How to Build EV Charging for All

Why You’re More Likely to Get an Electric Uber in Westwood Than Inglewood

Electrifying transportation is crucial to limiting global warming to 1.5°C. Unfortunately, early EVs and their charging infrastructure have been concentrated in wealthy areas—and have therefore not been broadly accessible. To make the EV transition more inclusive we must bring EV chargers to low-income neighborhoods. One way to do that is by electrifying ridehailing fleets.

There is already momentum behind ridehailing (or transportation network company, TNC) electrification. The outsized climate benefits of ridehailing electrification (electrifying one ridehailing vehicle has the emissions benefits of electrifying three non-ridehailing passenger vehicles) have led to government mandates and company commitments from Uber and Lyft to electrify their fleets. However, ridehailing electrification requires a much larger, more widely distributed public charging network than currently exists.

In a new RMI report, EV Charging for All, we dive into the charging infrastructure needs for TNC electrification, focusing on Los Angeles as a case study. The public direct-current fast charging (DCFC) network in LA needs to grow by three to six times by 2030 just to meet the additional demand for charging from TNC electrification. Although this requires a substantial amount of investment—between $116 million and $234 million for equipment and installation costs alone—our research shows that this investment would earn a consistent, healthy return while delivering more accessible EV charging to TNC drivers and the public.

The Current Charging Network Does Not Serve Low-Income Communities

To arrive at these insights, we collaborated with General Motors to analyze over 100 million miles of anonymized travel and charging patterns of TNC vehicles operating on the former Maven Gig rental platform. Maven Gig was a GM subsidiary that provided short-term rentals of both EVs and internal combustion engine (ICE) vehicles for ridehailing drivers. RMI’s analysis of that data showed an existing mismatch between the current DCFC network and the one needed to support TNC electrification.

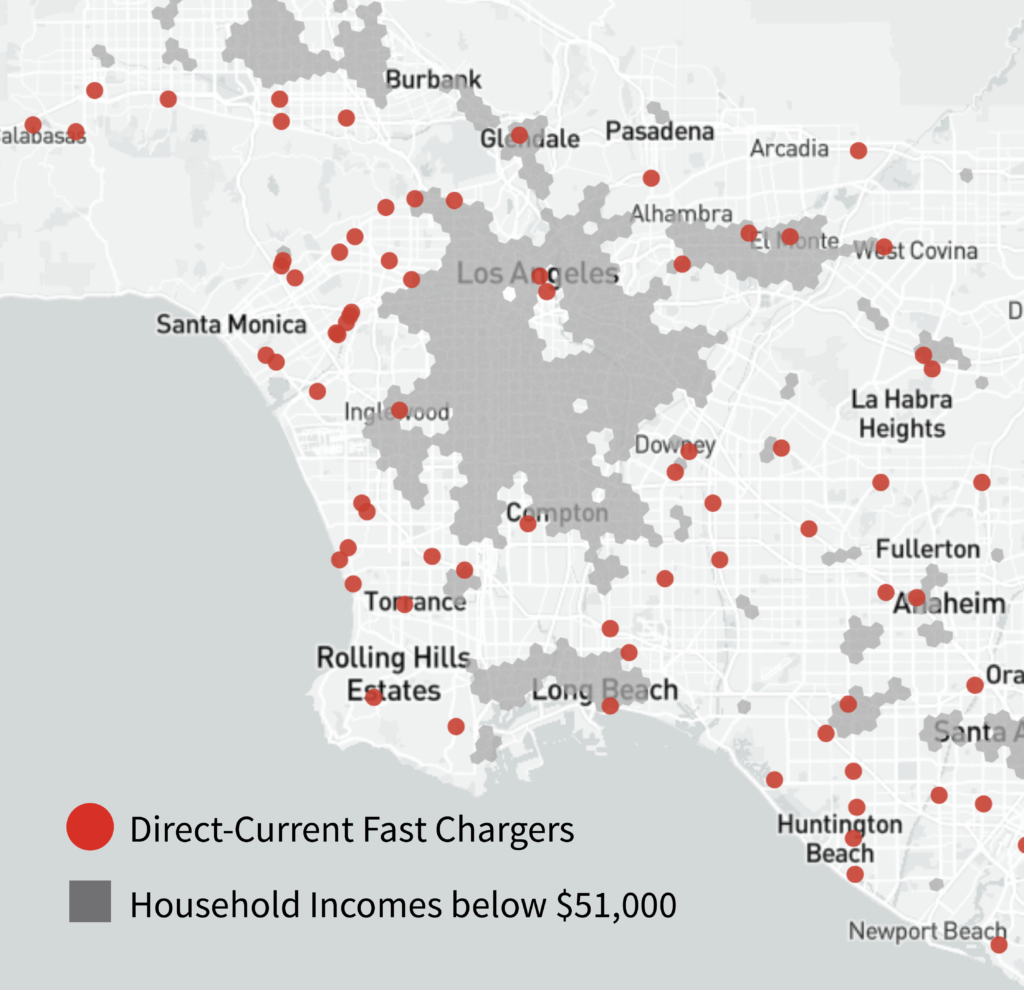

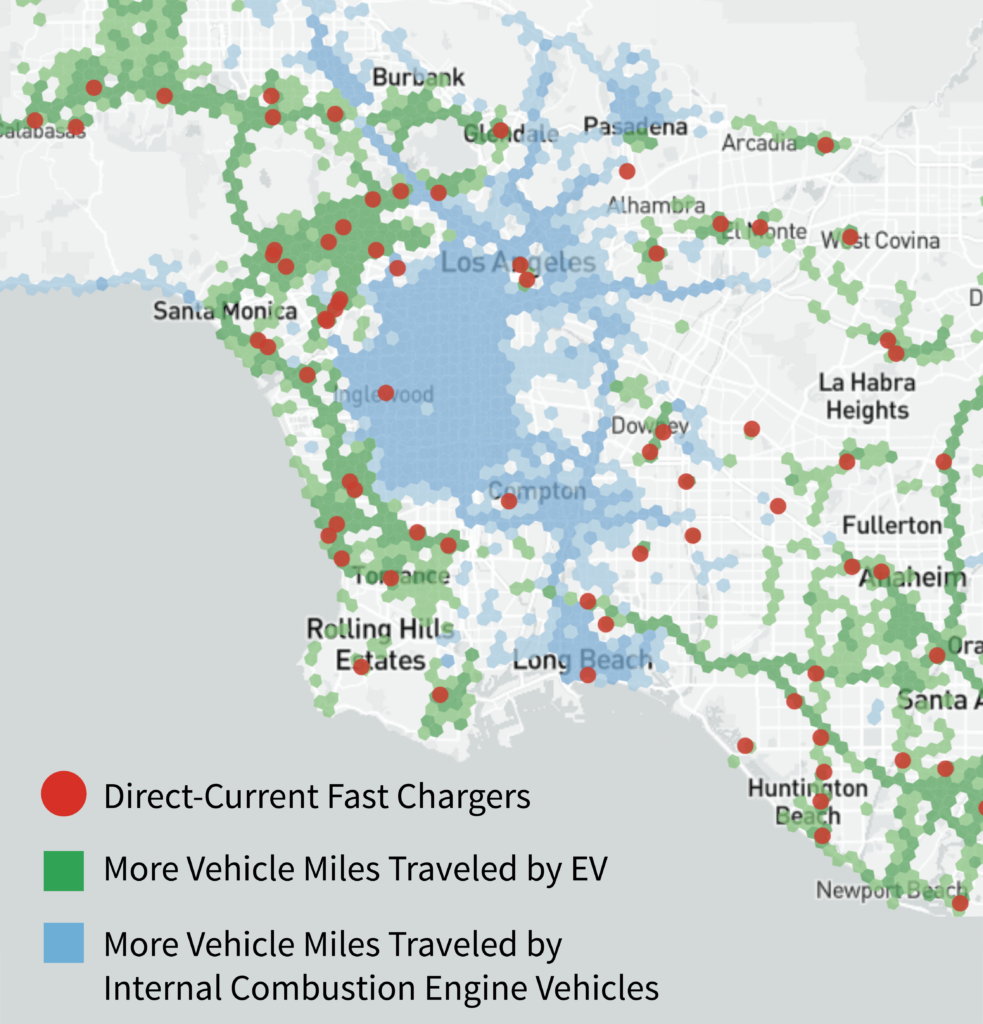

The difference between operating areas of former Maven Gig EVs compared with ICE vehicles illustrates this mismatch. Relative to ICE vehicle drivers, the EV drivers drove more in areas of LA with available DCFC stations (Exhibit 1). Not only is this an operational concern for TNC drivers (driving an EV is difficult when there are no chargers nearby), it is also an equity issue. Current charging stations are primarily situated in higher-income areas to meet demand from early EV adopters (Exhibit 2).

The result is that EV drivers have a harder time driving in lower-income areas, leaving ICE vehicles to meet demand for ridehailing services in these neighborhoods. Unless this issue is addressed, lower-income communities will see less of the local air quality improvements brought by TNC electrification.

Exhibit 1: In LA, many neighborhoods where household incomes are under $51,000 lack fast-charging infrastructure for EVs.

Exhibit 2: EV rides from ridehailing services tend to occur near charging stations—pulling EVs out of lower-income areas and concentrating benefits such as cleaner air in wealthier communities.

Designing a Charging Network for Ridehailing

This contrast highlights the need for a charging network supporting TNC operations that mirror those of current gasoline-powered TNC vehicles, including their substantial operations in lower-income communities (46% of Lyft rides start or end in low-income areas).

To address this problem, we set out to design a network that would meet the needs of TNC drivers in terms of the total number of additional chargers and the locations of the new chargers. We used a machine learning approach to characterize the charging patterns of former Maven Gig electric TNC vehicles and to predict where ICE vehicles would charge if they were electrified. We then used this predicted demand for charging to design a network balancing inconvenience for the drivers and cost to the charging providers.

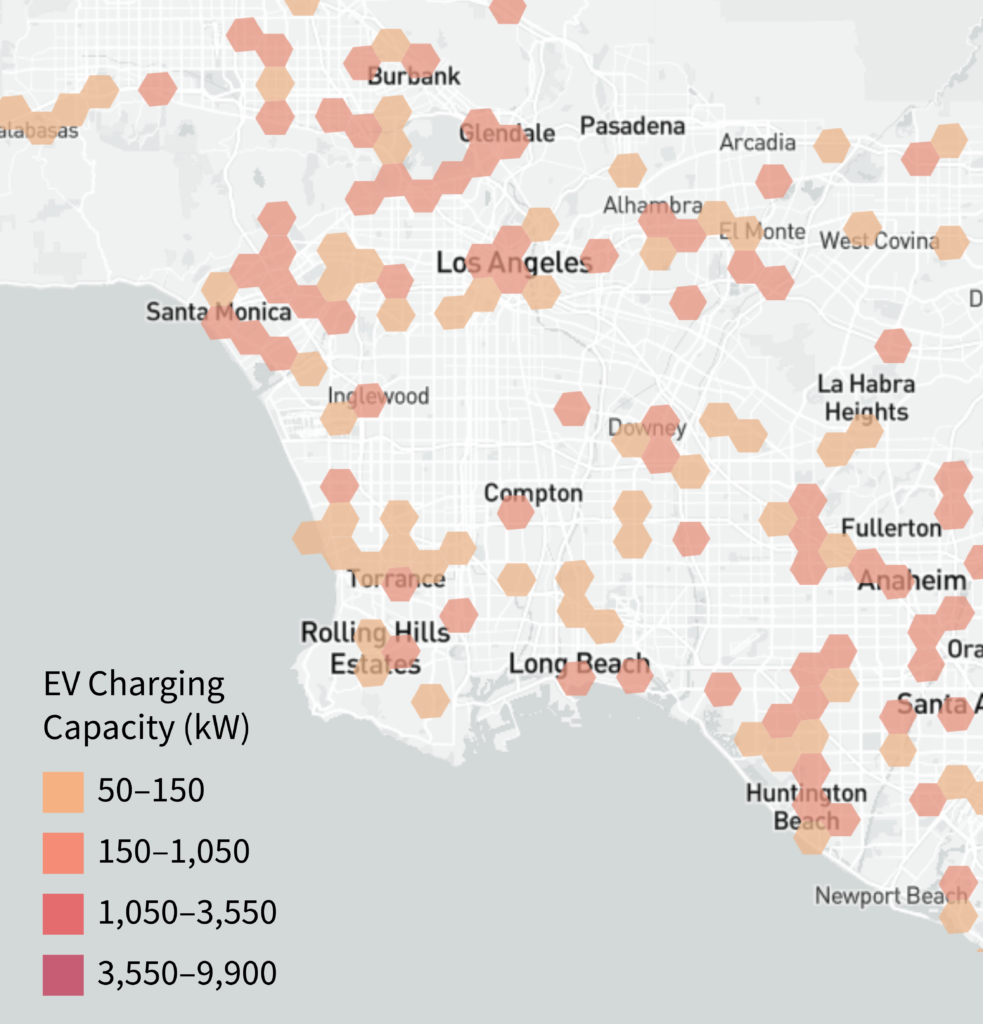

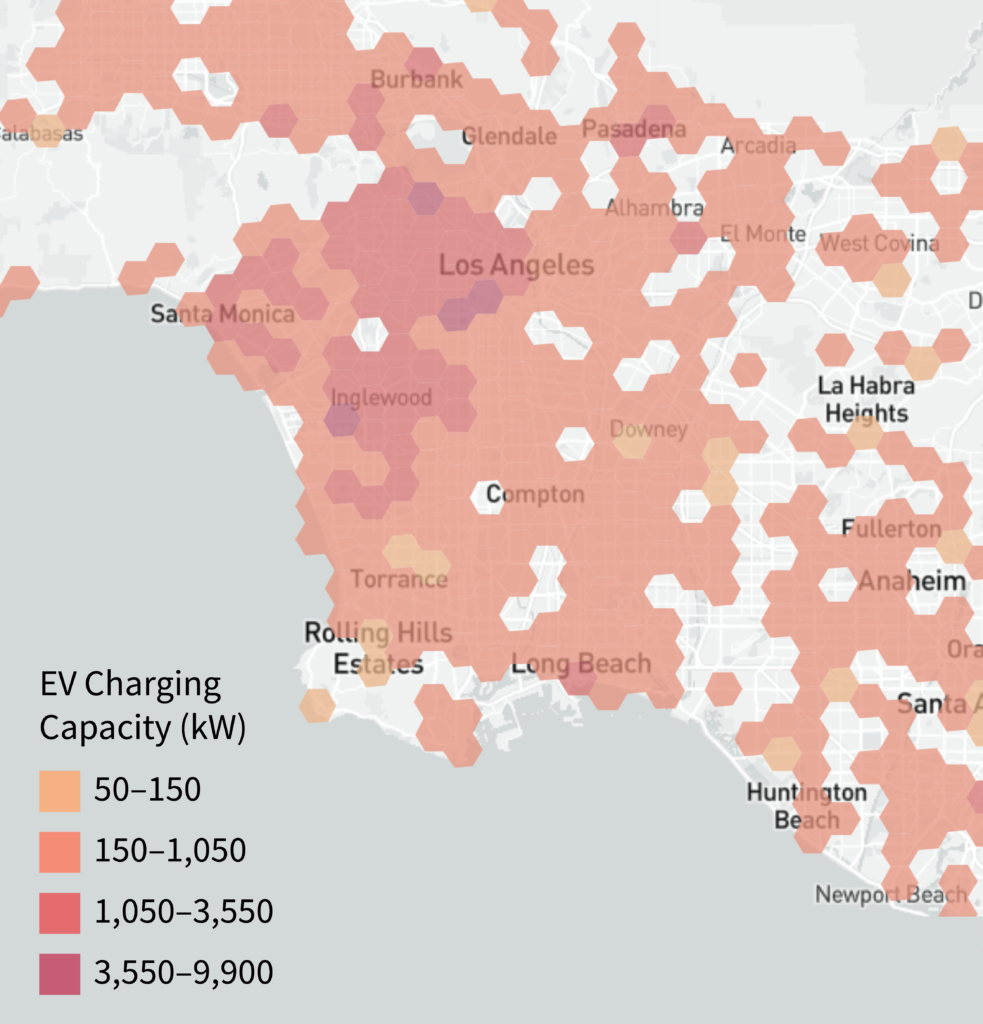

We found that as TNC electrification increases, the public DCFC network needs to expand throughout the city, with the most dramatic growth in lower-income areas (Exhibit 3). This resulting network would serve a much larger portion of the city than the current network.

Exhibit 3: The existing fast-charging network has been built to support early adopters of EVs, who tend to live in wealthier areas.

Exhibit 4: Electrifying 90% of ridehailing miles by 2030 will require a fast-charging network that is much larger and more equitably distributed than the existing network.

Regardless of the potential benefits of a DCFC network built for TNC electrification, such a network will only materialize if it is financially sustainable for charging providers to build and operate. It is expensive to deploy DCFC stations, and such high costs can only be recouped through consistent use (at least 15–30 percent daily utilization depending on the location). Predicting station utilization is therefore particularly important to determine which stations will be financially viable.

Fortunately, our results indicate that TNCs can deliver high rates of utilization to a much larger network than currently exists. Even a proposed network for TNC electrification three to six times larger than the existing network achieves over 30 percent average utilization, more than enough to financially support its development and operation. In other words, a DCFC network designed for electric TNCs is economically sustainable while providing more inclusive access to charging. Moreover, the higher coverage provided by this charging network also alleviates range anxiety—a significant barrier to wider EV adoption among the public.

Overcoming Barriers to Deploying DCFC

Despite the substantial opportunities for both developers and drivers that come with deploying public DCFC to support TNC electrification, there are still significant barriers facing the relatively new EV charging industry. Businesses and policymakers need to take careful and coordinated action to reduce these barriers and usher in the benefits of widespread public DCFC.

One barrier facing DCFC providers is the high cost of site development. Site acquisition and utility upgrades each represent substantial, and often unpredictable, costs. But cities and utilities can each reduce these costs and streamline the development process. To address high land and site development costs, cities can offer suitable public land at reduced or no cost for charger deployment. Utilities can work with EV charging providers to develop reliable cost and time estimates for necessary site upgrades.

Unfavorable utility rate structures also disincentivize DCFC deployment. For example, fees based on brief periods of maximum energy use (demand charges) can make station operation prohibitively expensive below a certain threshold of utilization. To avoid penalizing DCFC providers for building stations ahead of demand, utilities can institute something as basic as demand-charge holidays. These demand-charge holidays can remain temporary, lasting just long enough for TNC electrification to ramp up and deliver high station utilization (in our analyses, this occurs around 2025 in LA). Utilities can also establish EV charging-specific tariffs that account for the unique utilization profile of EV chargers.

If governments, utilities, TNCs, and charging providers work together and take actions such as these, they will dramatically accelerate the growth of a more ubiquitous public fast charging network. This is just one crucial step among many to help foster an economically sustainable path to a more equitable EV transition.