Maximizing Europe’s Green Hydrogen Supply

The EU will need both locally produced and imported hydrogen to keep industrial sites operational while replacing gas, coal, and oil in energy-intensive sectors.

To rapidly reduce reliance on Russian fossil fuels, the EU recently set one of the most ambitious hydrogen deployment targets in the world: to deploy 20 million tons of renewably produced hydrogen as a fuel and a feedstock by 2030. Still, with significant public funding promised to new green hydrogen producers in the United States, some advocates in Europe have expressed concern that the EU will lose out on investments in new hydrogen facilities.

But hydrogen market growth is not a zero-sum game, and the EU stands to gain from growing global support for ramped up green hydrogen production, in which renewable electricity powers electrolyzers that produce hydrogen and oxygen from water. Given the urgency of Europe’s energy transition, the bloc will need to leverage both locally produced and imported hydrogen to keep industrial sites operational while replacing gas, coal, and oil in energy-intensive sectors.

The Need for Imports

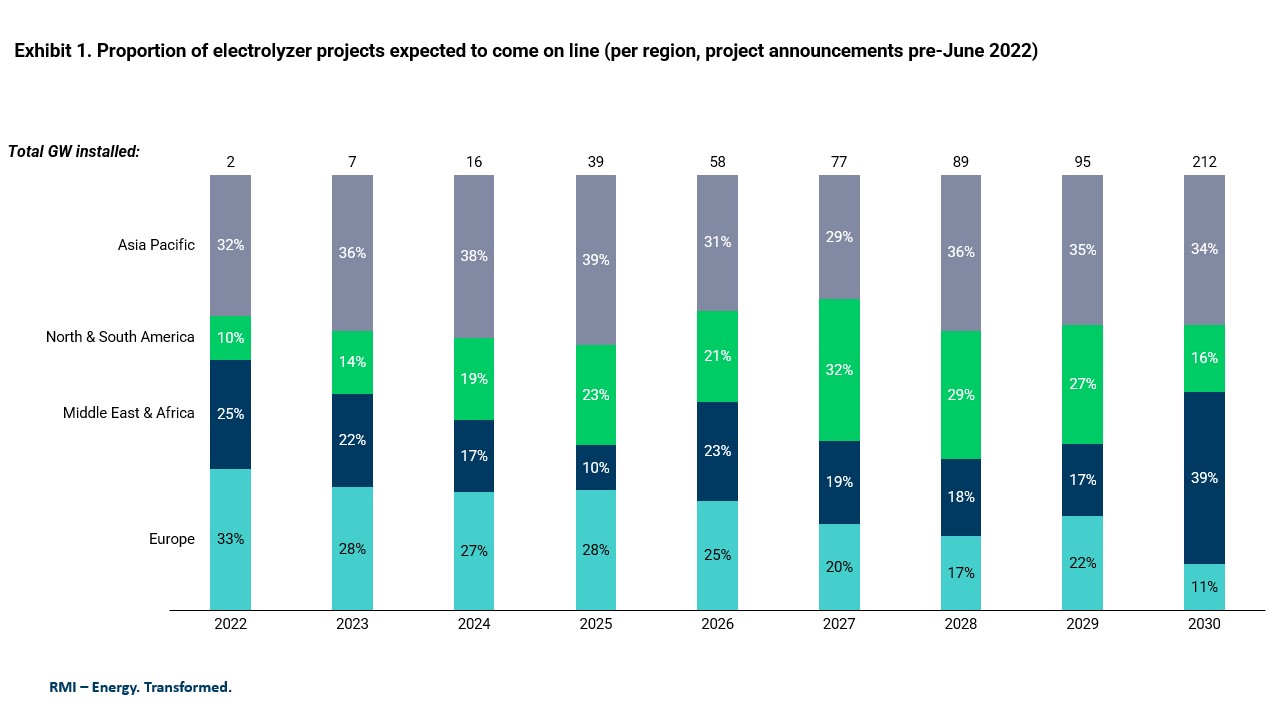

European industries facing extreme energy prices are ready to move away from fossil fuels and decarbonize their operations. Demand for green hydrogen across the continent could reach ~25 million tons per year by 2030, driven by fuel switching in chemicals manufacturing, fertilizer production, refineries, steelmaking, shipping, and heavy-duty trucking. According to electrolyzer installation outlooks, domestic production capacity in the EU will reach 80–100 GW by 2030, sufficient to meet a significant proportion of that demand (roughly 40 percent), but not all of it.

Considering only announced electrolyzer development projects, most early, large-scale green hydrogen production capacity will be concentrated outside the EU in countries like Australia, Mauritania, and Oman.

Sources: BNEF 2H 2022 Hydrogen Market Outlook, Project Pipeline of the European Clean Hydrogen Alliance, RMI analysis

Support for new projects is expanding, and green hydrogen projects can be executed over two to three years, so Europe’s electrolyzer pipeline will certainly grow by 2030. But to maximize green hydrogen deployment and minimize fossil fuel dependency, the EU will also need to leverage imported hydrogen from reliable trading partners.

The Benefits of Imports

Security and Diversity of Supply

Combining domestic green hydrogen with imports will bolster energy security for the EU. Europe can complement a steady internal supply with diversified provisions from a range of countries traditionally aligned with EU interests.

Procuring secure fuel sources for EU industries is more critical than ever, with manufacturers on the continent now curtailing their operations in the face of soaring fossil fuel prices. In two to three years, large-scale imports of green hydrogen should be available from stable, “weatherproof” partners like Australia and the United States for immediate use in European fertilizer and chemical plants. By prioritizing imports, the EU can save on subsidies for domestic hydrogen production while power prices remain exorbitantly high. An influx of imported green hydrogen will also help preclude investments in new gas import infrastructure that will strand as the continent decarbonizes.

Cost Savings

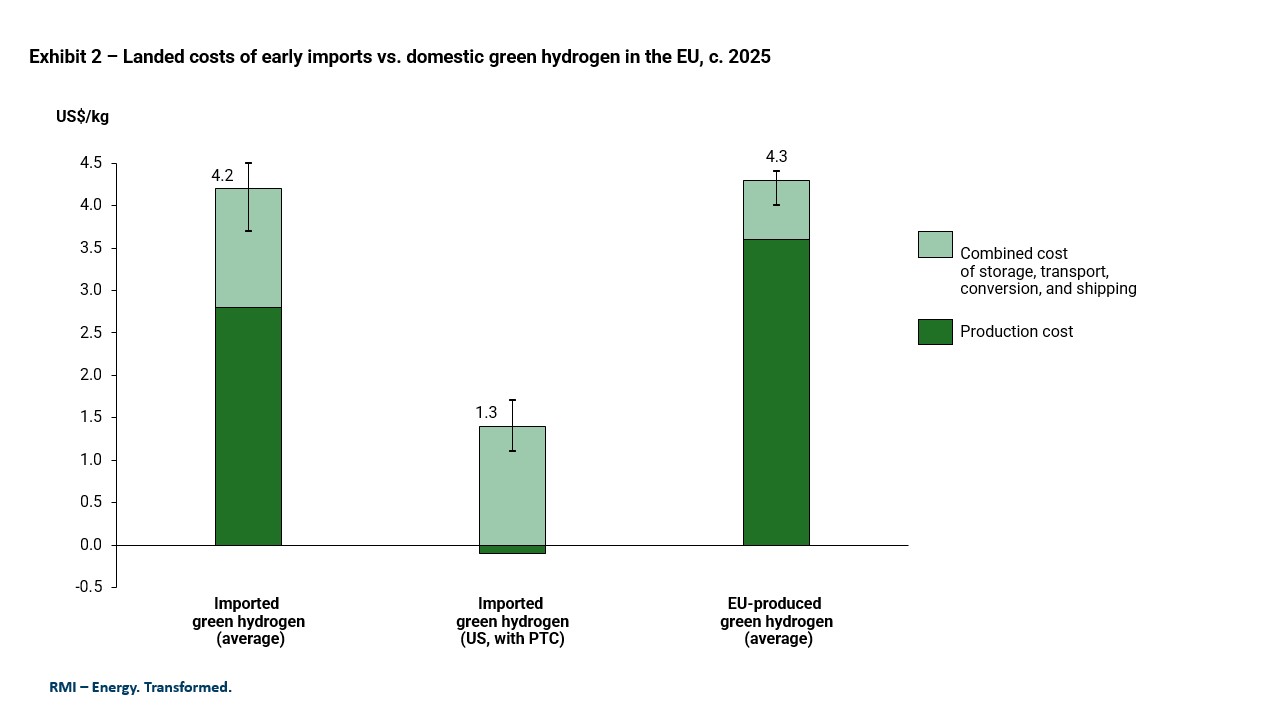

Balancing domestic production with imports will also enable the EU to share the cost burden of investing in new hydrogen facilities while technologies are still developing.

Several countries with ideal renewable profiles are planning to export cheap green hydrogen to Europe, including Australia, Morocco, Saudi Arabia, Chile, and the United States. National subsidies for hydrogen production in these countries will impact the delivered cost of green hydrogen imports, in some cases substantially. In the United States, for example, recently adopted hydrogen production tax credits (PTC) will reduce costs by $3/kg, potentially enabling US suppliers to deliver their fuel to Europe at an effective cost of less than $2/kg.

Sources: RMI Analysis, HySupply State of Play report, The Future of Renewable Hydrogen in the European Union

The EU can strategically seek out low-cost imports from other countries to supply energy-strained European industries with early supplies of green hydrogen while domestic production is still scaling up. Cost savings will accelerate hydrogen offtake and create new demand in key sectors that domestic suppliers can ultimately serve.

New Markets for EU Companies

Prospective exporters of hydrogen to the EU will need to invest in new production, storage, and distribution equipment. And for key technologies across the hydrogen value chain, European equipment manufacturers (OEMs) control most advanced manufacturing capacity. So they can attract substantial private investments in new technologies and even secure public funding for projects in regions like the United States where new facilities will be heavily subsidized.

Similarly, EU-headquartered companies aiming to produce green hydrogen abroad and ship it back to their home market can capitalize on global support schemes for expanded green hydrogen deployment.

Amplification Effects

Scaling up green hydrogen imports to the EU will generate knock-on effects that reverberate across global energy markets. Strong precedents suggest that countries collaborating — rather than competing — to drive the energy transition forward leads to faster cost reductions and wider deployment of decarbonization technologies. Europe previously played a leading role — along with the United States and China — in accelerating cost reductions for solar panels and wind turbines, and the whole world now profits from cheap renewable power.

If the EU joins forces with prospective green hydrogen exporters to support the buildup of more than 300 GW of electrolyzers by 2030 (sufficient to meet EU and US targets combined), the scaling benefits could lead to cost reductions so significant that green hydrogen will permanently become the most competitive fuel option for new energy-intensive industries.

Complementary subsidy schemes in different regions — the EU subsidizing consumption while the United States, Australia, and others subsidize production — will support hydrogen market growth in all regions. New green hydrogen import/export corridors can naturally evolve into green shipping corridors with vessels powered by hydrogen-based fuels, accelerating shipping decarbonization. And by linking itself to other decarbonizing markets via green fuel trade, the EU can easily establish a joint international market for low-carbon products benefiting all participants.

Bringing Imports into the Mix

Three priority actions will help the EU kick-start its hydrogen economy and facilitate the deployment of both domestic and imported green fuel:

- Set clear hydrogen deployment standards to promote certainty for producers

The European Commission should publish clear guidelines specifying how producers can verify their greenhouse gas (GHG) emissions savings in line with requirements. And at least in the short term, emissions from long-distance transport should not be included in the GHG savings calculation for imported green fuels, as this will disqualify nearly all imports from deployment until green shipping corridors are better established.

- Heighten investments in infrastructure and simplify permitting procedures

The EU should streamline project funding and permitting to speed up development and ensure critical infrastructure — new port terminals, storage facilities, and pipelines — is in place by the time green hydrogen starts to reach European ports at scale.

- Continue to expand access to capital for project developers

The EU and its member states should swiftly distribute capital from the European Hydrogen Bank (€3 billion) and from state aid programs (€5.2 billion) to green hydrogen project developers so they can factor public funding into their project financing decisions. Green hydrogen will scale more quickly and broadly if developers can easily access capital.

The EU has signaled strong support for domestic hydrogen buildup in recent weeks. Equally strong support will be required to land imports of clean hydrogen in the EU and power industries at Europe’s targeted pace and scale.