Corporate Climate Action: Analyzing the Recent Surge of Climate Commitments

RMI analyzes what this increase in corporate commitments means and introduces a new tool to measure impact.

On the eve of the UN Climate Change Conference (COP28), the media buzz about corporate climate action is decidedly mixed. Optimism about the growing numbers of companies setting climate goals is tempered by disappointing news about the pace of many companies’ actions to achieve their goals. We are still creating new structures and systems to guide corporate climate action and working through challenges as these systems mature. Beneath the surface, however, there are encouraging signals. Strong systemic forces are inexorably driving more companies to report greenhouse gas emissions, set independently verified climate action targets, and implement strategies to achieve these goals.

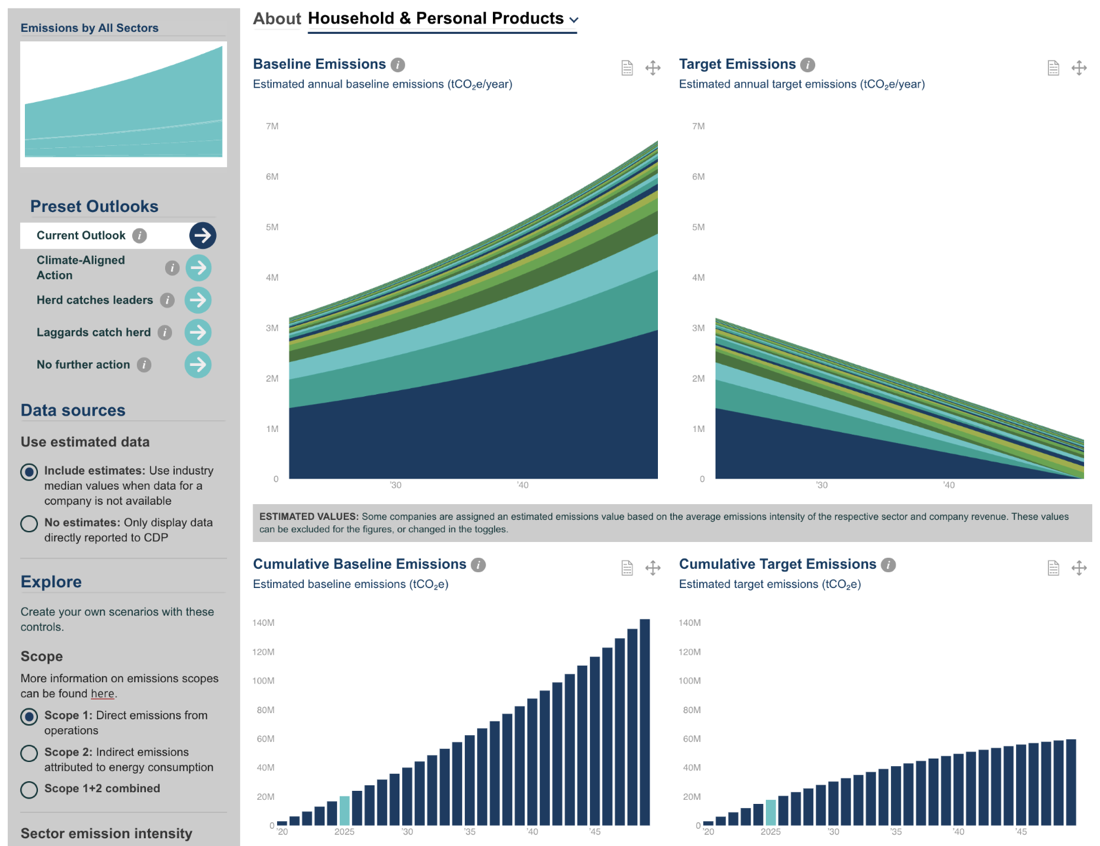

RMI is creating new tools and methods, still under development, to better analyze the potential implications of corporate climate action. In this article, we assess recent developments across this landscape, including preliminary analysis from the Corporate Commitments and Emissions Explorer (Corporate Explorer), a new online tool that allows users to explore sectoral emissions targets and actions.

Snapshot of corporate climate action: 2023

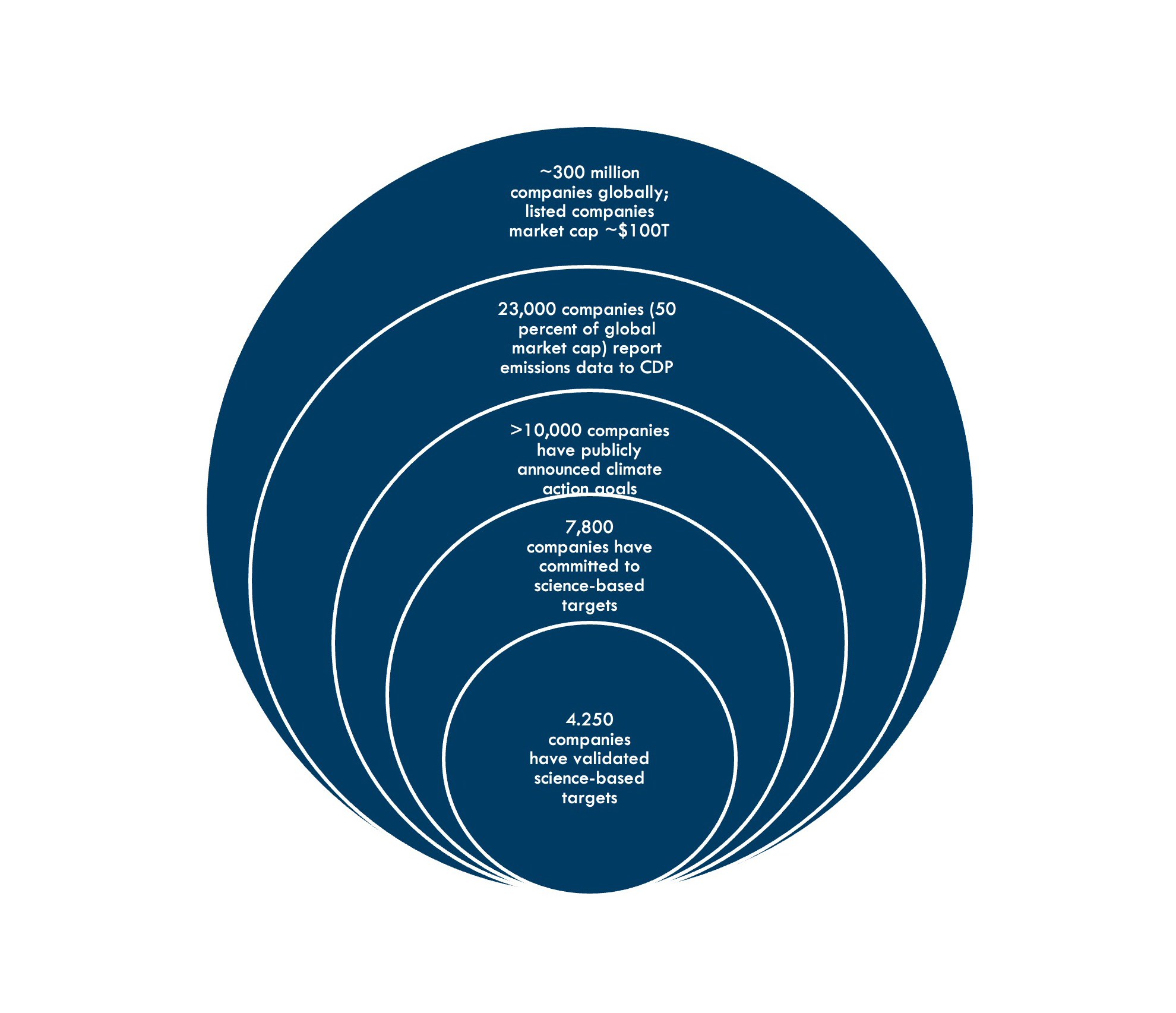

Assessing the implications of corporate climate action globally requires looking at several layers of data to understand where companies stand and how patterns change over time. Exhibit 1 provides a snapshot of the current status of climate action across global private sector companies. Gathering and reporting emissions data is typically the first meaningful step a company takes toward climate target setting and action. Today, more than 23,000 companies, representing more than 50 percent of global market capitalization, report emissions data to CDP, a nonprofit organization that runs the global disclosure system for companies to manage their environmental impacts.

The next step is setting climate action goals. More than 10,000 companies have publicly announced these goals in one form or another. Although many of these goals are not independently verified, among the world’s largest 2,000 companies, more than half have set net-zero targets according to Net Zero Tracker. In the past 16 months, the number of companies with these aims has risen 40 percent and now represents 66 percent of the annual revenue of the world’s largest 2,000 companies. At the same time, nearly 8,000 companies, representing over a third of the global economy by market capitalization, have either committed to science-based targets or had such targets independently verified through the Science-Based Targets Initiative (SBTi). RMI’s dataset of corporate climate action targets includes more than 7,500 companies, and indicates that commitments cover 56 percent of 2021 emissions overall, but with wide variation across sectors.

The final stage — translating those climate targets into action — has progressed steadily, but much work remains to be done to hold companies accountable to their commitments. The Net Zero Company Benchmark Assessment produced annually by Climate Action 100+ tracks climate action in depth for a sample of 150 companies identified as playing key roles in the transition to net zero. This reporting indicates that a majority of companies disclose medium-term greenhouse gas reduction targets and corresponding actions. But only 32 percent of these companies specify how much capital they plan to allocate to climate solutions in the future, and only 2 percent have committed to phasing out CAPEX in unabated carbon intensive assets. Similarly, according to Net Zero Tracker, just 4 percent of the companies with net-zero targets meet the minimum criteria laid down by the UN’s Race to Zero campaign, which includes covering all emissions, reducing them immediately, and issuing timely progress updates.

Exhibit 1: Snapshot of corporate climate action, 2023

Analyzing exponential growth, feedback, and tipping points for corporate target-setting

The number of companies with serious climate action targets is growing exponentially and approaching a critical tipping point. One key indicator of this trend is the rapid growth in the number of companies that have committed to science-based targets under the Science Based Targets Initiative, considered by some experts to be the gold standard for climate action target-setting. The number of companies engaging with SBTi has nearly doubled each year since 2020 and appears to be on track to do nearly the same in 2023. By the end of 2022, companies with approved science-based targets or commitments to set such targets through SBTi already represented over one-third of the global economy by market capitalization. Companies that commit to develop science-based targets have two years to get their targets approved.

Exhibit 2:

SBTi aims to commit 20 percent of the global economy to fully validated science-based targets by 2025, a critical tipping point. This would imply having $20 trillion of the global economy covered by approved 1.5°C targets, 5 gigatons of corporate emissions covered with science-based targets or commitments, and 10,000 companies with validated science-based targets or commitments.

Getting to the 20 percent tipping point, which is likely achievable given recent trends, would create a powerful reinforcing feedback mechanism to sustain rapid growth and acceptance of science-based targets by even more companies. This is because of multiple dynamics, such as pressure from consumers, increased advocacy, and changing regulations. For example, under new guidance issued by SBTi in June 2023, participating companies can address Scope 3 emissions targets through “supplier engagement,” which means getting supply-chain partners to set their own science-based targets. If this approach is successful, participation by a relatively small number of large companies will drive far-reaching change. Greater transparency up and down value chains will enable more accurate and robust targets and emissions reduction strategies.

Across this wider landscape of corporate target setting and action, two additional forces continue to drive more companies, especially small- and medium-sized companies, to set climate targets. First, changes in corporate governance are bringing new pressures to bear for companies to establish climate action targets. As of 2022, 92 percent of S&P 100 companies had formally charged their boards with overseeing sustainability issues, with 44 percent specifically referencing climate change in their committee charters, up significantly from 2021. Board-level changes are still gradually working through to action for many companies.

Second, many companies are recognizing a business case for improving their sustainability performance on the basis of cost reduction, competitiveness, or customer loyalty. According to a nationwide survey conducted online by The Harris Poll, 71 percent of US adults say they’re more loyal to companies that take an active role in protecting the environment. About 68 percent of Americans between the ages of 18 and 34 said they were willing to pay more for products from companies that have a strong stance on sustainability and climate change, compared to 52 percent of those ages 35 and over. Bain’s 2023 Consumer Lab ESG Survey found consumers are willing to pay a premium of 12 percent on average for minimized environmental impact.

Raising the bar for the quality of corporate targets

SBTi’s science-based targets, however, are just one channel for corporate target setting. SBTi operates alongside several other organizations that provide third-party verification of net-zero targets and pathways, including the Partnership for Carbon Accounting Financials, the Paris Agreement Capital Transition Assessment, the Transition Pathway Initiative, and the International Organization for Standardization, each of which has its own lines of influence to drive new climate-aligned targets.

Against this backdrop, the COP28 Presidency has created an overarching framework to mobilize as many corporate net-zero commitments and transition plans as possible, especially from underrepresented regions and sectors, and to ensure the credibility and accountability of net-zero emissions pledges. This new effort takes the form of the COP28 Net-Zero Transition Charter, that sets minimum standards for 1.5°C-aligned, science-based, credible and transparent net-zero 2050 and interim emissions reduction targets. Companies that have already made pledges consistent with these standards above do not need to recommit.

It is not yet clear what impact the new Net-Zero Transition Charter will have, in terms of increasing the number and quality of corporate climate commitments. There is plenty of work yet to be done to strengthen the quality of commitments and to hold companies accountable to their progress against these goals.

RMI’s Efforts to Track and Analyze Targets and Action

Although the exponential increase of commitments is impressive, not all climate targets are built the same. RMI analyzed 7,500-plus companies that span eight sectors and represent combined market capitalization of over $92 trillion, or 80 percent of the global total. The Corporate Explorer aggregates the impact of announced corporate targets on emissions. This tool allows users to explore and create different trajectories for sectors and industries. For example, companies in the household and personal products industry have made significant commitments to lower emissions by 2050 and have an optimistic outlook for meeting emissions reduction goals.

Of the companies in this dataset, only 24 have what we consider to be the most ambitious targets. These companies all meet the following criteria: 1) have disclosed Scope 1–3 emissions to CDP, 2) have emissions intensities less than the median for their sector, 3) include Scope 3 in their commitments, and 4) are committed to zero emissions (vs. net zero).

There are 2,083 companies in our data set with “somewhat ambitious” targets, which includes companies that 1) do not disclose to CDP but do have long-term climate commitments; 2) disclose to CDP, have intensities greater than the median, and have long-term climate commitments; or 3) disclose to CDP, have intensities less than the median, and do not have long-term climate commitments.

Finally, the majority of companies analyzed fall in the “least ambitious” targets category or do not have a known climate commitment. These are companies that either disclose to CDP with emissions intensities greater than the sector median and have no long-term climate commitments, or do not disclose to CDP and have no long-term climate commitments.

Exhibit 3

The good news is that 16 percent of companies have both near- and long-term targets (of any kind) accounting for an estimated 56 percent of 2021 emissions in this dataset. The actions of these 1,200 companies to achieve their goals would mitigate almost 8 gigatons of emissions by 2050.

Exhibit 4

We are entering a period of rapid and consequential change in terms of government-mandated climate reporting by private sector companies. Climate disclosure by private companies has historically been voluntary, provided under standards and frameworks from entities like CDP, GRI, and B-Corp. Despite steady increases in voluntary reporting, however, substantial numbers of companies globally have avoided disclosure under independent guidelines. Almost half of the companies in RMI’s data set of 7,500 companies report emissions to CDP, which accounts for 75 percent of emissions by these companies (Exhibit 5). The highest rates of reporting are for companies in basic materials, consumer goods, industrials, technology, and utilities.

Exhibit 5:

The Corporate Explorer analyzes emissions data from CDP and commitments data from Net Zero Tracker, estimates emissions for companies without data, and creates trajectories based on economic growth rates. Going forward, we hope to capture additional commitments and emissions from companies, gaining a more complete picture of the impact of corporate action.

To explore this tool, learn more about the methods, and keep up to date with insights and data updates, please visit RMI’s Corporate Commitments and Emissions Explorer page.

New reporting rules are driving increased transparency and accountability

New government mandates for climate disclosure will drive significant increases in the numbers of companies reporting climate data and in the quality of the information provided. In 2022, the UK became the first G20 country to make climate impact a mandatory component of financial disclosures, requiring 1,300 of the country's largest registered companies and financial institutions to disclose climate-related financial information. In addition, the EU's Corporate Sustainability Reporting Directive, currently being phased in through 2025, will impose new carbon emissions reporting requirements on approximately 50,000 organizations representing 75 percent of the EU's total company revenue and affect 10,300 non-EU companies including more than 3,000 American companies.

In the US, California Governor Gavin Newsom recently signed into law two pieces of legislation that will mandate corporate climate and climate-related financial risk disclosures for public and private companies. The California laws apply only to companies doing business in California, but as the world's fifth largest economy, these laws are estimated to affect 10,000 companies and will eventually include Scope 3 emissions requirements (for larger companies). In parallel, new reporting requirements proposed by the US Securities and Exchange Commission could be adopted in early 2024, affecting more than 12,000 public companies doing business in the United States. And, the Inflation Reduction Act provides funding to the EPA for corporate climate transparency and standardization.

Measures such as these, in addition to market dynamics and global momentum, will drive increased transparency in greenhouse gas emissions reporting, making it easier for investors, supply chain partners, customers, and activists to track emissions and push for greater action to reduce emissions. But, achievable strategies and corporate action need to follow to ensure we reach our shared climate targets in the near and long term.