The Clean Energy Opportunity Crosses Party Lines

In politically conservative Ohio, clean energy and clean technology industries bring bipartisan support and jobs.

This past October, Ohio’s Republican Governor Mike DeWine announced that Honda, in partnership with LG Energy Solutions, will invest $4.2 billion in multiple electric vehicle and battery manufacturing projects in the state. The investment is happening in southwest Ohio, near Jeffersonville, a small, politically conservative town of 1,200 residents.

“In another major step toward electrification, LG Energy Solution’s innovative battery technologies will not only power Honda’s brand-new EV models but support Ohio’s green economy,” Dong-Myung Kim, executive vice president of advanced automotive battery division at LG Energy Solutions said at the announcement. “We look forward to not only creating thousands of quality jobs here in Ohio but growing together with the community.”

In 2021, Ohio’s workforce included 110,272 clean energy jobs — a 7 percent increase from just the previous year. It’s part of a growing trend that more American communities are experiencing: politically-Republican places reaping much of the economic benefits from a booming US clean energy and cleantech industry. In fact, clean energy investment is quickly ramping up across the country — regardless of whether state delegations voted for the legislation responsible for making it happe

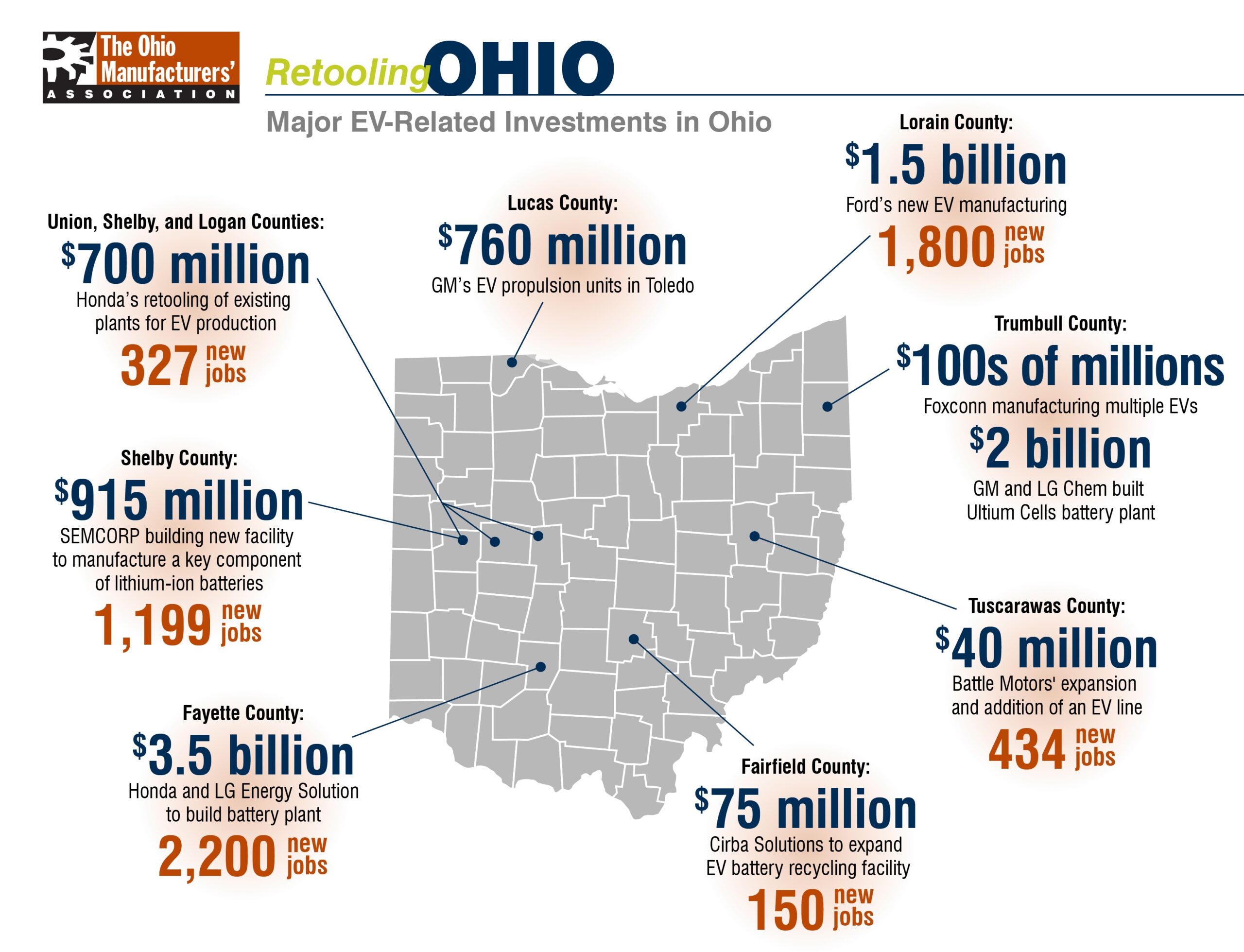

Credit: Ohio Manufactuers Association

Credit: Ohio Manufactuers Association

A Bipartisan Trend: How federal incentives are creating a state investment swarm

The growth in jobs and capital influx is fueled by the US increasing its policy ambition to grow a sustainable clean energy economy—exemplified by the bipartisan infrastructure package passed last year, and this year’s CHIPS and Science Act and Inflation Reduction Act (IRA).

RMI analysis shows that over the next decade, federal investment in clean energy will be roughly 3.5 times its level in the period from 2009 to 2017, and 15 times its levels in the 90s and early 00s.

“We’re watching in real-time as the politics of clean energy are quickly veering toward pragmatism. States of varied political coloring are capitalizing on federal incentives to attract clean energy and cleantech companies. As a result, these places are being rewarded with eye-popping investment announcements in terms of jobs and long-term capital investment,” said Aaron Brickman, senior principal on RMI’s US Program.

For example, it is estimated that the IRA alone will bring investments valued at $12.8 billion in large-scale clean power generation and storage to Ohio between now and 2030.

“Across Ohio, clean and readily abundant forms of energy are powering more homes and businesses than ever before,” said Ohio Republican Governor DeWine in an address at National Clean Energy Week. “Energy use is a necessity for all people, businesses, and organizations across the Buckeye State, and Ohio’s clean energy sources can assure low-cost, reliable energy.”

Ohio’s Massive Potential: The more ambitious the policy, the stronger the benefits

As Ohio looks to capitalize on this federal funding, the Energy Policy Simulator, a public data tool created by RMI and Energy Innovation, shows how the state could continue growing its clean energy economy and cut its emissions in half in line with overall US climate goals. Broadly, that would mean ambitious state plans, including producing 100 percent of electricity from clean sources, implementing a zero-emissions vehicle sales standard and strengthening building codes to electrify homes and buildings, among other policies, which would put states on a path to climate alignment.

The Energy Policy simulator also gives outputs beyond emissions reduction benefits — like economic growth, health improvements, and cost savings — that would come from these climate and clean energy policies. If Ohio were to reach 50 percent emissions reductions — a feat far more feasible with the support of the suite of recently passed federal legislation — the state would experience at least a 2.5 percent increase in GDP by 2035 along with the creation of over 45,000 new manufacturing and construction jobs.

In August of this year, Ohio Senator Sherrod Brown explained, “With the CHIPS Act and the Inflation Reduction Act, we are laying down a new marker: the technology of the future — from semiconductors to batteries to electric vehicles — will be developed in America and made in America. This positions Ohio to lead in the industries of the future, restores critical supply chains, and will create thousands of good-paying jobs.”

So far, Ohio has celebrated key new investments:

- Intel invested $20 billion into a semiconductor plant in New Albany as a result of the CHIPS and Science Act.

- Ford will invest $1.5 billion into northeast Ohio because of the tax credit announced in the IRA to facilitate new markets for electric vehicles.

- The bipartisan infrastructure package guarantees Ohio $140 million for EV charging stations over the next five years.

- First Solar Inc. announced on August 30th of this year that it will spend $1 billion on building a new facility in Ohio on top of a $185 million investment into its current facilities in the state.

The Great Onshoring: How domestic clean energy investment lowers costs

By onshoring the entire electric vehicle supply chain, one of IRA’s main objectives aims to increase domestic manufacturing and reduce the costs of clean technology in the United States. In an RMI research article, RMI Senior Associate Lachlan Carey explains the connection between domestic manufacturing and cheaper energy and technology costs. “Since 2010, there has been an 85 percent drop in the cost of solar, a 55 percent cost decline in wind, and an 85 percent drop in the cost of batteries. In other words, the more we build, the cheaper our energy.”

Ohio is not the only state reaping the benefits of federal funding for cleantech and energy. In 2022, companies have announced $13 billion in EV manufacturing investments and $24 billion in battery investments, which are respectively three times and 28 times the investment that occurred in 2020. Just between August and October of this year, several companies, from Tesla to Toyota, announced investments in domestic manufacturing that will lead to the onshoring of American jobs.

The policies and financial incentives in the IRA are sending major investment signals to states and regions across the country, effectively saying we’re going all in on a clean energy future and now is the time to take advantage of the massive economic opportunities. And while motivations to act on the growing clean energy trend may be mixed — with some states more motivated by climate and others by the lucrative opportunity around this growing industry— the outcomes are equivalent and increasingly apparent: jobs, economic development, and investment in regions across the country.