The Inflation Reduction Act Could Transform the US Buildings Sector

The US buildings sector has long been one of the most challenging when it comes to climate action, but a recent infusion of funds through the Inflation Reduction Act (IRA) could have a transformative impact on improving our built environment.

The IRA invests over $50 billion into clean energy technologies and improvements that can lower energy bills; make our homes, workplaces, and schools healthier and safer; significantly reduce climate pollution; and prioritize delivery of those benefits and new technologies to low-income and environmental justice communities. Successful implementation of the Act will mean Americans have greater access to efficient electric appliances, weatherized homes, rooftop solar, residential geothermal, low-carbon building materials, and more.

This investment, coupled with the Infrastructure Investment and Jobs Act, could reduce buildings sector climate pollution by anywhere from 33–100 million metric tons, getting us to between 10 and 30 percent of our 2030 goal to cut emissions in half. We are on the precipice of a massive transformation and must seize this opportunity to fully climate-align our buildings industry.

How Will the IRA Transform the Buildings Sector?

The IRA uses a suite of financial incentives to encourage individuals and businesses to invest in clean, efficient alternatives for their homes and businesses, rather than mandating these changes. As a result, the exact impact of the investment will be seen over time. Regardless, early analysis shows the IRA’s building retrofit programs could drastically change the landscape of the sector.

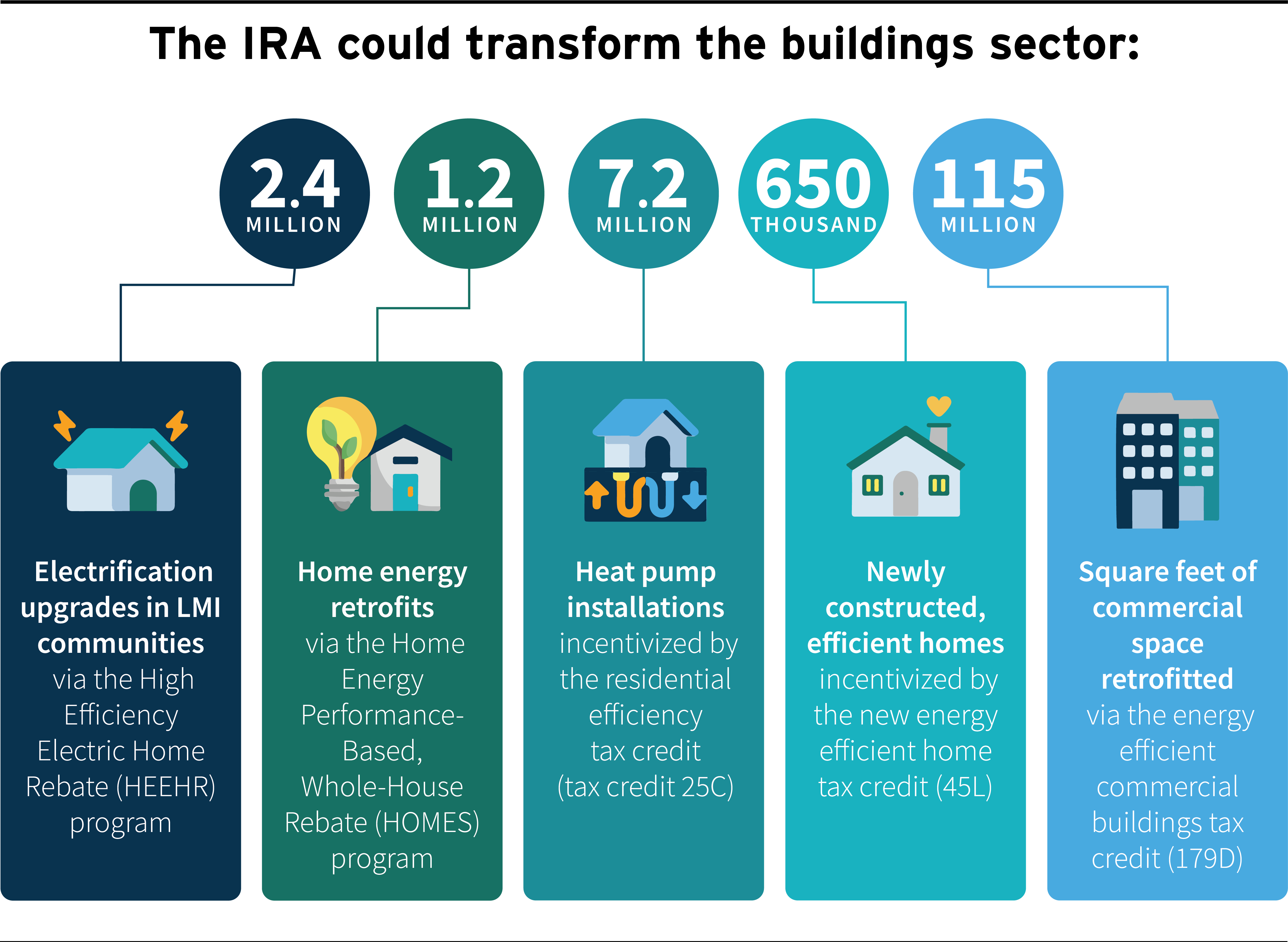

RMI’s initial analysis suggests the IRA could drive millions of retrofits, upgrades, and clean technology installations:

These estimates are significant on their own, but they are just the beginning: several aspects of the law enable the federal government and states to go even further. For instance, the building retrofit tax credits are uncapped and extend for a decade, potentially enabling even more energy efficiency and electrification retrofits than currently envisioned. The law also includes more than $30 billion in flexible greenhouse gas (GHG) reduction spending for states and cities. The federal government, the largest real estate holder in the nation, will have new resources and requirements to address the GHG footprint of its properties. And new funding for embodied carbon labeling and Environmental Product Declaration systems for construction materials will help develop the market for lower embodied carbon in buildings nationwide.

How Will the IRA Help Redesign Our Homes and Workplaces?

Rolling out new energy efficiency and electrification retrofit programs and braiding together the funds from those new initiatives where it is allowed are central pillars of the building decarbonization recipe. The IRA is delivering new and increased funds for federal, state, and local programs that will lower the upfront cost and result in the installation of:

- Efficient electric heat pumps that can both heat and cool your home, which the Department of Energy estimates will save families approximately $500 – $1,000 every year. With a rebate of up to $14,000, the IRA helps low-income households shift from polluting gas to healthy, affordable clean energy.

- Induction cooktops, which receive rave reviews from some of the country’s top chefs and will replace dangerous and health-harming gas stoves that contribute to asthma and other respiratory diseases.

- New insulation, windows, doors, and sealing ductwork, which will ensure a home’s heating and cooling systems don’t have to work in overdrive to keep families comfortable.

- Upgraded electrical panels and wiring for homes that have older electrical service

- And so much more.

Homeowners can check out Rewiring America’s tool to preview the incentives available to any individual household.

It’s critical to remember that our buildings are long-lived investments — they remain standing for decades, if not for a century, and investments in upgrading and modernizing major systems in homes, schools, and commercial buildings typically only occur every 12 to 20 years. The influx of funding from the IRA will facilitate major and direly needed improvements that will last for decades.

How and When Can We Take Advantage of the New Financial Incentives?

The IRA contains two main types of building improvement financial incentives for efficiency upgrades and electrification: tax credits and rebates.

- Tax credits for building retrofits are available now; however, the increased incentive levels (especially for advanced electric appliances) and other upgrades will go into effect beginning January 1, 2023. These credits will be available for a decade.

- The state-run efficiency and electrification rebate programs will take some time to design and roll out to consumers (up to 2 years).

The Inflation Reduction Act directs unprecedented levels of funding toward the critical aim of making the US buildings sector climate-friendly, more affordable, healthier, and safer. However, this funding alone isn’t enough to put the sector on track to meet our climate goals. To maximize the IRA’s transformative potential, the financial incentives must be coupled with a concerted effort to design effective state and local programs that educate and attract consumers and contractors, develop the necessary workforce to meet the demand of a growing industry, and fold together existing state and utility energy efficiency and electrification programs.

A full transformation of the built environment to align with climate and equity goals will take additional action from the Biden Administration and federal agencies, proactive planning from utility regulators, ambitious state and local policymakers, and so much more. The Inflation Reduction Act should start cascading changes in our built environment, and it’s up to all of us to take advantage of this unprecedented opportunity.