Planning for PJM’s Grid of the Future Starts Today

PJM’s proposed long-term regional transmission planning marks a new way forward. How much it will deliver is still uncertain.

It may be a new calendar year, but the US grid is facing many of the same challenges it did in 2023, including lengthy interconnection queue delays, a lag in transmission buildout, and accelerating fossil retirements. At the same time, it faces growing clean energy commitments by states and private actors, and increasing load growth from economy-wide electrification and other new investments.

Nowhere is this truer than in PJM, a regional transmission organization that coordinates wholesale electricity markets in 13 states and the District of Columbia. Just last year, PJM implemented interconnection queue reforms and approved over $5 billion in new transmission projects to support, among other needs, fossil retirements and load growth driven by data center expansion. All the while, states across PJM, from Maryland to Michigan, are strengthening their climate policies, heightening the need for improvements to the PJM grid to support the delivery of more clean energy. PJM’s Resource Retirements, Replacements, and Risks report, released in February of 2023, highlights the reliability risks surfaced by these significant supply- and demand-side shifts.

One thing is certain: proactive transmission planning will be critical to address all of PJM’s overlapping grid challenges in a reliable and affordable manner. Currently, PJM’s transmission planning process is overly myopic, resulting in an overemphasis on lower-voltage grid upgrades that do not deliver the scale of proactive transmission that we need for the energy transition. At the same time, generators are facing increasingly high costs to interconnect because of a lack of high-voltage regional transmission, posing a barrier to timely new entry.

As research from last year illustrated (Exhibit 1), PJM’s investment in high-voltage transmission has been declining in recent years, especially compared with other grid regions. We need to reverse this trend to meet the multiple changes noted above that PJM’s grid is facing today.

Last summer, PJM initiated a series of workshops to revamp its transmission planning process, called Long-Term Regional Transmission Planning (LTRTP). This has the potential to shift more investment to the higher-voltage, longer-distance lines the region needs for the energy transition. As proposed, LTRTP would enhance PJM’s existing transmission planning by modeling three scenarios on a much more comprehensive basis:

- The Base Scenario includes all announced and policy-driven generator retirements, forecasted new load, and enough new generation to maintain the 1-in-10 reliability standard. PJM proposes to allocate Base Scenario costs using its regional reliability cost allocation framework.

- The Medium Scenario includes the Base Scenario assumptions and adds new generation to fully meet state policy needs (e.g., renewable portfolio standards or clean energy standards). PJM proposes allocating any additional costs for the Medium Scenario, above those in the Base Scenario, to states with policy requirements using PJM’s State Agreement Approach.

- The High Scenario includes the same policy needs as the Medium Scenario but assumes higher loads, incorporating more ambitious electrification projections. PJM also proposes to allocate any higher costs in the High Scenario using the State Agreement Approach.

Compared to the status quo, PJM is taking a big step forward with LTRTP. By combining several drivers of transmission needs, including plant retirements, load growth, and new generation, into a scenario-based evaluation, LTRTP can identify holistic transmission solutions that resolve these issues, lower costs for consumers, and maintain system reliability. Importantly, PJM is also planning to calculate multiple benefits for transmission projects, modeled off of those enumerated in the FERC regional transmission Notice of Proposed Rulemaking. These include production cost savings, avoided generation and transmission costs, and reduced loss of load. By factoring in these benefits, everyone involved can make more informed investment decisions.

However, PJM and its stakeholders can take several additional steps to improve LTRTP. Specifically, we recommend the following:

- States should proactively explore and agree upon a cost allocation methodology for the Medium and High Scenarios. While the State Agreement Approach lays out a framework for dialogue, states through the Organization of PJM States Inc. should proactively come together to discuss how exactly costs could be divided. Pursuing a multi-State Agreement Approach, for example, might help meet multiple states’ policy goals more efficiently and cost-effectively. PJM’s proposed LTRTP benefits modeling can help inform these cost allocation conversations. As a starting point, PJM states can look to how other regions have structured long-term planning cost allocation, including MISO LRTP Tranches 1 and 2 and ISO-NE's new Long-Term Transmission Study (LTTS).

- PJM should include market efficiency in its drivers of transmission needs. Currently, PJM is planning to evaluate only reliability drivers as part of LTRTP while keeping market efficiency (economic) drivers to shorter-horizon (5 years out) planning. This runs the risk of underbuilding the transmission that we need long term by ignoring opportunities to simultaneously reduce congestion, and thus costs for consumers. Moving forward, PJM should consider how to also incorporate consideration of market efficiency drivers into LTRTP, including through sensitivity analyses. MISO’s LRTP is a good example of long-term, multi-driver planning.

- PJM should include multiple demand sensitivities in its Base Scenario. PJM’s current LTRTP framing includes just one load forecast for the Base Scenario, with a high electrification future considered only as part of the High Scenario (which is contingent on states agreeing to pay for the upgrades). PJM should instead incorporate multiple load forecasts into its Base Scenario through sensitivity analyses. Recent upward revisions to PJM’s annual load forecast reaffirm the need for analyzing multiple load growth futures independent of state public policy needs. At the outset of this year, for example, PJM released its 2024 load forecast, which projects 1.7–2 percent growth per year over the next 10 years — roughly double that of the 2023 forecast’s annual growth rate of 0.8–1 percent.

- PJM should plan for expanding connections to its neighbors in conjunction with LTRTP. LTRTP is focused on regional transmission, but PJM should also be planning for more interregional transmission. Recent studies have identified the potential for huge cost savings — more than $15 billion between MISO and PJM alone — that could result from PJM building more interregional transmission to neighboring grid regions. Interregional transmission also supports enhanced reliability and resilience during extreme weather events. Along with LTRTP, PJM should be strengthening its interregional planning efforts with neighboring grid regions.

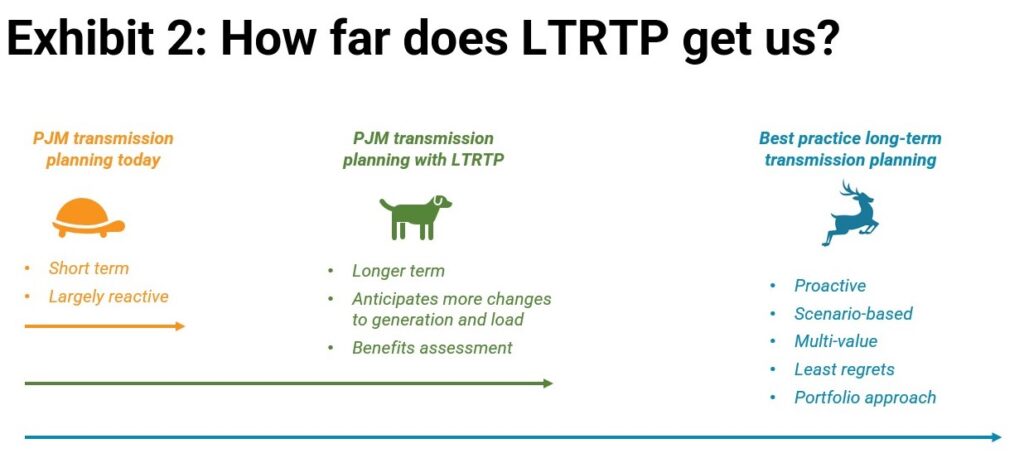

With these improvements, we believe PJM can use LTRTP to plan a “least-regrets” transmission portfolio that serves as a foundation for a reliable grid that meets the growing needs of its customers. Moving forward, we hope to see PJM finalize the LTRTP process in the coming months, so that implementation of these needed updates can commence. At the same time, with the pending FERC regional transmission rulemaking expected later this year, PJM should be prepared to fully comply with the rulemaking in a way that enhances the existing LTRTP framework. Exhibit 2 below illustrates the progress PJM’s LTRTP can make, as currently proposed, and the additional best practices that remain on the table.

As numerous studies have shown, high-voltage regional transmission has the potential to lower costs for consumers, maintain grid reliability, and foster economic growth by connecting new loads and generation. Furthermore, many grid regions are already doing the type of long-term, scenario-based planning that PJM is proposing through LTRTP and seeing results (e.g., MISO’s LRTP, CAISO’s Transmission Economic Assessment Methodology, ISO-NE’s LTTS, and NYISO’s Public Policy Transmission Planning Process).

To that end, all of PJM stands to benefit from a more robust, long-term approach to transmission planning, as all states in PJM are facing changes to their generation and load. A lack of proactive transmission buildout puts PJM states at risk of increased reliability issues and missing out on potentially lucrative economic development associated with new load growth. Transmission is a long-term investment that pays dividends, and stakeholders in the region should work to ensure 2024 is the year PJM starts investing sufficiently and wisely in the grid of the future.