The Billion-Dollar Costs of Forecasting Electricity Demand

How distributed energy resources can ease the challenges of grid investment planning

We make forecasts every day, and the technologies and other tools that help us make these forecasts are getting better each year. Weather forecasts, for example, have improved dramatically in the age of supercomputers and high-resolution climate models, and can now accurately predict the timing of rain or other events days in advance.

If the weather forecaster gets it wrong, the impact is generally low—we may get wet if we don’t have an umbrella on an unexpectedly rainy day, for example. Unfortunately, not all forecasts come with such low consequences. When tens of billions of dollars of investment are on the line, such as when we forecast electricity demand, it’s important to get it right—or, if we can’t, we need to attempt to make investment decisions resilient to the inherent inaccuracy of multi-decade forecasts.

Today, as a result of poor forecasting in past decades, U.S. electricity customers are spending billions of dollars each year for power plants they don’t need because they were built to serve electricity demand that never materialized. Grid planners are only now starting to adapt to the realities of the changing grid and to recognize the benefits of prioritizing investment in small, cost-effective, and flexible resources instead of today’s large, costly, centralized fossil-fuel plants. Let’s explore why.

“It’s tough to make predictions, especially about the future”

These timeless words often attributed to Yogi Berra call for humility when we seek to predict the future. Unfortunately for utilities and other grid planners, maintaining a reliable grid requires making many predictions about the future. In particular, planners must forecast changes in their system’s peak demand, which is particularly difficult over the time scales required for planning multibillion-dollar power plants. If a utility thinks peak demand will be 10 percent higher in 10 years, it must begin planning now for a new power plant to meet that demand.

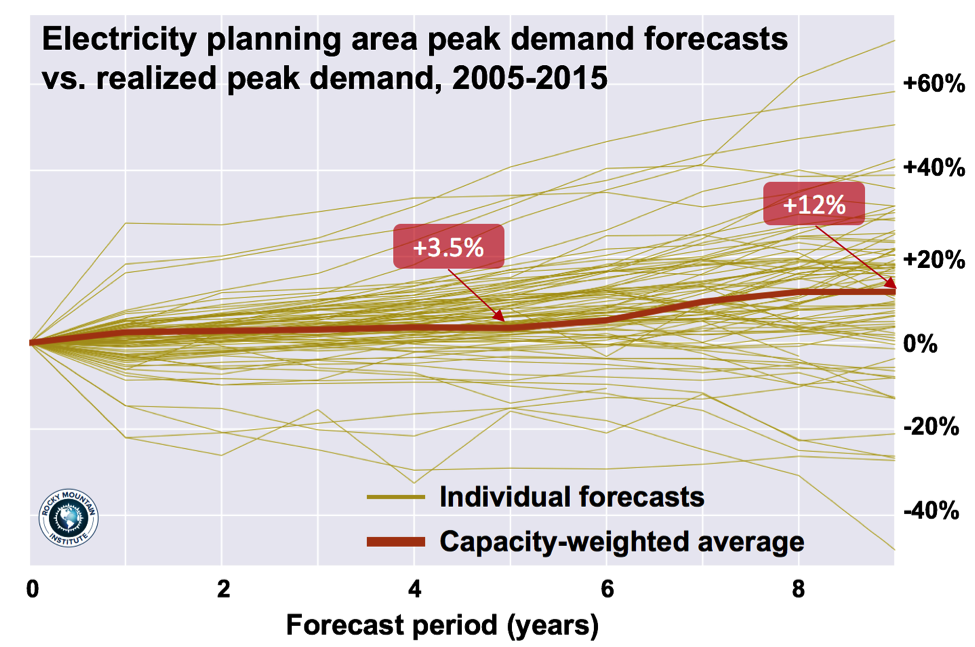

Given the uncertainty of forecasting anything 10 years away, it is not surprising that these forecasts are rarely right. Accuracy of individual forecasts wouldn’t necessarily matter if, on average, planners under-forecast as much as they over-forecast; forecast errors would cancel out and have no impact over the broader system. Unfortunately, that is not the case.

Rocky Mountain Institute’s analysis shows that for at least the last decade, planners have, on average, over-forecast electricity demand by one percentage point for each year of their forecast. That might seem trivial, but a one percentage point over-forecast every year means that forecasts more than 10 percent too high 10 years out. That 10 percent over-forecast translates to spending billions of dollars on power plants that no one needs, but that need to be paid for.

Why Planners Over-forecast

Three systematic factors help explain why over-forecasts are so common:

- Changes in the U.S. economy have permanently reduced its energy intensity. The U.S. economy now requires 40 percent less energy to create one dollar of gross domestic product (GDP) than it did in 1990. In part this is due to the growth of the service sector relative to the manufacturing sector, since the service sector uses much less energy than the manufacturing sector to create a dollar of GDP.

- Over-forecasting demand is far less risky than under-forecasting demand. If a planner over-forecasts demand and causes more power plants to be built, some of those plants may not be needed. The downside is solely financial, with relatively small costs that are passed on to customers or shareholders. On the other hand, if a planner under-forecasts demand, there could be blackouts on high-demand days, leading to significant customer disruption and real economic costs. These asymmetric risks give planners good reason to err on the side of over- versus under-forecasting.

- Over-forecasting is often rewarded with shareholder profit. A fundamental tenet of the typical U.S. utility business model is a regulated rate of return on capital deployed to serve customers. In other words, once a utility justifies an investment in a new power plant (often using a forecast of increasing peak demand), the utility can recover costs and earn a preapproved return on that investment, even if the plant is rarely needed or used.

The Value at Stake

Over-forecasting is a problem because it leads to overbuilding and costs borne by customers who never needed the new generation. In the past, with peak demand that reliably increased every year, an over-forecast one year merely meant that assets were built a few years before they were needed. Now, with structurally flat load growth, an over-forecast can mean that assets are built that may never be used at all. U.S. generating capacity already exceeds required reserve margins by 30 percent, which costs electricity customers billions of dollars per year.

New power plants that may be cost-effective given rising demand are instead uncompetitive if demand remains flat or declines. But to recover the costs of power plants once they are built (and sometimes even while they are under construction), utilities increase rates for their customers. These increases pose their own risk since they make load defection—using grid-connected solar-plus-storage—more attractive to certain customers, eventually eroding utility revenue and profitability. This can lead to the dreaded “utility death spiral”—when utilities charge a declining number of customers with the costs of maintaining a system built to serve a much greater number of them, leading to more customer losses.

Planning in Pieces Can Lower Risks

To reduce the risk of an over-forecast leading to financial harm for shareholders or customers, planners are increasingly focusing their investments on distributed energy resources (DERs) like energy efficiency, demand response, battery storage, and other relatively small, modular investments (e.g., community- or utility-scale renewable energy projects), rather than large, traditional infrastructure projects. DERs and renewables offer small, low-risk, low-cost resources that are more flexible than the large, high-risk, and expensive projects typical of traditional infrastructure investment.

Such projects can be sited, permitted, and built more rapidly than traditional power plants or grid upgrades, creating projects that are right-sized to meet near-term needs in near real-time. Doing so removes much of the risk and uncertainty inherent in the long-term forecasts required to plan traditional infrastructure. The recent examples below join a growing list of projects that progressed from conception to completion in less than a year:

- Last summer, a freak storm plunged parts of South Australia into darkness as tornadoes destroyed key infrastructure. That blackout highlighted the vulnerability of South Australia’s electricity grid, which has high renewable penetration but limited and expensive flexibility owing to far-away gas plants burning expensive gas. In response, Tesla is installing a 100 MW battery that it guarantees will come online in 100 days or there’s no bill.

- The vast majority of Southern California’s flexible generation is from natural gas power plants, leaving the region’s reliability vulnerable to an interruption in the supply of natural gas. After the massive Aliso Canyon gas leak threatened just such an interruption, utilities were able to construct a portfolio of “preferred resources” (i.e., DERs) much faster than they could have built a traditional power plant. The DER portfolio contains battery energy storage that will provide flexibility and reduce the region’s dependence on natural gas for reliable electricity.

The modularity and low lead time of DER projects is of clear value when the grid needs resources deployed quickly. That also means less need to forecast the future. Instead of making large bets on new resources in response to forecasted demand, planners can instead build resources with short lead times, when and where they are needed, and avoid taking on risk that large investments will be stranded if load growth doesn’t materialize.

While it’s unlikely that we will ever be able to forecast long-term electricity demand as well as we can predict the weather, with DERs and other modular resources emerging as a quick-to-deploy and increasingly cost-effective choice for utilities, perhaps we don’t have to.

Image courtesy of iStock.