Pushing the Limit: How Demand Flexibility Can Grow the Market for Renewable Energy

Download Demand Flexibility: The Key to Enabling a Low-Cost, Low-Carbon Grid. This is the first of a series of three RMI reports on the role new technologies are playing in replacing traditional capital investment in fossil-fueled electricity delivery and generation infrastructure.

As the share of U.S. electricity generated from coal plants continues its steady decline, the question remains as to what will ultimately replace this resource in meeting U.S. electricity demand. Low natural gas prices driven by advances in extraction technology over the last decade position gas as a potential winner. Yet technology breakthroughs and innovative business models have positioned wind and solar as viable competitors, with long-term prices at record lows for both large-scale and distributed projects.

These trends may not be mutually exclusive; in fact, many electricity industry players see natural gas and renewables going hand in hand. For years, U.S. utilities and system operators have argued that the build-out of natural gas capacity is essential to balance variable renewable energy generation and meet peak load, and suggested there may be an associated “upper limit” to renewable generation on the grid. In addition, wind and solar resources tend to reduce energy prices when they are available; this “merit order effect” can dampen the investment value proposition for developing new renewable projects and potentially further limit their overall share of generation.

Yet this analysis only looks at the supply side of the equation, and ignores flexibility on the demand side. Rocky Mountain Institute’s new insight brief, Demand Flexibility: The Key to Enabling a Low-Cost, Low-Carbon Grid, shows how demand flexibility can be a lower-cost, less-polluting alternative to natural gas-fired power plants for balancing renewable energy on the grid. RMI modeled the use of demand flexibility across a large geographic area to shift electricity consumption from times of the day with high demand but low renewable supply to times with high renewable supply, and found that the strategy can significantly reduce customer costs, curtailment of renewable energy, peak demand, and carbon emissions compared to relying on natural gas-fired generation.

Why Higher Renewable Penetration Limits Its Own Economic Success

Due to its low operating costs, new renewable capacity often displaces more expensive generators on the grid, lowering wholesale clearing prices. Higher amounts of variable renewable energy on the system also creates a mismatch between energy demand and supply, increasing the risk of renewable curtailment—the forced reduction in power output—when other inflexible generators like coal and nuclear are unable to ramp down during periods of high renewable availability.

The combination of mismatched renewable supply and hourly electricity demand, coupled with inflexible thermal generation, can significantly lower the revenues of renewable projects and hinder their potential to grow market share. In California and in the Midwest, for example, revenues from renewable generation are falling due to rising renewable adoption, grid congestion, and the inflexibility of other generators.

Integrating Renewables with Demand, Not Supply

RMI’s new insight brief shows how this misalignment of supply and demand, and the “value deflation” of renewables, largely can be addressed by the deployment of control and communication technologies used to manage energy consumption. Typically, demand response programs focus solely on shedding load during times of high load; our study analyzes the role of demand flexibility that can shift consumption to different times of the day, while maintaining the same level of daily electricity use.

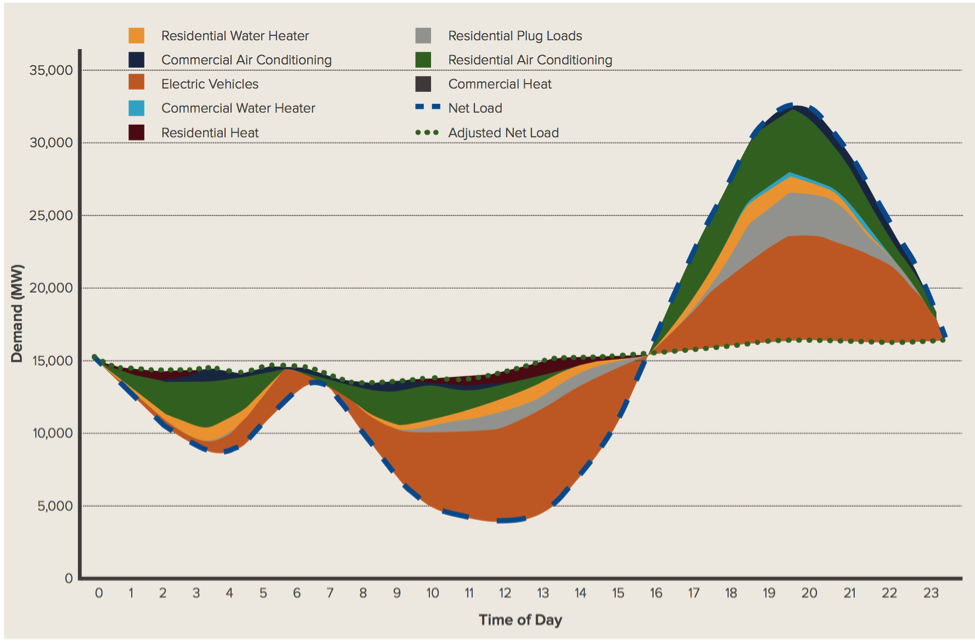

Using an hourly simulation of a future, highly renewable Texas power system based on scenarios drawn from RMI’s Reinventing Fire analysis, we show how using demand flexibility across eight residential and commercial end-use loads to shift demand into periods of high renewable availability can flatten the net-load curve and reduce peak load, significantly mitigating afternoon ramping. By reducing curtailment, demand flexibility can increase the value of renewable energy by over 30 percent compared to a system with inflexible demand, making the development of new renewable projects more attractive.

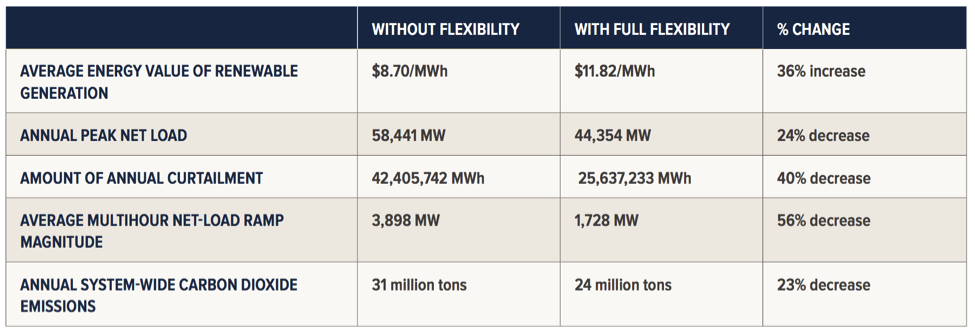

Demand flexibility not only better matches demand to variable supply, but can lead to a system with lower overall costs and carbon emissions than would be possible using only gas-fired generation to balance renewables and meet peak load. Overall, using demand flexibility in the modeled system would avoid almost $2 billion of annual generator costs and one-fifth of total annual CO2 emissions. Flexible demand of this magnitude would also reduce renewable curtailment by 40 percent, lower peak demand net of renewables by 24 percent, and lower the average magnitude of multihour ramps (e.g., the “duck curve”) by 56 percent.

Incorporating Demand Flexibility into System Planning

To fully capture these benefits, demand flexibility needs to be accounted for as a core resource throughout all stages of grid and portfolio planning. Neglecting to fully integrate demand flexibility into procurement decisions may lead to duplicative investment in natural gas-fired power plants or in new infrastructure that may be stranded as demand flexibility becomes more cost-effective and commonplace, enabled by advances in machine learning and data analytics. In setting renewable supply targets, demand flexibility can push predetermined limits of renewable adoption upward by significantly improving the value of new renewable capacity. Integrating demand flexibility with renewable projects could also alleviate some of the price risks that project developers and off-takers face with unsure returns.

Develop Incentives for Both Utilities and Customers to Invest in Demand Flexibility

For more than a century, cost-of-service regulation has incentivized utilities to prioritize capital investments they can include in their rate base, which lead to higher earnings under typical business models. However, new regulatory tools are emerging that can allow utilities to preserve traditional returns when investing in or procuring lower-cost and/or third-party-owned demand flexibility as a grid resource. These adjustments to the utility business model will play a central role in expanding the use of demand flexibility in system-planning decisions.

Energy customers will also need a helpful nudge when deciding to purchase new flexibility technologies. While rebates can lower the initial cost, time-varying rates that reward grid-friendly consumption can improve customer payback. Nonmonetary incentives, such as the increased use of automation and control technologies, can improve the customer experience, further motivating customers to participate in utility demand-flexibility programs.

An Opportunity for the Climate and for Customers

The U.S. grid is at a crossroads. RMI estimates that approximately half of existing coal, nuclear, and gas-fired power plants are likely to retire in the next 15 years, creating a gap in capacity that needs to be filled. At the same time, renewable energy prices are dropping much more quickly than expected, leading to their accelerating adoption. Investing in new gas plants to replace retiring capacity and balance the variability of new renewables will lock in significant cost and carbon emissions for decades to come. Our new research shows, however, that demand flexibility can be a cleaner, less-costly option, promising to unlock new value for renewable energy and utility customers alike.

Image courtesy of iStock.