Death And Taxes: How “Business-Friendly” Tax Reform Has Alarming Consequences for Clean Energy

This blog post is part of a series from RMI’s Business Renewables Center (BRC), which streamlines and accelerates corporate purchasing of off-site, large-scale renewable energy.

In late 2015, Congress passed bipartisan legislation that provided the wind and solar industries with a stable policy environment. After over a decade of short-term tax credit extensions, the legislation’s multiyear extension of key tax credits provided project developers and investors with a clear roadmap for long-term planning.

Last weekend, a handful of provisions tucked inside a major tax reform bill threatened to claw back this policy support for renewables.

Shortly after midnight on Saturday, Dec. 2, the Senate passed its version of the tax reform legislation that lowered corporate tax rates and set up a high stakes showdown to reconcile with the House version of the bill before a final vote and the President’s signature.

While many industries have applauded the pro-business measures in these bills, some of the provisions—whether intentionally included or not—put the renewable energy industry at serious risk for a major setback.

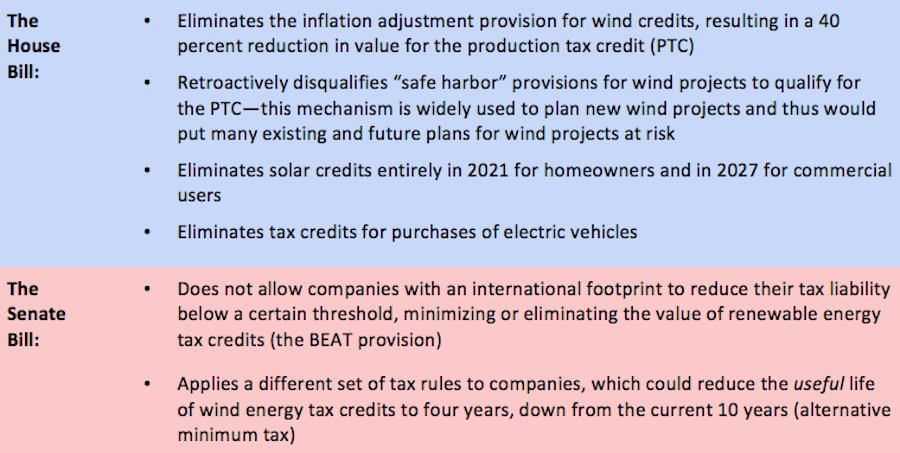

Both the House and Senate versions of the bill include multiple provisions that negatively impact renewables, both directly and indirectly. The House bill includes language that significantly reduces the value of existing tax policy that levels the playing field for clean energy. The Senate indirectly removes an investor’s ability to finance renewables via the tax credit mechanism altogether—potentially affecting 21 percent of all U.S. investment in clean energy.

Now, in the final hours of debate over what goes into the final bill, Congress should change course to preserve the existing policy framework for renewable energy enshrined in the 2015 law and remove the harmful provisions for wind and solar. To do otherwise would lead to a significant loss of jobs and investment dollars, which would undermine the growth trajectory of clean energy. Given that the purported goal of the tax reform legislation is to spur economic growth, it is ironic that both proposed versions of the bill undercut an industry that today creates jobs at a rate 12 times faster than the rest of the economy and is increasingly backed by dozens of major corporations.

The Dirty Details

How exactly could these tax bills cripple renewables? Here’s a quick rundown on the most problematic provisions:

But Wait, There’s More

Especially troubling in both the House and Senate bills is the retroactive nature of many of these changes. As currently proposed, changes to the tax policy for wind, the BEAT provision, and the impact of the alternative minimum tax, could all negatively impact existing renewable energy projects. Imagine signing a 30-year, fixed-rate mortgage, only to be told several years later that your rates are changing after all.

There’s a reason why retroactive changes to tax policy are rare: changing the rules midgame undermines investor confidence, which leads to less, not more growth. Why would investors put money in a project if there’s a chance that the value of their investment could decrease following a retroactive policy change?

It is even harder to make sense of these harmful provisions in light of the fact that renewable energy tax credits are already scheduled to ramp down. The production tax credit for wind steps down over the next few years before disappearing in 2020. Solar’s investment tax credit (ITC) is scheduled to lose 66 percent of its value by 2022. This fixed schedule has served as a solid foundation for investors and developers to build project pipelines in a rapidly maturing market. For Congress to tamper with existing law undermines the market signals enshrined in the 2015 legislation and introduces damaging uncertainty into the energy markets—which, at its essence, is an anti-business approach.

What Will Happen to Renewables?

The short answer? Nothing good. Experts at the American Wind Energy Association (AWEA) estimate a loss of 60,000 jobs across the U.S. Both AWEA and the American Council On Renewable Energy (ACORE) estimate that this could affect up to $50 billion in private investment dollars. And law firm Akin Gump predicts that approximately 50 percent of solar investors and a majority of wind investors would exit the tax equity market.

Thanks to the retroactive nature of these changes, law firm Norton Rose predicts that the BEAT provision in particular would contribute to claw backs on PTC deals “closed as far back as 2008.” Retroactive changes to the value of the PTC in particular could send existing corporate power purchase agreements underwater.

So What Can Be Done?

In the near time, Congress has several important decisions to make. First, it can choose to reject the provisions in the House bill and leave untouched the 2015 legislation that extended the PTC and ITC with planned sunset provisions. This would go a long way to maintain investor certainty and avoid undermining deals in the pipeline.

Next, Congress can find a solution to the unintended consequences introduced by the alternative minimum tax provision, to ensure that investors can continue to make market-based decisions to put money in renewable energy projects. Finally, the Senate can also choose to either abandon the BEAT provision entirely, or pass a two-year fix for renewable energy tax credits. Either of these options would avoid unnecessary and unintended consequences for the wind and solar industries, ensuring that tax equity investment dollars could continue to flow through at least 2019.

Time is Short

While RMI and the Business Renewables Center want to see renewables compete in a market-oriented environment on a level playing field, this kind of destructive public policy undermines the cost and technology gains that wind and solar can achieve on their own. By tampering with existing policy, Congress risks driving away private investment and eliminating jobs from across the country. And as more Fortune 500 companies seek to buy renewables to power their operations, this tax bill doesn’t just harm the developers and investors who seek to make money off renewables—it also harms the customers who simply want clean, affordable power.

Time is short. Congressional leaders are aiming to pass the tax reform legislation before the end of the year. Right now, a “conference” made up of two teams from the House and Senate are deciding what provisions will be included in the final bill.

Let’s hope they address the provisions that would undo the existing policy framework for renewables and make the necessary fixes to preserve a strong future for all renewable energy technologies.

Image courtesy of iStock.