How Real Estate Investment Trusts (REITs) Can Drive Solar Development

Leveraging REITs to Reduce Emissions and Increase Shareholder Value

As tensions mount on the placement of large-scale solar developments in the United States, real estate investment trusts (REITs) could help reduce solar developments’ environmental impacts and our nation’s power sector greenhouse gas emissions, all while improving REITs’ bottom line.

The Opportunity

REITs are currently sitting on an embedded asset, their rooftops, parking lots, and garages. Morgan Stanley, in a recently published report identifying the market opportunity for REITs solar development, estimated they control roughly 38.5 billion sq. ft. of solar-appropriate surface area. These spaces are estimated to be capable of generating over 25 percent of all the electricity used in commercial buildings in the United States (roughly 320 GW), or approximately 10 percent of total US electricity sales. That is about 2.5 times the total US solar capacity that was in place at the end of 2022. Harnessing and monetizing this asset has the potential to both hasten our transition to a net-zero economy and generate significant incremental value for the REIT industry.

Key advantages of REITs over other solar developments include:

- Existing infrastructure: Using existing rooftops or parking lots on already developed lands, means the solar installations not only create value out of unproductive assets, but also avoid some of the regulatory barriers and permitting challenges faced by projects proposed on undeveloped land and don’t compete with other land uses.

- Optimal generation conditions: Many commercial buildings typically have large, low, flat roofs and are usually free of tree cover, allowing panels to be easily installed for maximum generation.

- Building electrification ready: As more and more jurisdictions pass building performance standards and/or phase out the use of natural gas, solar can help REITs to both electrify their buildings and lower their operating costs.

- EV charging offsets: Solar generation can offset increased power demand for EV charging for both tenant-owned fleets as well as for personal vehicle charging.

- Faster implementation: Offsetting buildings’ operational energy requirements provides a source of captive demand, lessening the impact of interconnection delays and allowing projects to be put in place sooner.

The combination of all these advantages can make these projects extraordinarily profitable for REITs. The Morgan Stanley report estimated that on-site solar would be “in the money” or cheaper than buying electricity from the grid for 90 percent of the top 50 REITs by 2025 and would result in revenue accretion of 3 percent.

The Challenge

But even given this positive economic potential, REITs have been slow to move on this opportunity. One issue preventing REITs from solar development is their financial structure. It can be challenging for REITs to take direct advantage of federal energy tax credits for installing solar. While the Inflation Reduction Act, the climate bill passed in 2022, included a provision making it easier for REITs to benefit from the sale of tax credits, there remain significant barriers preventing REITs from deploying solar at scale. At a minimum, the sale of tax credits by REITs is still complicated due to Internal Revenue Service recapture rules. But there are additional challenges as well, such as the financial complexity of installing solar on industrial and warehouse REITS despite their large flat roofs:

- Given their relatively low energy intensity per sq. ft. most distribution centers (70,000 – 1 million sq. ft.) would only use about 10–20 percent of their roof’s potential solar capacity. Due to interconnectivity delays, and regional utility regulations, the projects may not be able to readily sell excess power back to the grid.

- The average commercial lease is only three to five years, which means that there is the potential for the building to “go dark” due to vacancy during tenant turnover. The industry considers developing solar on industrial rooftops solely to serve the on-site load as risky due to a combination of vacancy and usage risk.

The Solution

Community solar provides a potential solution to these challenges. Rather than structuring the project as “amenity solar” that only serves the tenants of the building, commercial projects can be a source of clean and renewable energy for the broader community in which the building is located. In addition, by structuring as a community solar project, and selling the power at a discounted rate to low- and moderate-income residents and businesses, the project can benefit from an additional investor’s tax credit bonus adder of 10–20 percent, greatly increasing the profitability of the solar project. Recognizing that most REITs are not in the business of acquiring and managing thousands of residential solar subscribers, this is best accomplished by partnering with an existing community solar developer.

While community solar currently exists in some form in 28 states, many of these programs do not support rooftop community solar development. At present, the only states that support rooftop community solar are NY, IL, MA, MD, CA, MN, NJ, CT, and VA. Legislation to allow rooftop community solar is in progress in several new locations now. For multifamily housing, a solution exists in CA, Virtual Net Metering, which would address several issues described above. Such a policy must be rolled out at other utilities across the country. Many multifamily housing owners seek to own these systems and sell power virtually back to their tenants, supported by sophisticated billing software.

Some REITs have been resistant to pursue this option due to the mistaken belief that if they host community solar, they are not able to take credit for generating renewable energy and that it would not count toward their carbon reduction goals. However, the US Environmental Protection Agency has set out a very clear guide on how to structure transactions so that REITs can both take advantage of the financial benefits created by hosting community solar while also continuing to meet their renewable energy and carbon reduction goals.

Progress Has Been Made among First Movers

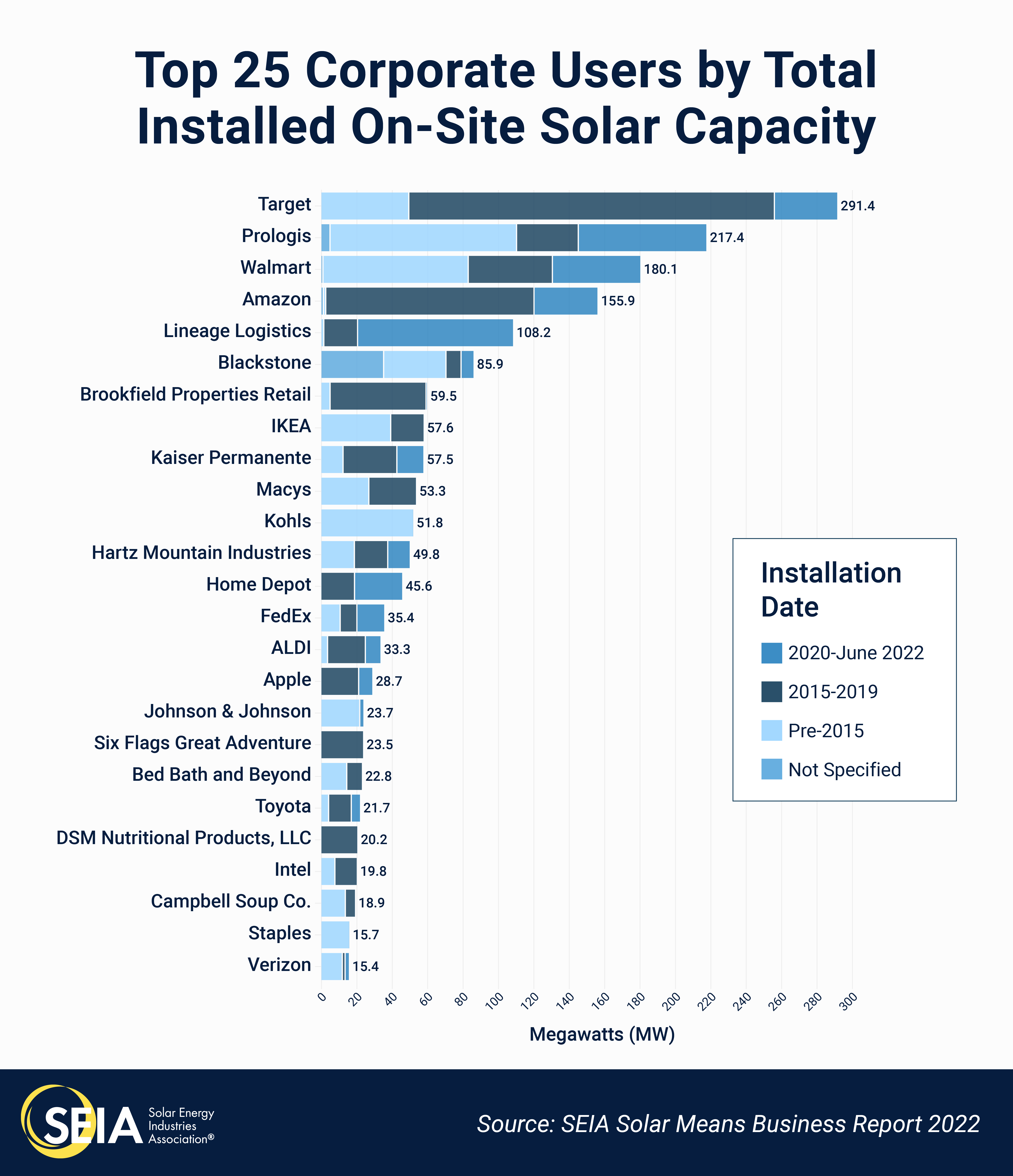

While there is still an incredible amount of opportunity for REITs to install more solar, the larger players are already taking advantage of the opportunity. The chart below shows how some of the leading real estate companies compare with leading corporations in terms of total megawatts of on-site solar installed. Prologis (the largest REIT by market cap) is in the top three, where it has been for the past decade, and is joined in the top 12 spots by real estate companies Lineage Logistics, Blackstone, Brookfield, and Hartz Mountain.

A Path Forward

So how can REITs take the next steps to host on-site renewables?

First, REITs need to work through which sites are actually viable candidates — based on location, roof ages, roof rights (tenant consents), lender and partner consents, and ensuring the property is not a redevelopment or disposition candidate. Second, REITS should hire an experienced and trusted solar technical advisor. Third, determine which sites are in geographies conducive to solar development. From there, identify potential developers and run a competitive procurement process to find the best economics and partners to work with.

REITs already control one of the keys to unlocking the energy transition, rooftops, moving us to a cleaner, greener, and more stable grid. That key also unlocks potential profits for REITs all while creating a mechanism to contribute to the communities in which their assets operate, in the form of greater energy security and utility cost savings.