Germany’s Renewables Revolution

While the examples of Japan, China, and India show the promise of rapidly emerging energy economies built on efficiency and renewables, Germany—the world’s number four economy and Europe’s number one—has lately provided an impressive model of what a well-organized industrial society can achieve. To be sure, it’s not yet the world champion among countries with limited hydroelectricity: Denmark passed 40% renewable electricity in 2011 en route to a target of 100% by 2050, and Portugal, albeit with more hydropower, raised its renewable electricity fraction from 17% to 45% just during 2005–10 (while the U.S., though backed by a legacy of big hydro, crawled from 9% to 10%), reaching 70% in the rainy and windy first quarter of 2013. But these economies are not industrial giants like Germany, which remains the best disproof of claims that highly industrialized countries, let alone cold and cloudy ones, can do little with renewables.

Germany has doubled the renewable share of its total electricity consumption in the past six years to 23% in 2012. It forecasts nearly a redoubling by 2025, well ahead of the 50% target for 2030, and closing in on official goals of 65% in 2040 and 80% in 2050. Some areas are moving faster: in 2010, four German states were 43–52% windpowered for the whole year. And at times in spring 2012, half of all German electricity was renewable, nearing Spain’s 61% record set in April 2012.

EFFICIENCY AND RENEWABLES BOLSTER POST-FUKUSHIMA GERMANY

To underscore the remarkable German case, let’s review what happened in 2011, right after Fukushima. The Bundestag—led by the most conservative and pro-nuclear party, with no party dissenting—overwhelmingly voted to close eight of the country’s nuclear plants immediately and the other nine by 2022. (In a double U-turn, a nuclear phase-out agreed in 2000 was first slowed and then reinstated; nuclear output has actually been falling since 2006.) Skeptics said this abrupt shutdown of 41% of nuclear output would make the lights go out, the economy crash, carbon emissions and electricity prices soar, and Germany need to import nuclear power from France. But none of that happened.

In fact, in 2011 the German economy grew three percent and remained Europe’s strongest, buoyed by a world-class renewables industry with 382,000 jobs (about 222,000 of them added since 2004, with net employment and net stimulus both positive). Chancellor Merkel won her bet that it would be smarter to spend energy money on German engineers, manufacturers, and installers than to send it to the Russian natural gas behemoth Gazprom. Germany’s lights stayed on. The nuclear shutdown was entirely displaced by year-end, three-fifths due to renewable growth. Do the math: simply repeating 2011’s renewable installations for three additional years, through 2014, would thus displace Germany’s entire pre-Fukushima nuclear output. Meanwhile, efficiency gains—plus a mild winter—cut total German energy use by 5.3%, electricity consumption by 1.4%, and carbon emissions by 2.8%. Wholesale electricity prices fell 10–15%. Germany remained a net exporter of electricity, and during a February 2012 cold snap, even exported nearly 3 GW to power-starved France, which remains a net importer of German electricity.

Was this just a flash in the pan? No. In 2012 vs. 2011, official data show that these trends broadly persisted.

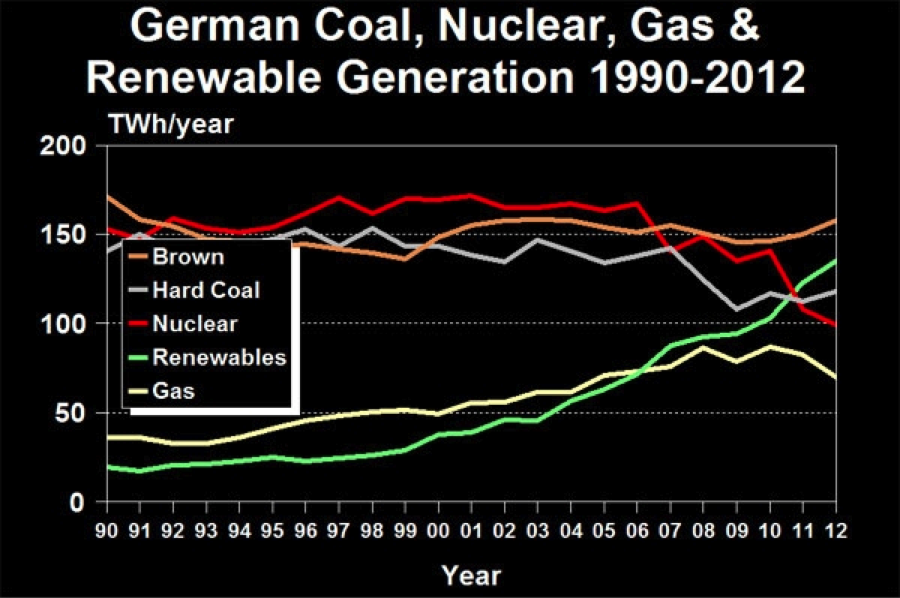

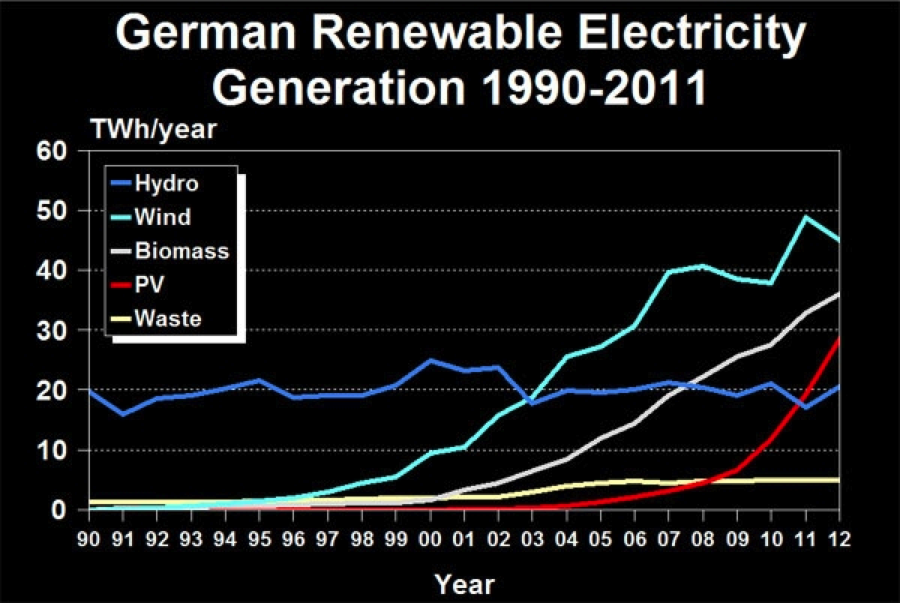

Germany generated 617 TWh of electricity in 2012, up 0.3% from 2011. Nuclear generation fell below 100 TWh, the lowest in at least two decades. Gas prices spiked above coal, so gas-fired generation fell 13 TWh while coal-fired generation ticked up 14 TWh or 5%—still near modern lows, but boosted by a record 23 TWh of profitable power exports. Renewables added 15 TWh: they rose from 20% of electricity consumption in 2011 to 23% in 2012, passing every rival except brown coal (lignite, expected to recede in 2013). Renewable output has risen by one-third just in the past two years. And though Germany’s mix of solar, wind, biomass, hydro, etc. wouldn’t all run at the same time, its total end-of-2012 renewable generating capacity impressively rivaled the country’s 82 GW peak demand. Driven by renewables’ competition, wholesale electricity prices continued to plummet. Germany’s grid remained the most reliable in Europe. And while real GDP, damped by the Euro crisis, grew just 0.7%, electricity consumption fell 1.3%. Total carbon emissions rose 1.6%, boosted by an unusually cold winter, but emissions from industry plus power stations stayed constant, and weather-adjusted total emissions probably fell.

GERMANY’S ELECTRICITY RATES AND FEED-IN TARIFF

German renewables’ dual trajectories of declining costs and rising installation rates are sending big ripples through the electricity system. Rating agencies are downgrading major European utilities because renewables—now over one-third of Europe’s generating capacity—have almost zero running cost. They can thus underbid fossil and nuclear plants, making them run fewer hours and earn lower prices, and thus slashing their profits. For example, German wholesale power prices have fallen about 30% just in the past two years to near eight-year lows, putting big utilities that underinvested in renewables under severe profit pressure.

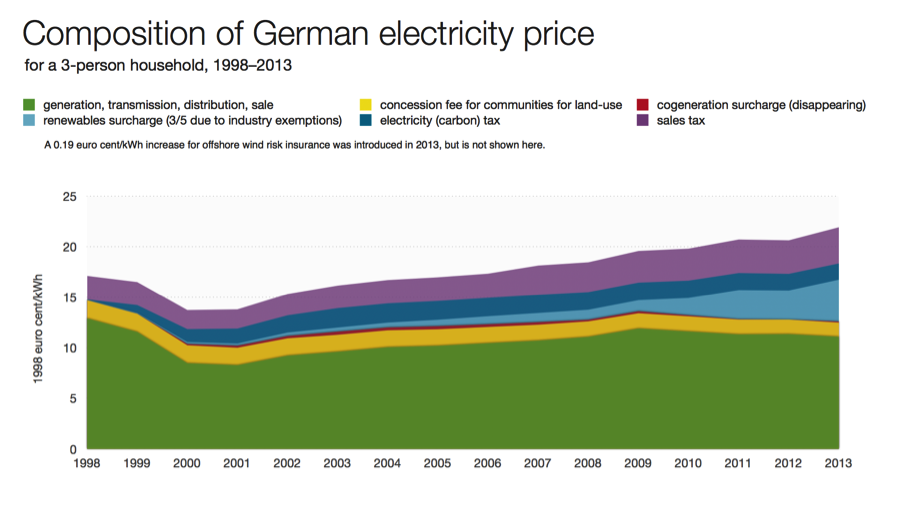

Even so, Germans pay a lot for their household electricity, about $0.34/kWh in 2012. The household tariff includes a “renewables surcharge,” expected to amount to roughly $249 per three-person household this year. That’d be three-fifths smaller if households weren’t subsidizing many businesses, mainly large ones—exempted from nearly the whole renewables charge, allegedly to boost German competitiveness—by 3–4 billion Euros a year. Yet German industry enjoys the lower spot prices that renewables create, so it pays about the same for electricity as it did in 1978, and less than French industry pays today. This cross-subsidy from households to industry, and the size of the resulting household surcharge, have generated lively debate about how much Germans pay for their electricity and why.

The German Renewable Energy Act introduced two key policies in 2000: 1) a fixed 20-year power purchase contract (i.e. feed-in tariff) offered to most renewables, such as rooftop solar PV, which also gain priority access to the grid, and 2) a stipulation that such power purchases not draw on Germany’s public purse. That second piece is notable, because German utilities—required to pay the feed-in tariff for each kind of renewable energy fed into the grid by any producer—recover those payments via the renewables surcharge.

At the beginning of 2013, that surcharge jumped 47%, but only one-ninth of that increase was for renewables; the rest came from calculational quirks, chiefly the generous industrial exemptions. The household surcharge has been rising rapidly because home photovoltaic generation has quadrupled in four years, with 1.3 million rooftop systems producing 28 TWh in 2012—adding at least 1 GW more in 2012 than the government intended. In a German national election year, this prompted calls from various members of government to postpone or reduce payments (even retroactively) or spread the fee to more customers. Those proposals were promptly scuttled. With Germany’s firm commitment to an energy future grounded in renewables, and with clean technologies such as solar rapidly taking off, the renewables surcharge will probably remain widely supported, controversial, misrepresented, and widely misunderstood.

THE TRUTH BEHIND GERMANY’S FIT AND ELECTRICITY RATES

Some critics have thus blamed renewables and the surcharge for Germany’s high household electricity prices, but such claims are little more than smoke and mirrors.

Many coal and nuclear subsidies came for decades from tax revenues as they still do in the U.S.; if transparently self-financed the way the German renewable surcharge is now, they’d raise German household prices about twice as much as renewables now do. But Germany stopped subsidizing photovoltaics nine years ago and has adopted a far more rigorous, egalitarian, effective, and transparent system of buying the power mix it wants and paying for it through an electric-bill line-item. This is no more a subsidy than the standard U.S. practice of charging customers for the cost of any power plant the utility regulator has approved: society simply chooses and buys the kinds of power it wants.

But in Germany those renewable charges present a key choice: you can earn them back—and more—by choosing to invest in renewables personally or through a co-op or community, the way 65% of Germany’s renewable capacity is now owned. In other words, you pay the surcharge like most German citizens, but you can also reap the feed-in tariff for your renewable generation. Such level-playing-field investment opportunities are rare in America, where corporations, usually large ones, own about 98% of non-hydro renewable capacity.

Even for customers who choose not to invest in their own renewables, the surcharge is a tiny drop in the bucket. Of the steep average German household electricity price, only 56% bought electricity and its delivery and sale; the rest was taxes. Less than a third of those taxes was the 13.6% for the renewables surcharge—after its roughly 150% enlargement by not fairly spreading the cost to all customers.

From 2000 to 2012, only two-fifths of the increase in the household electricity price was due to the renewable surcharge. The 2012 renewable surcharge cost the average German three-person household about ten euros a month. That’s about 3% of the household’s total energy costs, or 0.3% of its total expenditures, or less than 0.2% counting its offsetting cost reductions. You need a magnifying glass to see it—as the Environment Ministry thoughtfully illustrated.

Further, renewables also directly reduce several costs, such as wholesale electricity price and an electricity tax (effectively a carbon tax). These declines offset nearly half of the increased renewables surcharge—and decrease customers’ risk from volatile fossil-fuel prices. (German’s electric bills rose 70% during 2000–12, while heating oil and gasoline prices rose 86% to a total nearly three times higher. Heating oil alone rose 119% since 2000.) In fact, as renewables keep getting cheaper and fossil fuels probably costlier, the surcharge should turn into a large public dividend—as happened in France in 2008—in about a decade, and should total over a trillion dollars during 2030–50; so far, this shift from investment to return is outpacing expectations.

GERMANY’S EFFICIENCY REIGNS: ECONOMIC GROWTH WITH LESS ENERGY

The broad consensus behind Germany’s energy turnaround rests on foundations laid long ago. During 1990–2011, German coal-fired generation fell 14% and nuclear generation fell 30%, while renewable generation grew by 614%. Moreover, and often overlooked, German energy productivity advanced across all sectors. Indeed, Germany is rapidly becoming the world’s most energy-efficient country. Since 1990—the base year for Kyoto carbon accounting (and also the year Germany reunified)—the country’s weather-adjusted primary energy use fell 11% and its carbon emissions fell 25.5%, while its real GDP rose 37%.

Thus the economic productivity of its carbon combustion, reflecting big gains in every sector, rose by 84% in 22 years. This powerful trend is just getting started: Germany intends by 2050 to cut its absolute greenhouse gas emissions by 80–95% below the 1990 level, double its overall energy productivity from the 2020 level, and supply 60% of its total final energy renewably. Applying Reinventing Fire’s integrative design approach could probably far outdo the 20% electricity savings projected during 2008–2050. This could shrink the projected need for renewables and transmission.

While coal and nuclear shares of electricity generation decreased, Germany’s renewable share exceeded 1.5 times the nuclear share by mid-2012 (as also occurred worldwide in 2011). Germany is installing 8 GW of solar power each year (more in the past three years than the U.S. added in the last 30), and added 3 GW just during December 2011—more than the U.S. added all year. The feed-in tariff, now below $0.19/kWh for small photovoltaic systems, falls monthly. Thus as liberalized power markets in Europe and the phase-out of German coal subsidies both gain traction, renewable costs and subsidies are falling, and Germany’s relatively stable policy has built a world-leading clean-energy industrial base.

So the world’s largest economy (the U.S.) hangs suspended between the old and new energy worlds, while #2 China, #3 Japan, #4 Germany, and #10 India are consolidating their energy vision around transformation. So are many others, as surveyed annually at REN21. But in particular, Germany’s methodical and determined energy turnaround offers proof that a heavily industrialized, world-class, politically pluralistic market economy can run well on a self-financing combination of efficiency and renewables. The losers in the German market are those who assumed the energy turnaround couldn’t work. The winners are those who applied their capital and skills to make it happen.

The author gratefully acknowledges helpful data and comments by Craig Morris in Freiburg, whose blog is an exceptionally valuable source on Germany’s energy shift, and by U.S. renewables expert Paul Gipe. Graphs of German electricity generation and renewables mix courtesy of Paul Gipe. Composition of German electricity price graph developed with data from the German Association of Energy and Water Industries and based on a similar Creative Commons version here.