Hot Property: Why the Financial Sector Must Lead Real Estate Decarbonization

The Inflation Reduction Act directs over $50 billion in tax credits, rebates, and grant programs toward reducing the carbon emissions generated by buildings. This is expected to leverage tens of billions more in private sector investment.

While this investment is a “game changer,” best estimates are that we will need to spend $1.7 trillion a year between 2020 and 2050 to decarbonize the existing residential and commercial building stock. In addition, we are currently on pace to spend $920 billion on residential construction and another $500 billion on commercial construction and too many of those new buildings are still utilizing health-damaging and carbon-emitting fossil fuels.

To ensure that the buildings where we live and work do not exacerbate the devastating heat and natural disasters that are ever more frequently plaguing our communities, the real estate finance industry must rethink how it evaluates, underwrites, funds, and invests in these properties.

Many of the largest banks and real estate owners have already committed to meeting this challenge. JP Morgan Chase, Bank of America, Citi Bank, and Wells Fargo are all signatories to the Net Zero Banking Alliance — an industry-led, UN-convened group of banks committed to aligning their lending and investment portfolios with net-zero emissions by 2050. Likewise, many of the largest real estate owners and real estate investment trusts (REITs) have committed to reducing their carbon emissions. According to NAREIT, 59 percent of REITs have greenhouse gas emission reduction goals and 27 percent have a net zero goal.

Where to Start

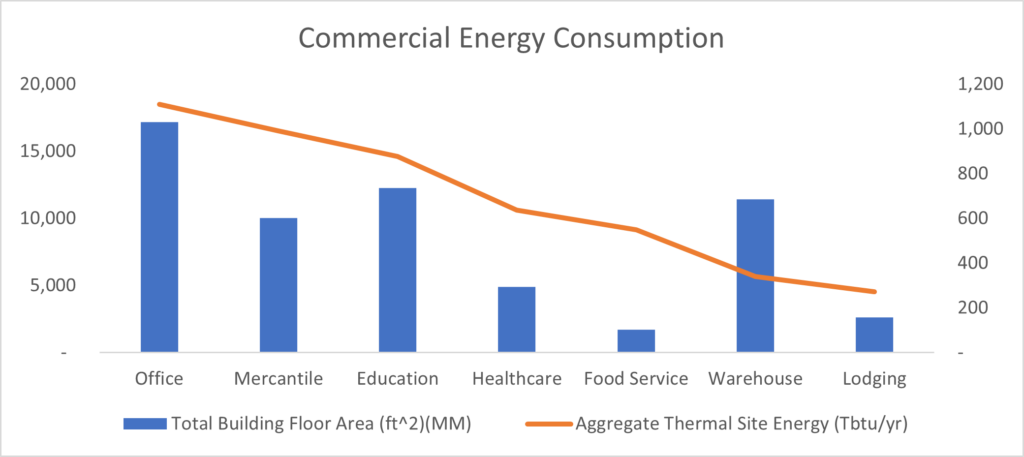

RMI worked with the Department of Energy’s National Renewable Energy Laboratory (NREL) and the Lawrence Berkeley National Laboratory to look at how energy consumption differed across residential and commercial buildings. The chart below compares the aggregate floor area of different building types with the aggregate thermal site energy used. As the chart shows, a building’s energy consumption varies greatly by building type. Office buildings use the most energy but also represent the largest floor area. Contrast that with food service, which occupies the smallest floor area, but consumes an outsized amount of energy.

Clearly, taking a one-size-fits-all approach to different property types won’t work. Each of these building types represents a distinct market segment with different ownership concentrations, financial structures and products, and different lenders and investors. Any real estate decarbonization strategy must understand the nuances of those market segments and incorporate those distinct players.

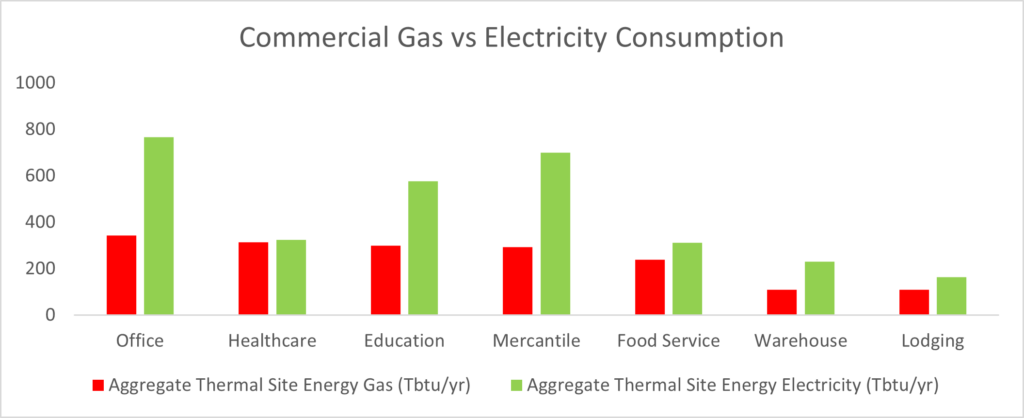

There is almost universal agreement that any viable path toward achieving a net-zero target for real estate and limiting global warming to 1.5°C will require electrifying all direct pollution sources in buildings (e.g., space heating and cooking appliances). But using the same NREL data set, we can clearly see that different building types use very different percentages of gas and electricity in their operations.

This difference not only has implications for the financial products and structures needed to switch out gas for electric, but also provides an indication for the level of resistance we can expect within a given market segment toward adopting and absorbing the needed changes and investments.

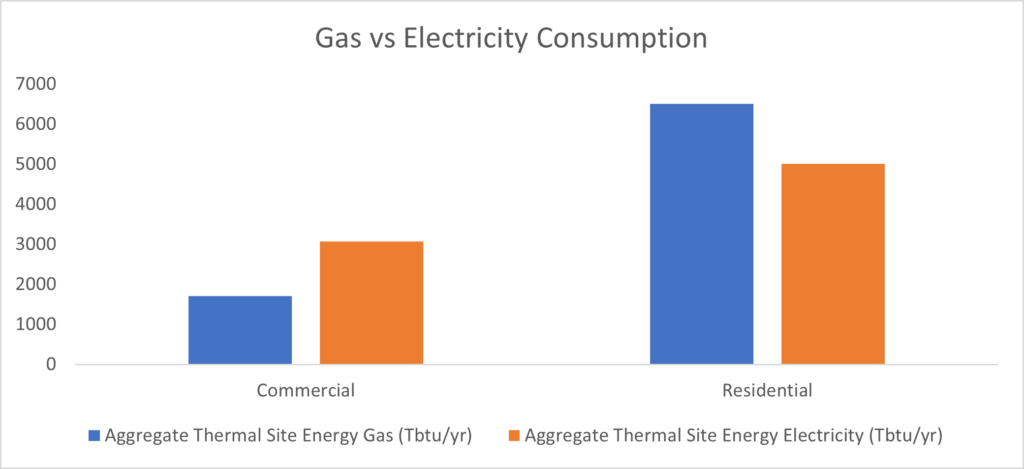

This is most keenly apparent when looking at the relative usage of gas versus electricity between the residential and commercial sectors. The commercial sector is already much more reliant on electricity than gas, while the residential sector continues to be dominated by gas.

Given the size of the residential market, its outsized reliance on gas for heating and cooking, and the detrimental health implications of using gas in our homes, it is easy to understand why so much of the funding from the IRA is focused on the massive effort it will take to get fossil fuels out of residential homes. It is up to industry to move other building types off of fossil fuels and continue the work of electrification.

How to Make Sense of It All

The combined commercial and residential real estate industry accounts for over 20 percent of US GDP, generates over 10 million jobs, and directly or indirectly accounts for about 30 percent of US carbon emissions. As such, there are already a dizzying array of standards, regulations, and initiatives which the industry needs to make sense of.

Want to commit to only financing “green” construction? There are 14 different green building accreditation standards that apply in the US, all of which have varying degrees of alignment with carbon reduction goals.

Want to launch a new finance product? There are 17 different international agreements and standards addressing how banks should measure, track, and account for the carbon generated by the buildings they have financed.

The SEC has issued the new carbon disclosure standards that will require real estate companies and funds to track and report on their carbon emissions and climate risk. Building owners, banks, and investors also need to understand the implications of new building performance standards — such as local law 97 in New York City — that cities, counties, and states are enacting across the country.

How RMI Is Helping

The massive investment that comes from the IRA provides a once-in-a-lifetime opportunity to get us on track toward a net-zero real estate sector, but it won’t be easy. RMI’s Center for Climate-Aligned Finance already has relationships with many of the largest players in real estate finance as well as partnerships with most of the organizations promulgating regulations and standards. RMI’s Carbon-Free Buildings team is already working with building owners and the construction industry and has deep experience with many of the largest accreditation entities.

Over the coming months, RMI will leverage this extensive knowledge base to complete a systems-level scoping and analysis of the real estate finance industry to identify barriers and potential solutions toward achieving net-zero commitments for residential and commercial real estate.

We will be looking at how capital flows into the different real estate market segments; what decarbonization pathways exist and how they differ for each property sector; and how to reconcile and standardize different metrics and target-setting structures. We will then assemble coalitions of actors from finance, industry, real estate owners, government, and nonprofits to develop climate-aligned finance solutions. Finally, we will market-test potential solutions to ensure broad industry buy-in.

We will share updates as our work progresses. To stay connected with our real estate finance work, follow us on LinkedIn.