sources or other non-petroleum materials, is safe for airplanes, and can be mixed with fossil-based jet fuel. One of many SAF feedstock options is right out of a Back to the Future banana peel scenario that converts household trash to aircraft energy. Other feedstock sources can be plant or animal oils, textile or forestry waste, or fast-growing plants like algae.

To address SAF’s cost barriers, Rocky Mountain Institute (RMI) and the World Economic Forum (WEF) created the Clean Skies for Tomorrow coalition to gather the world’s most ambitious corporate stakeholders in the aviation sector to spur rapid SAF deployment.

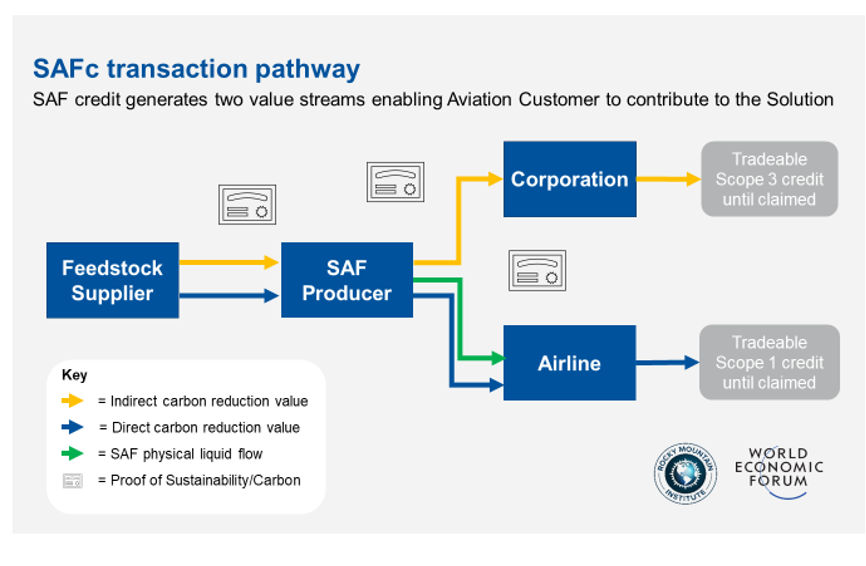

Corporate leaders are joining Clean Skies for Tomorrow to advance the Sustainable Aviation Fuel credit (SAFc) program. The SAFc is a game changer for the aviation industry and can serve as a model for other industries with similar price challenges for funding the cost of lower-carbon operations.

How Does the SAFc Work?

Through the SAFc, corporations can invest in direct decarbonization of company flying by creating a carbon credit certificate they can purchase for SAF. The key innovation of the virtual credit is recognizing the direct emissions benefit to the airline, the fuel itself, and the indirect decarbonization to their customers, can each be monetized through a carbon credit that can be sold and traded. Separating these benefits enables airlines and their corporate customers to cover SAF’s price premium, lowering a major barrier that has hampered SAF use until now.

Is SAF Truly Sustainable?

Clean Skies for Tomorrow has four requirements to ensure SAF sustainability. First, producers must obtain certification from a credible recognized third-party provider. Only two organizations have this status currently: Roundtable for Sustainable Biomaterials (RSB) and International Sustainability and Carbon Certification (ISCC). Next, the fuel producer must officially disclose all information regarding the source feedstock for the SAF. Third, no palm oil-related materials of any form are permitted. Finally, SAFc requires at least 50 percent carbon reductions in the SAF versus conventional fuels, measured on an annual lifecycle basis.

Why Pay More for SAFc vs. Carbon Offsets?

Carbon offsets are a long-established method to address emissions and one that can be inherently flawed. The current UN aviation climate change program, the Carbon Offsets and Reduction Scheme for International Aviation (CORSIA), allows airlines to prioritize offsets to reach carbon neutral growth once their fuel burn exceeds 2019 levels.

Concerns about the quality of an offsets include the “permanence” of the carbon reduction, whether the offset purchase resulted in an emission reduction that would not have occurred without the offset funds, and if their use discourages direct emissions reductions by corporate actors. Offset projects are also not usually related to the emissions source that a buyer wants to mitigate.

The SAFc is a superior choice because it directly addresses aviation emissions within the sector’s value chain. Sustainable jet fuel products also yield additional benefits such as local air quality improvement and regional economic development for feedstock collection and processing. Corporations who rely upon business air travel see it as an impactful way to show their customers they are addressing their passenger and freight emissions.

Will the SAF Go into Aircraft Carrying the Corporation’s Employees or Cargo?

While it is possible to deliver sustainable jet fuel to a specific aircraft, it is not efficient and increases costs to use SAF. One of the benefits of a virtual product like the SAFc is that it allows corporations to purchase the lowest cost fuel supply that meets sustainability requirements. Relying on an existing supply chain to move the SAF to the closest airport saves money and transportation carbon.

Using a “book-and-claim” system, corporations can own the SAF environmental attributes without having control the actual fuel itself. SAF is physically measured before it is blended with conventional fuel and then tracked via mass balance checks each time it transfers along the supply chain, until it is delivered to an airport. Chain of custody documentation and digital ownership tracking provides assurance that SAF reaches the airport and then will be mixed with the fuel going into aircraft.

What Are Next Steps for the SAFc?

Now that the SAFc is growing with support from corporate leaders, we can scale its impact. CST is developing a SAFc concept paper that will be available in fall 2020. In 2021, the team will produce a complimentary, full, detailed methodology that can serve as a step-by-step playbook for all points of the aviation sector and their customers. To convene and support early adopters, RMI and WEF will establish a “buyer’s summit” to expand the reach of SAF. We are also planning to create a virtual marketplace for transparent and efficient transactions.

What about Other Heavy Industries?

Other transport sectors, such as trucking and shipping, also have few cost-effective alternative energy sources. While the logistic companies may own the equipment, and therefore are responsible for direct emissions, renewable energy options may be too costly for an operator to adopt independently.

This is where addressing scope 3 emissions—indirect emissions that a company does not directly create—may be useful. If reduction of scope 3 emissions can be monetized, customers can pay for low carbon alternative solutions that might not be possible without their contributions. For fossil fuel-intensive production industries, such as steel, cement, and plastics, the manufacturers themselves may be able to sell lower-carbon materials or goods at a premium by monetizing scope 3 benefits as the SAFc does.

With forward-thinking partners in the Clean Skies for Tomorrow program, RMI is charting a new path for lower-carbon air travel. The SAFc enables corporations to reduce their travel and freight carbon footprint, while helping clear the runway for the larger decarbonization of the aviation industry.