WASHINGTON - SEPTEMBER 18: The U.S. Securities and Exchange Commission seal hangs on the facade of its building September 18, 2008 in Washington, DC. Republican presidential candidate Sen. John McCain (R-AZ) has called for the ouster of SEC Chairman Christopher Cox in the wake of the collapse of several giant banks on Wall Street and the resulting financial crisis. (Photo by Chip Somodevilla/Getty Images)

The SEC Opted Not to Lift the Veil on Corporate Emissions. But the Market Is Making Moves Anyway.

RMI is poised to help leaders reach a new level of climate performance transparency.

Nearly two years after initially announcing proposed rule changes requiring corporations to disclose climate-related risks, the US Securities and Exchange Commission (SEC) has released comprehensive guidance on the level of emissions and accounting disclosure required. The SEC’s rule was expected to be a watershed moment for increasing the transparency of climate change-related risks and their material impacts on businesses, but the final rule falls short. By failing to include Scope 3 requirements, the SEC has lost an opportunity to capture the full scope of major emissions sources and related risks.

The decision comes at a time when climate change-related disasters are already weakening the global economic system. In the first half of 2023, global losses came to nearly $200 billion and investors are increasingly demanding greater transparency about the inherent climate risk of companies in their portfolios.

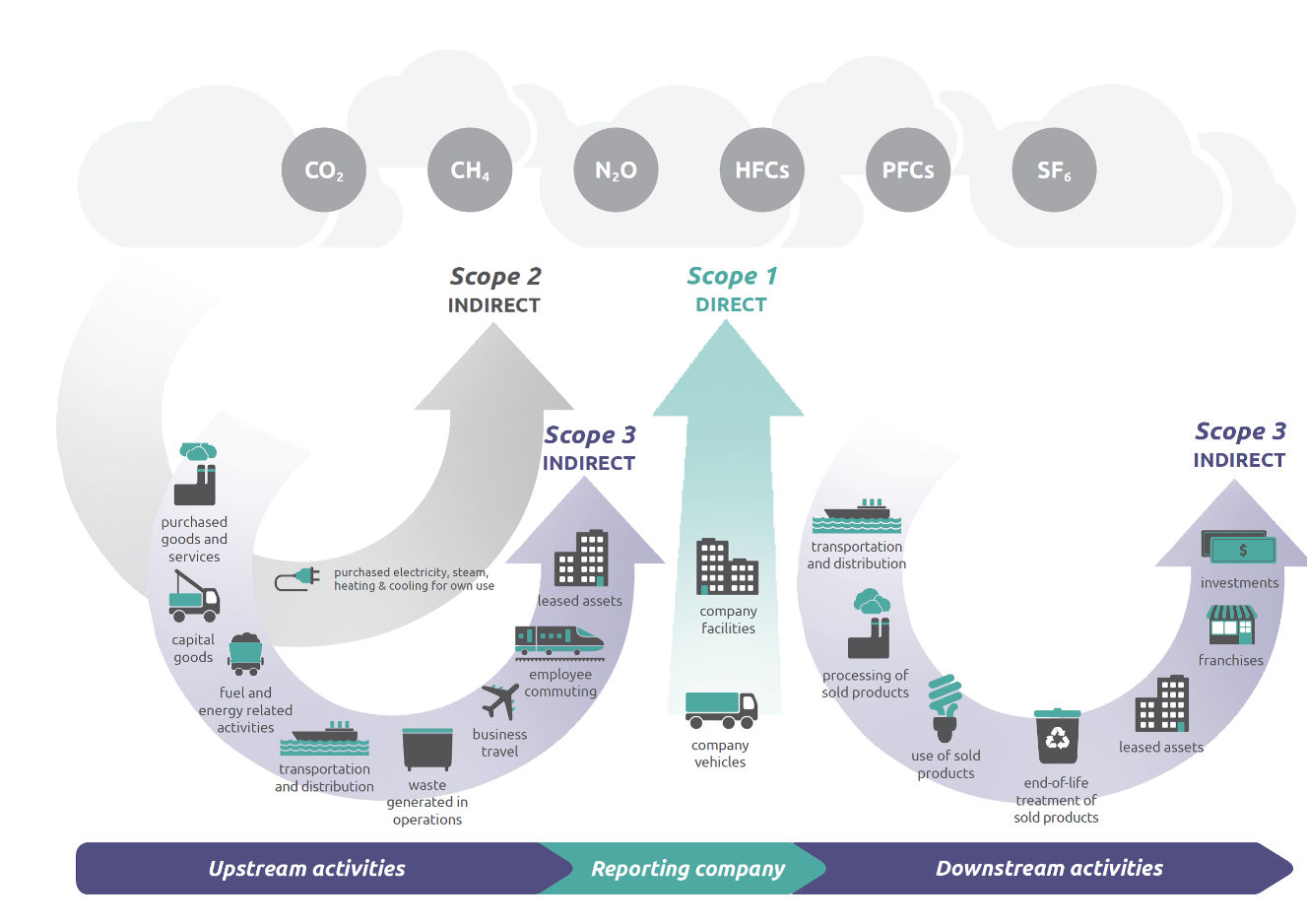

Exhibit 1. Overview of GHG Protocol scopes and emissions across the value chain. Graphic credit: EPA.

Exhibit 1. Overview of GHG Protocol scopes and emissions across the value chain. Graphic credit: EPA.

With federal guidance not yet up to the task, others are stepping in. California’s Climate Corporate Data Accountability Act (SB 253), signed into law in October 2023, as well as new voluntary transparency standards issued by large corporations are expected to serve as the new guiding stars for emissions accounting and reporting best practices.

The silver lining that could eliminate emissions reporting gray areas

The California Climate Corporate Data Accountability Act signed into law late last year is the first of its kind in the United States, requiring companies doing business in the state with annual revenues of $1 billion or more to disclose their supply chain emissions or face fines up to $500,000. As the world’s fifth-largest economy if it were a country, California’s environmental rules are quickly followed by other states, even when they exceed federal requirements.

In Europe, the Carbon Border Adjustment Mechanism and Corporate Sustainability Reporting Directive set a high bar for emissions transparency in global trade. Adding to this market momentum, the corporate landscape has become increasingly climate-conscious in recent years, sparking the development of a plethora of reporting requirements for corporate emissions inventories. For example, starting this year, Amazon will update its supply chain standards to require regular reporting and emissions goal setting from the many suppliers that sell to this global e-commerce leader.

It is increasingly clear that corporations are continuing to face pressures to provide accurate, transparent accounting for their supply chain emissions. The big question now is how they can best meet the demands of a shifting market.

How can RMI help provide corporations clarity in this confusion?

RMI has been anticipating these market shifts for years and has been working closely with corporate stakeholders to create solutions that will future-proof their supply chains against rapidly evolving climate disclosure requirements.

Adopting RMI’s product-level carbon accounting guidance, like the recently finalized Aluminum Emissions Reporting Guidance gives corporate buyers and their suppliers the data granularity and consistency to understand emissions performance in complicated industrial supply chains. While corporate-level footprints provide a big-picture understanding of an organization’s emissions impact, a product-level perspective gives clarity on emissions associated with what corporations buy and sell (i.e., the emissions corporations are driving in their supply chains). By calculating and disclosing the most relevant data, corporations have the unique ability to understand the once-nebulous emissions in their supply chains.

RMI is also leading efforts to help corporations align procurement strategies with measurable supply chain emissions cuts. Corporate buyers’ coalitions for carbon-intensive products are allowing buyers to band together with clear demand signals and purchasing commitments for sustainable materials based on a defined emissions performance metric.

The Sustainable Steel Buyers Platform is aggregating buyer demand for low-emissions steel to support an initial commercial-scale purchase in North America. By bringing together committed buyers and leading producers, RMI is aiming to deploy the first commercial-scale low-emissions steel facility in North America. Corporate participants will claim a place in history as first movers to slash the steel industry’s carbon footprint — about 7 percent of global emissions — while reporting measurable progress toward their announced climate ambitions.

Transparency benefits for corporations and suppliers

Receiving comparable emissions numbers from commodity suppliers, especially suppliers of carbon-intensive products like steel and aluminum, allows a corporation to accurately determine its upstream emissions. Requiring suppliers to conform to accounting and data standards enables buyers to better understand and compare the standardized emissions data received, and more easily make low-carbon purchases to decrease Scope 3 emissions.

Engaging with RMI’s industry-specific solutions is an opportunity to get ahead of the competition and potentially earn premium pricing. With more customers requesting carbon emissions data to determine their own upstream Scope 3 impact, adopting standards makes it easier for suppliers to deal with an increasing reporting burden.

Emissions transparency is the new best practice for doing business

Ultimately, understanding what’s in your supply chain makes basic business sense. Greater transparency fosters greater accountability and helps companies and investors gain a better understanding of accountability for emissions hot spots. More informed leaders can mitigate transitions risks and capture opportunities to create more responsible and prosperous markets.

Despite the SEC rule’s shortcoming on the inclusion of Scope 3 emissions criteria, corporations are still facing mounting demands for emissions transparency from voluntary and other regulatory drivers. Fortunately, more effective accounting tools are emerging, empowering corporations to meet these evolving disclosure expectations with greater ease and accuracy.