Our Climate as an Infrastructure Asset

Our climate is getting plenty of attention, but we don’t often view it as infrastructure. We should. The global climate comprises an essential and massive part of the natural systems that form the foundation for our world and our society. Our economy is built on assumptions about climate stability. Our real estate industry, food systems, electric grid, and, by extension, our financial markets all rely on expectations around how it behaves.

Every four years, the American Society of Civil Engineers issues an Infrastructure Report Card for the country. They gave us a D+ in 2017 (and the same score in 2013). If the organizational equivalent existed to grade the state of our climate, the results would be similar. Just as we’re starting to feel the effects of our failing dams and overcrowded airports, the costs of climate change are becoming impossible to ignore.

We can take the infrastructure analogy further – just as every $1 spent on road maintenance helps us avoid between $4 and $10 dollars on repairs, investments in climate action are dwarfed by the cost of neglect or inaction.

In this article, we will describe some of the costs of inaction, compare them to the cost of preventive “maintenance and repairs”, and detail some of the actions we can take to mitigate climate change and head off the massive costs associated with living on a broken planet.

The Cost of Inaction

The cost of climate inaction can be broken down into three categories:

- The direct costs: the physical losses associated with more frequent extreme weather events, wildfires, and rising sea levels;

- The indirect costs: the future weaker growth and lower asset values created by a damaged planet; and

- The cost of uncertainty: Investors place a value on risk and volatility (or lack thereof), and climate change has a powerful destabilizing effect on our natural and economic systems.

Let’s look at each of these in turn.

Direct Costs: Lost Labor Productivity, Premature Deaths, Property Damage

From 2008 to 2018, extreme weather disasters cost $840 billion, or an average of $84 billion a year. According to the National Oceanic and Atmospheric Administration (NOAA), 2017 saw $318 billion spent on climate- and weather-related disasters, with Hurricane Harvey alone causing $100 billion in property damage. In 2018, Hurricane Maria left 1.6 million Puerto Ricans without power – which took 11 months to conclusively restore and plunged its more than 3 million citizens into a deep humanitarian crisis.

We have known for some time that climate change is increasing the frequency of extreme weather events, and that warmer air and water contain more energy – and therefore carry more destructive potential. And with the continuously improving science on “climate attribution”, we can increasingly identify and quantify the impact of human-induced climate change on specific events.

Here’s what climate scientist Professor Nerilie Abram had to say about the continent-wide devastation occurring around her: “Wildfires need four ingredients: available fuel, dryness of that fuel, weather conditions that aid the rapid spread of fire, and an ignition… (climate change is) making Australian wildfires larger and more frequent because of its effects on dryness and fire weather”.

The past five years have seen major natural disasters more than double – to more than 12 events occurring annually. The median risk of commercial properties being exposed to a category 4 or category 5 hurricane is projected to increase by 275 percent by 2050.

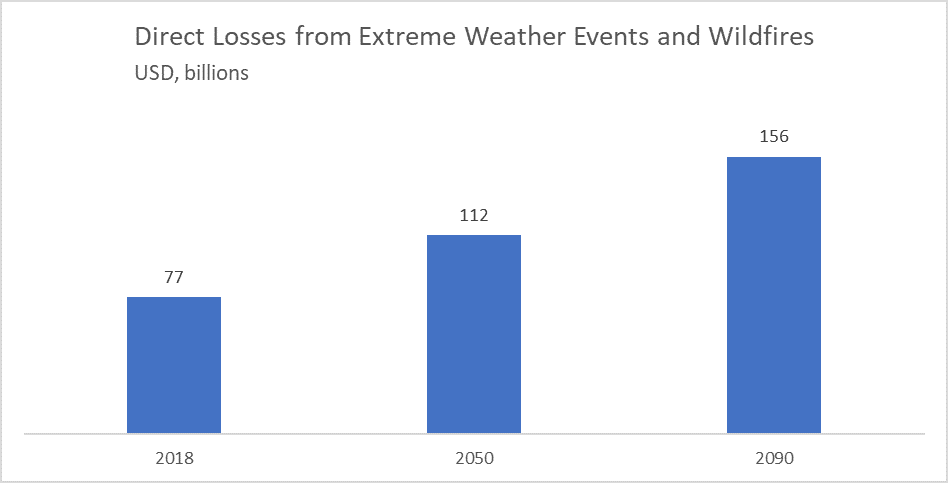

Based on these forces, National Climate Assessment (NCA) estimates find that the present value of direct costs will rise to $112 billion by 2050 and $156 billion on average by 2090.

Indirect Costs: Lower Growth, Lower Savings, Lower Returns

Unfortunately, these direct costs only begin to scratch the surface. Climate change will also result in lower economic growth, lower savings, and lower returns on assets according to the Economist Intelligence Unit (EIU). As Dr. Sebastian von Dahlen, Chairman of the International Association of Insurance Supervisors (IAIS) puts it, “it’s not so much the question of which asset classes are exposed, but rather, are there any assets which wouldn’t be”.

Extreme weather events are short-lived, but their effects can last decades. As Solomon Hsiang, who runs the Climate Impact Lab at UC Berkeley, pointed out in his recent testimony to Congress (citing his own research): “Hurricanes, floods, tornadoes, droughts, and fires destroy assets that took communities years to build. Efforts to rebuild then divert resources away from new productive investments that would have otherwise supported future economic growth.”

Hsiang and his colleagues estimated that the compounding effect from Hurricane Maria “set Puerto Rico back over two decades of progress”. And the effects of extreme weather events can last far longer than a few decades. Ninety years later, there are American communities still suffering from the effects of the 1930s Dustbowl, according to an analysis by Richard Hornbeck at the University of Chicago.

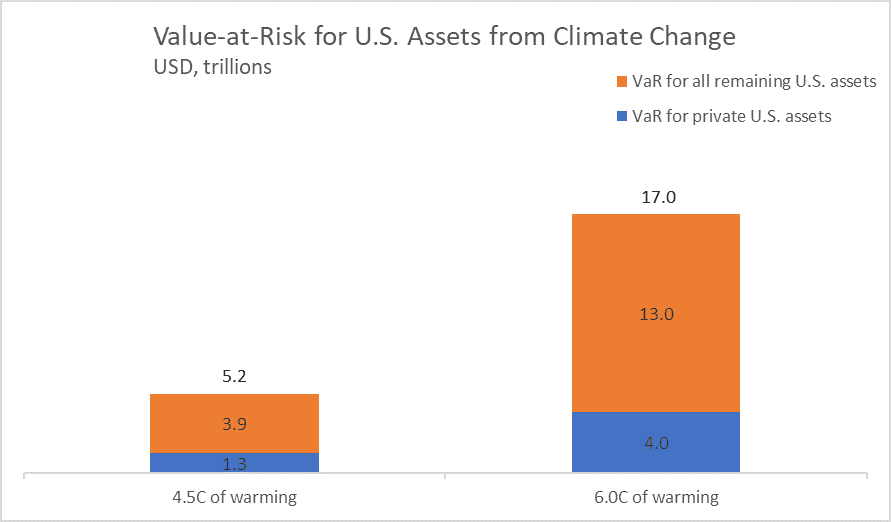

The potential future cost of climate inaction in the United States is staggeringly large. Based on analysis by the EIU, if our nation’s average temperature increases by 4.5°C from 2015 levels, the value-at-risk (VaR) to privately held assets in the U.S. could be more than $1.3 trillion. If we include all US assets, including public sector and societal ones like employment opportunities and agricultural yield, the VaR is $5.2 trillion based on our current trajectory.

Under a more extreme 6.0°C degrees of warming scenario, these figures rise to $4 trillion in privately-held assets and $17 trillion for all assets. This comes out to more than $130,000 per household. To put that in context, the median net worth of an American household today is $88,000, including home equity.

The Cost of Uncertainty

Investors and markets value certainty, and we are reasonably familiar with the market impacts of uncertainty from a range of causes – policy, politics, international conflict, and natural disasters. For example, the uncertainty associated with Brexit contributed to the FTSE 100 declining by 13 percent from May 8, 2015 (when Prime Minister Cameron won reelection, with his Brexit referendum promise) to June 24, 2016 (the day the UK elected to “leave”).

Historically, the Dow Jones has fallen by an average of 1.6 percent in open presidential election years but has risen by more than 10 percent in years in which the President seeks reelection. These events highlight how financial markets price the uncertainty that follows disruptive events (as distinct from disasters, which result in direct losses and economic consequences).

Given the size of our nation’s financial markets, even small movements can have dramatically large impacts. A mere 1 percent decline in value translates to over $300 billion in losses (US stock markets are collectively valued at 34 trillion). Unlike the effects of a political event or one-off policy occurrence, the uncertainty injected by climate change is more pernicious, longer lasting, and will steadily increase as we move further and further into uncharted territory.

Investments in Climate Action and Carbon Pricing Versus Inaction

Investments in climate change mitigation, even assuming very high (read: appropriate) levels of ambition, pale in comparison to the costs of inaction described above. And we choose the word “investments” carefully – unlike the damage and uncertainty caused by climate change, these are payments and capital expenditures that will usually deliver positive financial returns (even at private sector discount rates).

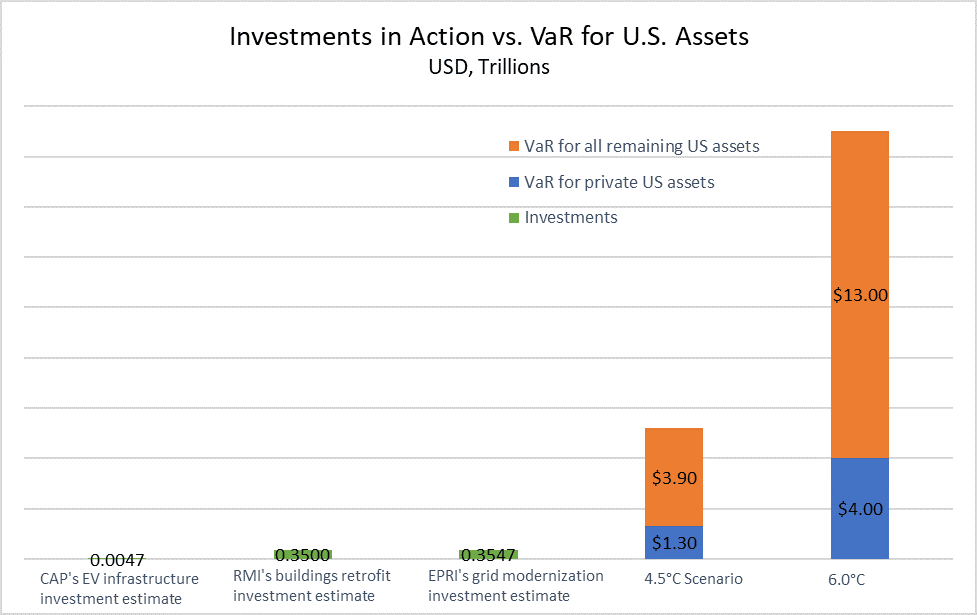

According to RMI’s Reinventing Fire study, deep retrofits for America’s entire building stock would cost $350 billion. However, the net value from the resultant tripled or quadrupled efficiency would be $1.4 trillion by 2050 (at a 33 percent internal rate of return), as the savings are typically worth four times the costs.

Similarly, the Electric Power Research Institute (EPRI) estimates that upgrading our grid to enable and manage high renewables penetration will cost $476 billion over the next twenty years – but also deliver $2 trillion of tangible benefits in saved energy costs and improved reliability. The Center for American Progress (CAP) has determined it would cost $4.7 billion to install 330,000 new public charging stations through 2025, while states have already found ways to fund nearly half of this amount.

These investments alone will not solve our climate crisis, but they represent critical pieces of the puzzle – and the less-than-$1 trillion they collectively represent is dwarfed by the $5-17 trillion in value-at-risk to the American asset base.

The math is similar with respect to carbon pricing. According to carbon tax analysis done by Columbia’s Center on Global Energy Policy, a $50/ton carbon tax would result in an emissions reduction of 39-46 percent below 2005 levels by 2025. This is ahead of the Paris target of 26-28 percent, but not enough to get us to an 80 percent reduction by 2050, which some models estimate we need in order to stay under two degrees Celsius of warming.

In other words, a $50/ton carbon tax could conceivably deliver around 50 percent of the impact we need to stay under the two degree threshold – assuming the rest of the world takes similarly ambitious action, which is admittedly a big assumption. $50/ton also happens to be what some scientists estimate to be the social cost of carbon in the United States. This is another way of looking at the “cost of inaction”.

Most economists agree that the effects of a carbon tax depend on what the government does with the revenue. For example, it can make investments or provide dividends that get returned to US citizens, promote equity goals, and provide stimulus. Pairing a tax with border adjustments can help ensure we don’t export our emissions. Economists also generally agree that any effect from a carbon tax – even a high one – is likely to be small relative to other forces, including demographic change, trade, or productivity gains.

The Columbia Center on Global Energy Policy estimates that a carbon tax starting at $50/ton and ratcheting up to generate stable revenue over time — such as to offset falling emissions volume with increasing price of emissions — would raise $180 billion every year from 2020-2029 in annual revenue. This represents a net present value of $1.5 trillion based on a 3 percent discount rate, and is small potatoes relative to the over $7 trillion in climate change-related costs it could help us avoid.

The rational economic decision for our nation is clear – invest in climate action today. Even with relatively conservative assumptions, the math yields a clear and compelling answer – effective climate action today, whether in the form of direct investments or carbon pricing, would be a lot cheaper than the effects of unmitigated warming. As if we needed any other reasons, economic prudence and fiscal responsibility are clearly calling for us to start taking better care of our most foundational and all-encompassing infrastructure asset: a stable climate.