RMI Buys Renewable Energy Certificates in China’s Pilot Market

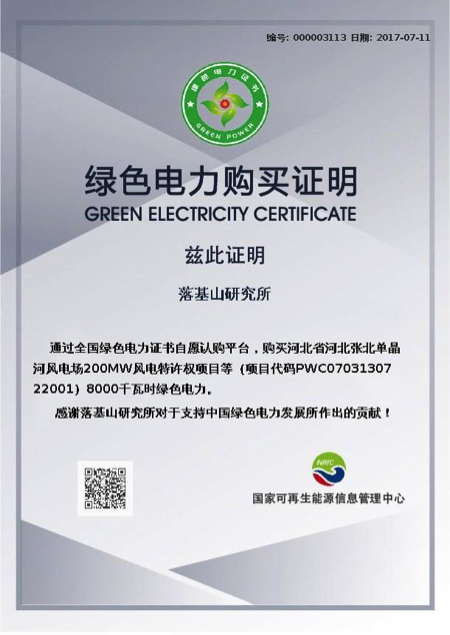

In July 2017, China opened its green energy certificate market—often called renewable energy certificates (RECs) or Guarantee of Origin (GoO) in other parts of the world—which allows businesses and individuals to buy renewable energy (in China’s domestic market). RMI was one of the first to support this new product by purchasing eight RECs to offset our Beijing office’s electricity consumption for the one-year period between July 2016 and June 2017.

A Fast Moving Market: Renewable Capacity and Portfolio Standards

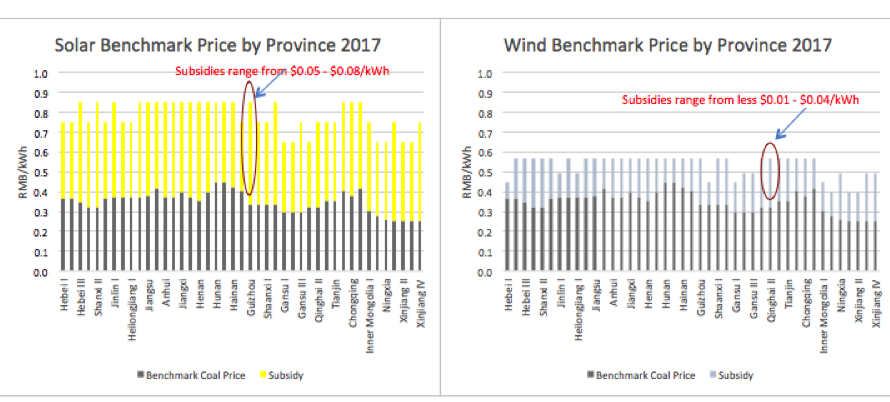

China Electricity Council report shows that from 2010 to 2016, China added 199GW renewable capacity on to the grid. . This was possible because of strong leadership from the Chinese government and a government subsidy for each kilowatt-hour (kWh) of renewable power integrated into the grid. The government sets the subsidy, or feed-in-tariff (FiT), by province for both wind and solar. For each kWh of renewable power integrated into the grid, the renewable developer receives the government-set benchmark coal price from the grid company plus the FiT from the government. Together, these two prices represent the wind or solar benchmark price (Figure 1).

The FiT had the intended outcome: Chinese generators rapidly added renewable capacity to the grid. However, the FiT faced a challenge: it is funded by charging a small fee on every kWh sold, and since electricity demand for the past three years in China has been relatively flat, growing renewable capacity led to shortfall in funds for the FiT. Still, the government wants generation companies to increase the percentage of renewable energy in their respective portfolios. And from the private sector, corporations in China are demanding access to renewable energy along with a way to prove and track that their payments are funding clean energy projects.

In response to these factors, China turned to a system used in many international power markets: a national registry for renewable power production. In China, this took the form of a REC market. China’s pilot REC market began operating on July 1, 2017.

China’s RECs, issued by the National Renewable Information Center (NRIC), serve as a digital paper trail to account for renewable generation and the positive environmental attributes associated with that generation. Any level of government department, public institutions, private corporations, and individual can purchase RECs on the platform. Each REC has a unique ID number that allows the NRIC to track every MWh of on-shore wind or solar electricity from generation to retirement. After application materials have been authorized by the NRIC, the renewable developer can receive the RECs for their generation and sell them through the platform.

Under the national REC pilot, developers who sell RECs forgo the FiT, reducing the amount of money the government spends on subsidies. While this market is still in pilot stage, it is customary in China to pilot mechanisms on a small scale before rolling things out nationally. While developers determine the price they are willing to sell RECs for, the price cannot exceed the FiT. Because the government-set FiT is generally higher for solar than wind (Figure 1), REC prices follow the same trend. The trading price for wind RECs from mid July to December ranged between 137.2–330.0 RMB/MWh ($20– $49/MWh). Solar ranged between 600.7–640.5 RMB/MWh ($90–$96/MWh) and attracted fewer buyers (Figure 2). Unlike some other renewable procurement mechanisms used throughout the world but similar to other REC markets, RECs in China are a price premium; any REC purchase is additional to a customers’ utility bill.

For generators, RECs provide an alternative option to receiving the FIT, which is often delayed in China. One estimate found that it takes an average of 18 months after the grid buys a MWh from a centralized solar plant for that plant to receive its subsidy payment from the government. By the end of 2016, the government delayed paying out over 60 billion RMB ($9 billion) worth of renewable subsidies. This is expected to increase to 300 billion RMB ($45 billion) by 2020 if no solution is introduced. RECs represent one solution, bypassing the FiT backlog and granting developers immediate payment once their RECs are sold. To calculate the present value for an 18-month delay in the FiT, we used an 8 percent discount rate; if developers received payment within a month of when their power was sold, 100 RMB is discounted to 89.09 RMB. This means a seller may be willing to offer a 10 percent discount for RECs sold within a month of generation instead of waiting 18 months or longer for the government subsidy.

For buyers, RECs are easy to use. This is a benefit for companies, offices, and individual buyers, who may want to achieve a renewable energy target but have limited options to do other types of deals because of limited electricity demand or the expertise needed to sign a large-scale deal.

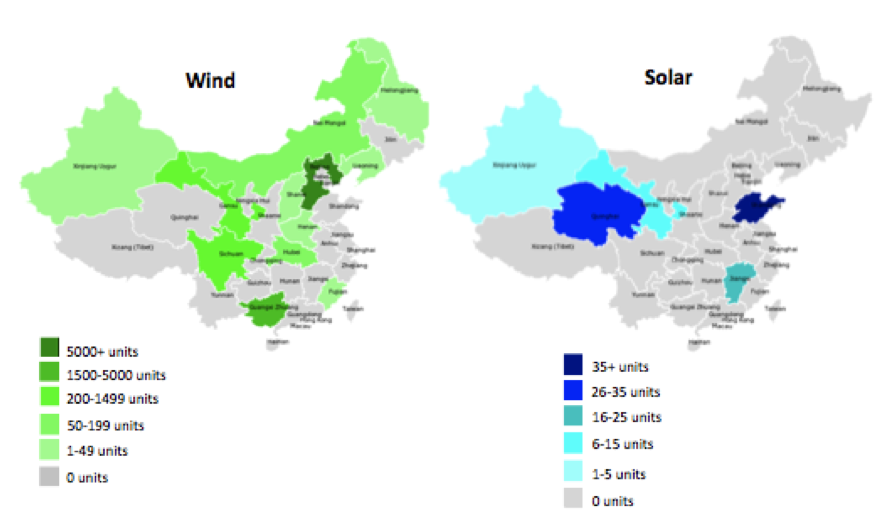

In the first five months of the pilot, almost 11 million wind RECs and 500,000 solar RECs were issued on the exchange. Hebei, Inner Mongolia, and Shandong provinces issued the most wind RECs, while Qinghai, Xinjiang, and Inner Mongolia issued the most for solar. But only about 1,600 buyers purchased 21,300 RECs in total—a small fraction of what is available.

China’s National Energy Administration (NEA) has set a renewable portfolio standard (RPS) target for each province for 2020, specifying how much power must be supplied by non-hydro/non-fossil power, but not who is responsible for fulfilling the RPS. Demand for RECs is likely to grow quickly when regulators confirm who must fulfill the RPS and establish RECs as an option to fulfill their obligations. This could take many forms: one plan would require generators to produce at least 9 percent of power from renewable (non-hydro) sources by 2020 with generators verifying they met these targets through RECs; another would require the grid companies to buy a certain percentage of renewable power and use RECs to verify that. Some market participants believe that as government departments and public institutions set their own obligations, they too will become major REC purchasers.

Challenges of Tracking Green Electrons

However, there are some inherent challenges to the REC market in China. The most striking is the price and limited trading volumes. In many parts of the U.S., the price of RECs are about $1/MWh. U.S. RECs can be used to get tax credits, making the economics of RECs more attractive. In China, RECs are a pure price premium for buyers (prices range between $20–$96/MWh in China’s national market so far).

Another downside to RECs is they do not contribute to additionality. Many international corporations have additionality requirements under their renewable energy targets; in other words, their investment in renewables should increase the amount of renewable energy on the grid. While there are competing definitions over additionality, in China we believe the issue is not just getting additional renewable energy onto the grid, but rather, integrating the renewable energy capacity that currently exists. Because of China’s system of equal allocation dispatch, high curtailment rates in the northwest part of the country are only exacerbated when new renewable capacity comes on in the same region. In this context, any action to integrate or use renewable energy that would have been curtailed under the current dispatch system should likely count as “additional” power. However, in China RECs don’t affect dispatch and therefore can’t address curtailment. But they allow individuals to support the sector by using their own funds.

Our Experience Buying RECs in China

By entering China’s pilot REC market, we offset 100 percent of our power supply to our 15 person, 290 square meter office in a LEED platinum building in Beijing’s Central Business District. Our building has a central air conditioner system for heating and cooling, and our office uses zone control in both lighting and HVAC system to reduce energy use.

While many tenants of large office buildings must estimate their electricity use, our building has sub-meters for each tenant and is broken down between air conditioning and other electricity demands. From July 2016 to June 2017, our office consumed a total of 6.67 MWh of electricity: 1.94 MWh from the air conditioner and 4.72 MWh from lighting, plug loads, and other uses.

Once we decided to buy RECs in China’s pilot program, we found the process relatively simple. We registered an account on the RECs trade platform and provided supportive legal materials, necessary for corporate buyers but not for individuals. The platform allowed us to search by geography, wind vs. solar, size, and developers.

Like many corporate buyers, we considered whether to include geographic criteria in our decision-making process. We know that some buyers may want to support renewable development in areas with low renewable capacity or where the grid is the dirtiest. Others may want to support developers in areas with high capacity and high curtailment. For us, understanding the limitations of the system helped clarify our geographic goals—we wanted to support a local renewable energy development. Since the market didn’t have any RECs from Beijing, we choose the closest option: a wind plant in Hebei province. When we purchased our RECs, Hebei didn’t have solar on the platform but had a high installed wind capacity with a relatively low price compared to Inner Mongolia, Shandong, and Liaoning provinces. The Zhangbei Danjinghe wind farm—the issuer of our RECs—was developed by the China Energy Conservation and Environment Protection Group, a state-owned enterprise that provides pollution-control technology and energy and environmental consulting services and develops renewable projects. The 200 MW wind farm has provided power to the grid since 2008.

After we purchased RECs for our energy consumption over the past year, we used an independent certifier to verify we offset our electricity use. For companies or individuals without submeters, certifiers can perform an energy audit to calculate how many RECs are needed to offset consumption.

An Evolving Market

The emergence of China’s national REC market allows for individuals to participate in renewable energy and provides benefits to companies looking to track their purchases. If combined with an RPS market, RECs could play a critical role in a faster transition to a clean power source. But RECs are not the only mechanism available to corporate buyers in China. In our State of the Market 2017 Report, we lay out nine existing or emerging renewable procurement mechanisms ranging from RECs and on-site generation to centralized bidding and bilateral deals. Demand from a wide range of companies in China from RECs to PPAs sends the signal that it’s good business to buy clean energy.

Image courtesy of iStock.