Op-ed: Clean Energy Tipping Points

Editor’s note: The following op-ed was posted in Mandarin in Caijing Magazine, an influential Chinese publication that covers social, political and economic topics.

On April 20, 2020, for the first time ever, the price of oil—specifically the price on the futures contract for West Texas crude oil—was negative. COVID-19 and the response by governments, businesses, and individuals around the world have significantly reduced the movement of goods and people, resulting in a dramatic decline in the demand for oil and associated products.

While it is clear that the current global pandemic is a major cause, oil and gas companies have faced mounting challenges in recent years. Declining costs for clean and renewable technologies combined with stated commitments from the business and investment community are causing major disruptions to established, trillion-dollar markets.

Clean Energy is Pushing Fossil Fuels to the Tipping Point

In March of this year, in response to the already declining price of oil, Rocky Mountain Institute published a blog proposing that the petroleum industry may have already reached a fundamental tipping point. History has repeatedly shown that tipping points occur when a new, disruptive technology reaches approximately 3 percent of market share, resulting in a shift in capital away from stated incumbents.

The number of horses in use peaked in the United States at the point that car ownership was 3 percent, gas lighting demand in the UK peaked with electric lighting was 2 percent of the market, and the use of landline phones in the United States began to fall precipitously once wireless demand passed 5 percent of the market.

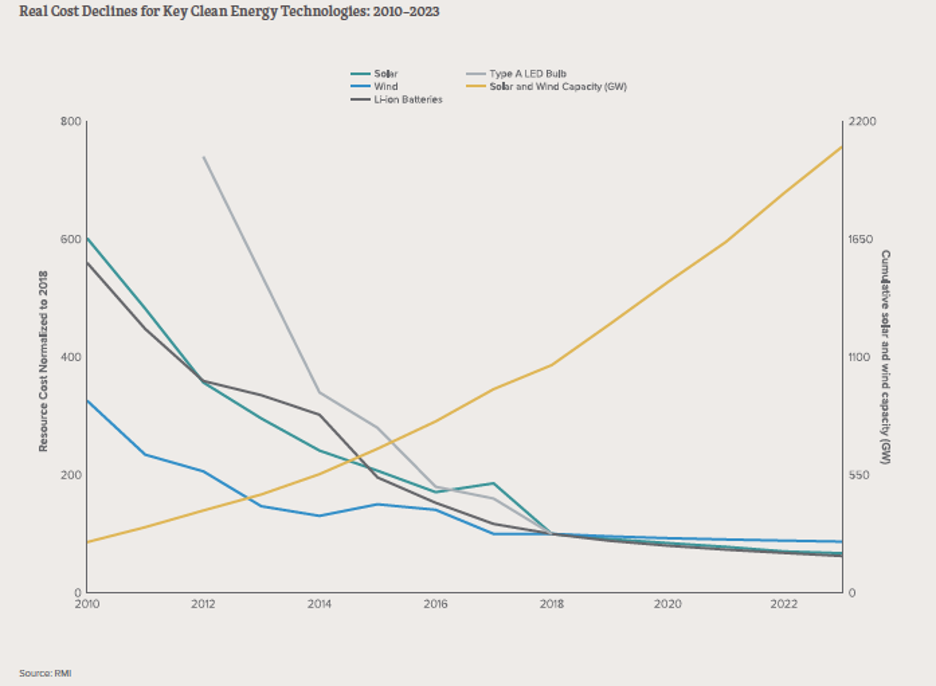

In RMI’s report, Seven Challenges for Energy Transformation, we discuss the pattern of exponential improvement in a technology’s cost curve associated with increases in production volumes. We have seen this occur in clean technology sectors where the cost of solar, wind, LEDs, and lithium-ion batteries have all dropped by more than 80 percent over the past decade thanks to the combined force of technology innovation, learning-by-doing, and scaling (Exhibit 1).

According to Bloomberg New Energy Finance (BNEF), in its Long-Term Electric Vehicle Outlook 2019 report, global EV sales have risen from 100,000 annually in 2012 to nearly 2 million in 2018. This has come as the average price for a lithium-ion battery pack as dropped from US$1,160 in 2010 to $176 in 2018 (in real 2018 US dollars). UBS estimates that battery costs will continue to decline by as much as 80 percent in the coming decade. And Wood Mackenzie projects that global energy storage deployments will grow thirteenfold to a 158 gigawatt-hour market in 2024, which equates to $71 billion in investment.

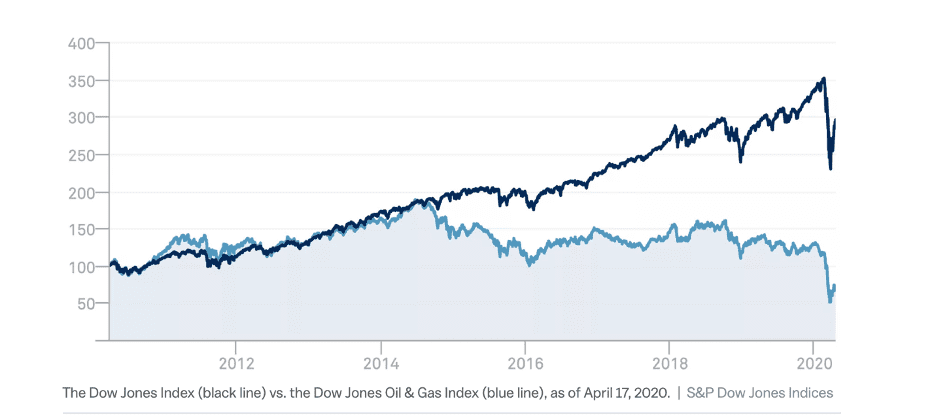

The declining cost of batteries and growing demand for electric vehicles is a contributing factor to the declining performance of oil and gas companies in recent years. A comparison of the S&P Dow Jones Index and the Dow Jones Oil & Gas Index paints a clear picture of the underperformance of the oil and gas sector (Exhibit 2). Looking beyond the current challenges stemming from COVID, while demand for oil may rebound, the long-term picture remains bleak. A recent analysis by BNP Paribas estimates that the long-term break-even price for oil to remain competitive as a source of fuel for mobility is US$10–20 per barrel.

A similar situation is playing out in the coal sector, where the declining costs of solar, wind, and battery storage are making coal power generation increasingly uneconomic in markets around the world. Recent analysis by Carbon Tracker indicates two key economic metrics regarding the outlook for coal markets. First, new renewable energy is cheaper than new coal generation assets in every major global market. Second, over half of the existing fleet of global coal assets are more expensive to run than new renewables. According to a report by IRENA, in 2018, investment in renewable energy reached US$272.9 billion, nearly three times the investment that year in coal and gas-fired generation combined.

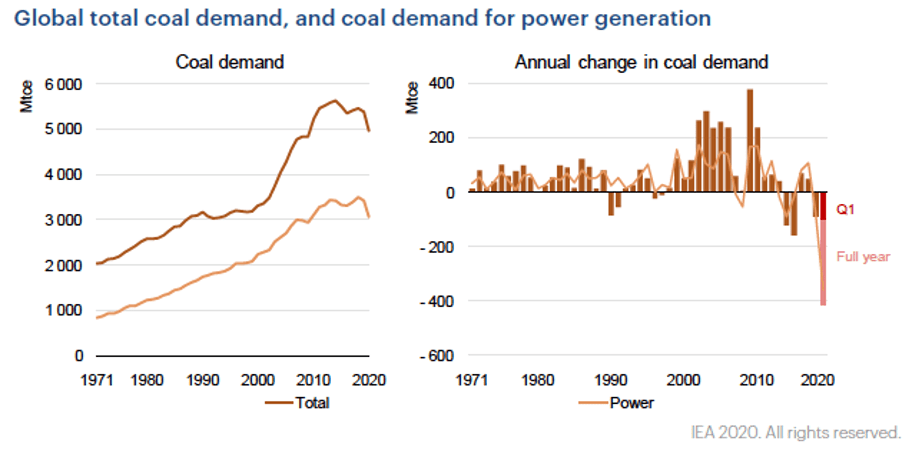

In the past several weeks we have seen coal’s economic disadvantage play out in real-time. Given that coal is more expensive than gas and renewables in most places, coal power plants have been the first to be priced out of electricity markets as demand has declined during the pandemic. According to IEA, in the first quarter of 2020 coal consumption fell by 8 percent in China compared to 2019, 30 percent in the United States, and more than 20 percent in the European Union. Globally, coal is expected to decline by approximately 8 percent by the end of the year (Exhibit 3).

While coal demand has declined, gas and renewables have increased. According to the Institute for Energy Economics and Financial Analysis, in the United States, more electricity has been produced from renewables than from coal-powered generation on 47 days so far in 2020, surpassing the 38 days across all of 2019. In Europe, renewables delivered nearly half of all electricity generation between March 10 and April 10, an increase of 8 percent compared to the same time last year. Coal use will likely recover as people go back to work and school, but the broader trend is clear. Coal is increasingly uneconomic and new energy investments will continue to focus on lower-risk clean and renewable energy.

The declining costs of clean energy technologies are disrupting major established markets, including oil and gas as a primary fuel for transportation and coal used to generate electricity, as new investments increasingly shift away from fossil fuels and towards renewables. The COVID-19 crisis is further highlighting the competitive advantage of clean technologies and the broader energy transition underway.

Now is the Time to Focus on Clean Energy

The global economy is facing unprecedented challenges. While addressing the health and economic impacts of COVID-19 are clear priorities, now is not the time to backtrack on the transition to clean energy. Major oil companies, including Royal Dutch Shell, are releasing ambitious energy transition plans. Also, according to the Financial Times, several investors are continuing to call on companies globally to maintain their commitments to reducing carbon emissions, despite the significant current economic challenges.

Government, business, and investor leaders should consider the longer-term market disruptions, and associated risks and opportunities, in addition to near-term needs when making decisions in the months and years ahead.

As stated earlier, while several clean energy technologies, including solar, wind, and EVs, are reaching maturity, there are not yet economical, proven technologies for a large portion of the broader clean energy transition. Gaps include long-haul transportation; high penetration renewables and associated grid flexibility; low-emission or “green” solutions for steel and cement; and addressing the growing global demand for space-cooling, including air conditioning. By tackling these key gaps, government, businesses, and investors can gain a lasting competitive advantage as demand for new clean technology solutions will continue to drive economic growth and jobs in the decade ahead.

Action by both private and public sector actors is required to advance the development and deployment of key technologies. Companies can support clean technology through individual R&D programs and joining consortiums to work together to address specific market barriers. In North America, the Renewable Energy Buyers Alliance, an alliance of large clean energy buyers, energy providers, and service providers, has worked together to grow the overall market for renewable energy and lead the procurement of over 20 gigawatts of renewable energy deals since 2015.

In addition, companies can consider the current market disruptions taking place and invest now in developing clean energy infrastructure that will mitigate risk and continue to drive economic growth. Economic downturns can serve as an optimal time to consider making these investments due to cheap labor and materials, access to inexpensive capital, low valuations if the company is pursuing acquisitions, and the ability to stimulate the economy and create jobs. According to a Bain & Company analysis of the 2008 recession, in addition to cost restructuring and strong financial tracking, the strongest companies planned to capture opportunities and reinvest during the recession, while others took more conservative approaches.

Investors can individually and collectively work to align investment portfolios with the goals of the Paris Agreement, including agreeing on definitions, setting methods, and sharing data. Several ongoing efforts, including the Climate Finance Leadership Initiative and the Poseidon Principles, are examples of how the finance sector is working to align and advance the transition to clean energy.

The Climate Finance Leadership Initiative is comprised of the senior executives of seven major financial institutions, with a focus on mobilizing private capital to scale and accelerate the transition to a low-carbon economy. The Poseidon Principles is an example of a new model where financial institutions and industry leaders commit to a global, sector-wide, and self-governing climate alignment agreement. Last summer, 11 banks representing approximately US$100 billion signed onto the Poseidon Principles, which defines a framework for assessing and disclosing the climate alignment of a financial institution’s portfolio in line the IMO’s 2050 climate target.

It is true that COVID-19 and the associated economic slowdown is creating significant uncertainty around how these trends will continue in the near-term and whether government responses will further enable or challenge continued progress on clean technology. One thing is clear: government stimulus packages will have an emphasis on infrastructure investment and associated job creation. There is an opportunity through the COVID crisis to maintain leadership on clean energy and new technology innovation in the decade ahead or to continue investing in risky, uneconomic fossil fuel infrastructure. China as the global clean energy leader is well positioned to lead the continued investment in and transition to clean energy infrastructure.

China Can Lead the Global Transition to Clean Energy

China has already stepped into the center of the global transition to clean energy. An IRENA report shows that in 2018, China accounted for 33 percent of global wind power installed capacity and 36 percent of global solar power installed capacity. According to the China Automobile Association, 62 percent of global EVs were sold in China in 2018.

These are happening as traditional players in the markets are significantly slowing down their pace. According to a report by China’s Energy Research Institute, in 2018, the overall investment to China’s power sector shrank to US$120 billion while the share of this investment to renewable energy increased to 70 percent. Data from the China Automobile Association indicates that the sale of passenger vehicles in China also saw a 3 percent decrease in 2018 after almost 30 years of continuous growth. Meanwhile, EV sales witnessed a year-on-year growth of 61.7 percent in 2018, hitting a new record. These markets in China are showing clear signals that tipping points for market transformation are already happening.

Looking to the future, with powerful state-led industrial policies, large market scale, a comparative manufacturing advantage, and highly integrated and efficient supply chains, China has a unique ability to get technologies on a virtuous cycle where costs can be rapidly lowered. This will enable China to lead and eventually benefit from the cultivation of emerging industries driven by the energy transition, such as hydrogen electrolysis, high-efficiency solar PV, energy storage, high-efficiency heat pumps, direct air carbon capture, and third-generation biofuels.

China and many countries around the world are seeking to recover their economies from the impact of COVID-19 and planning stimulus packages. It would be a significant opportunity to define a path, not only to address near-term challenges but also to support long-term green and low-carbon economic growth and development. Spending sufficient recovery resources to support China’s transition to clean energy will be crucial to maintain China’s leadership in the field.