What Happens When Utilities Start to Integrate the IRA into Planning?

Michigan’s largest investor-owned utility projects it can save its customers $500 million over 20 years when incorporating the Inflation Reduction Act’s tax credits into its plan.

The passage of the Inflation Reduction Act (IRA) was one of the climate highlights of 2022. As we enter 2023, our attention shifts toward implementation — and uncovering what’s possible when regulators and utilities leverage the full set of resources the IRA offers to accelerate an equitable energy transition.

One of the places we expect to see changes emerge as a result of the IRA is in utility integrated resource plans (IRPs). IRPs are where utilities evaluate their long-term options for meeting energy needs, such as when to retire existing resources and what to build next. They typically happen every 2–5 years and look 10–30 years into the future.

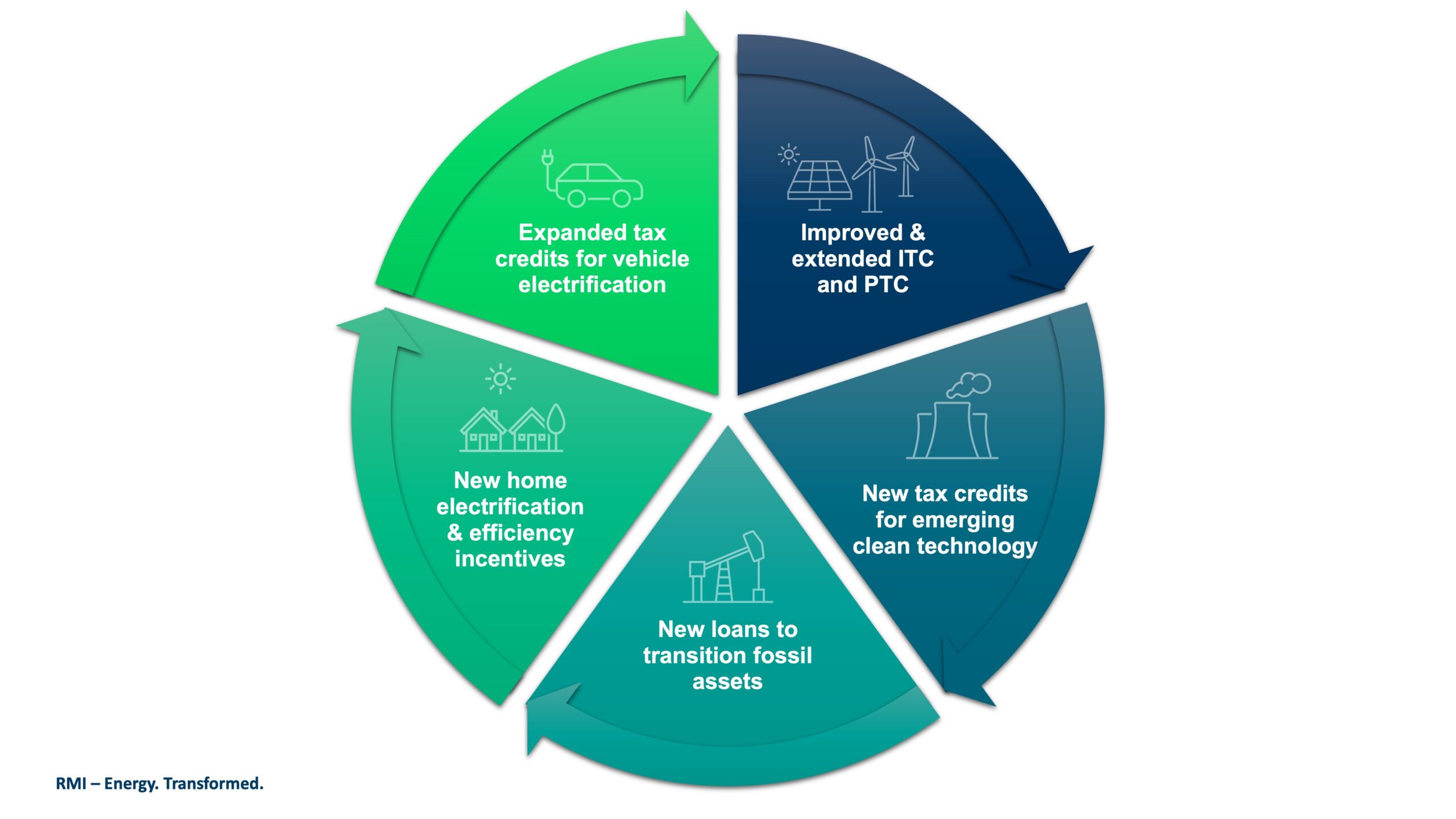

We would expect that plans that incorporate the IRA would look quite different than they did in their prior iteration. Changes include:

- Lower renewables costs due to the production and investment tax credits, which also incentivize stand-alone storage, drive more near-term buildout, and prompt utilities to reconsider the economics of new proposed gas

- Accelerated electrification as a result of customer incentives for EVs, heat pumps, and more

- Additional energy efficiency savings, as a result of funding for more affordable retrofits

- Accelerated coal retirements due to new financing options for asset transition and the falling cost of renewables and storage

- Deeper consideration of emerging technologies that could also play a long-term role in reliability

The IRP filed by Michigan’s largest investor-owned electric utility, DTE, in November 2022, is the first resource plan in the country that has attempted to demonstrate some of those expected changes. By incorporating assumptions related to IRA tax credits, DTE executives projected that they will be able to save customers about $500 million over the course of the 20-year plan. Branded as the Clean Vision, the plan outlines DTE’s pathway to meet both Michigan and federal goals for emissions reductions of 28 percent below 2005 levels by 2025, 52 percent by 2030, and be carbon neutral by 2050.

How DTE’s Plan Shifted

In its 2022 IRP, DTE expanded its clean energy pathway beyond its 2019 plan, with several major changes:

- If approved, the proposal would add over 15 GW of solar and wind by 2042 — bringing renewables to about 60 percent of DTE’s portfolio, up from 10 percent today — and represent a major increase from the 2019 plan, which included about 3 GW of proposed renewables investment.

- Battery storage increased in the 2022 plan with nearly 3 GW proposed before 2042, a number bolstered by IRA tax credits, improving upon DTE’s tentative exploration of battery pilots in the 2019 IRP.

- The 2022 IRP includes an updated, phased retirement date for the Monroe Power Plant — the fourth largest coal plant in the United States — in 2028 and 2035, earlier than the 2019 IRP’s proposal to close Monroe in 2040.

What DTE Did to Include IRA Impacts

Ahead of filing its IRP, DTE made updates to its reference planning scenario to include the impacts of the IRA. The “REFRESH scenario” assessed the impacts of the tax credits for wind, solar, battery storage, nuclear, and carbon capture by updating the levelized cost of energy (LCOE) of these resources (see chart). The scenario also updated other planning assumptions that had changed while DTE conducted its analysis, including increases in gas prices and wholesale electricity prices. The REFRESH scenario also imposed constraints on renewables build-out based on planning factors such as supply chain, interconnection issues, and siting considerations. Including IRA tax credits resulted in all portfolios from the REFRESH scenario — with the exception of one that kept Belle River Power Plant on line past 2028 — being more affordable than the base case.

Using “All the Carrots” of the IRA in a Resource Plan

Beyond the tax credits, there is further opportunity for utilities, including DTE, to demonstrate how they will use all the incentives (the carrots) in the IRA in their resource plans.

Assessing the opportunity to use new loans to reduce the cost of transitioning existing fossil assets could shift retirement timelines in IRPs. The Energy Infrastructure Reinvestment (EIR) program, for example, appropriates $5 billion through 2026, which will guarantee loans to projects that retool, repower, repurpose, or replace decommissioned energy infrastructure and help build energy infrastructure to avoid, reduce, utilize, or sequester greenhouse gas emissions. For example, incorporating the EIR could allow DTE to retire its remaining coal plant on an accelerated timeline to align with the state’s proposal to phase out coal by 2030.

Understanding the options and costs of emerging technologies that will receive IRA tax credits could bring them into the planning horizon, and potentially compete with new gas investment. DTE, for example, has proposed a conversion to natural gas from coal at Belle River in 2026 and identified the potential need for a 950 MW dispatchable resource in 2035. DTE says it will continue to evaluate the affordability of emerging dispatchable, low-carbon resources as those technologies mature before selecting a resource to fill this possible need in future IRPs.

The IRA also includes incentives for further deployment of energy efficiency and demand response, which can be included in an IRP. DTE’s 2022 IRP, for example, uses a 2021 Michigan statewide potential study, but new IRA programs for home retrofits and efficiency incentives will enable more savings, especially for low-income customers. Utilities must work with state and federal agencies to understand the impacts of these programs and maximize the benefits from energy efficiency investments.

What Regulators Can Do

DTE’s proposed plan demonstrates both the opportunity and the learning curve that utilities and regulators face in using the IRA to support rapid decarbonization of the energy sector. In 2023, several other utilities — including PacifiCorp, Santee Cooper, Tennessee Valley Authority, Duke Energy Progress, and Duke Energy Carolinas — will file or finalize long-term plans and should consider how to reflect IRA provisions.

Further regulatory action may be needed to ensure that these plans make the most of IRA incentives and maximize ratepayer savings. Regulators can review plans with an eye to utilizing IRA provisions, or require changes to future utility plans with IRA provisions in mind. Regulators can also start building expertise to support their evaluation of utility plans with IRA provisions — including engaging with local, state, and federal agencies to coordinate on implementation.

DTE’s IRP starts to show us the transformational potential of the IRA to accelerate renewables deployment and deliver customer savings — it’s time to build on that and deliver more examples in 2023.