Report | 2023

Unlocking Coal Contracts

Pathways to decarbonizing long-term coal power purchase agreements

A rapid global transition from coal to clean power is critical for strong economic growth and ambitious climate action. However, while there has been significant momentum for such a transition, over 93 percent of coal power is shielded from competition — much of which sits under coal power purchase agreements (PPAs). This report shares specific solutions to decarbonize coal PPAs and scale those solutions effectively. Unlocking these contracts could help stakeholders realize the many benefits of the clean energy transition — lower costs, higher earnings, more jobs, and better health outcomes.

These solutions were developed through detailed financial analysis of a specific, representative Indonesian coal PPA and in consultation with a law firm with in-country expertise. Such a focused approach was needed as decarbonizing PPAs involves integrating legal, policy, financial, and technical considerations — all while managing stakeholder relationships (Exhibit 1).

RMI’s proposed solutions are organized into three categories based on differing grid needs — 1) early coal PPA termination, 2) replacing the coal PPA with a clean energy PPA, and 3) restructuring the coal PPA to lower its emissions before eventual closure. Our analysis balances the priorities of key stakeholders such as utility customers, taxpayers, and investors while ensuring sufficient decarbonization.

This analysis shows that using innovative financial mechanisms (or coal transition mechanisms [CTMs]) opens up windows to decarbonize coal PPAs while maintaining similar costs for customers and taxpayers and the same earnings for investors.

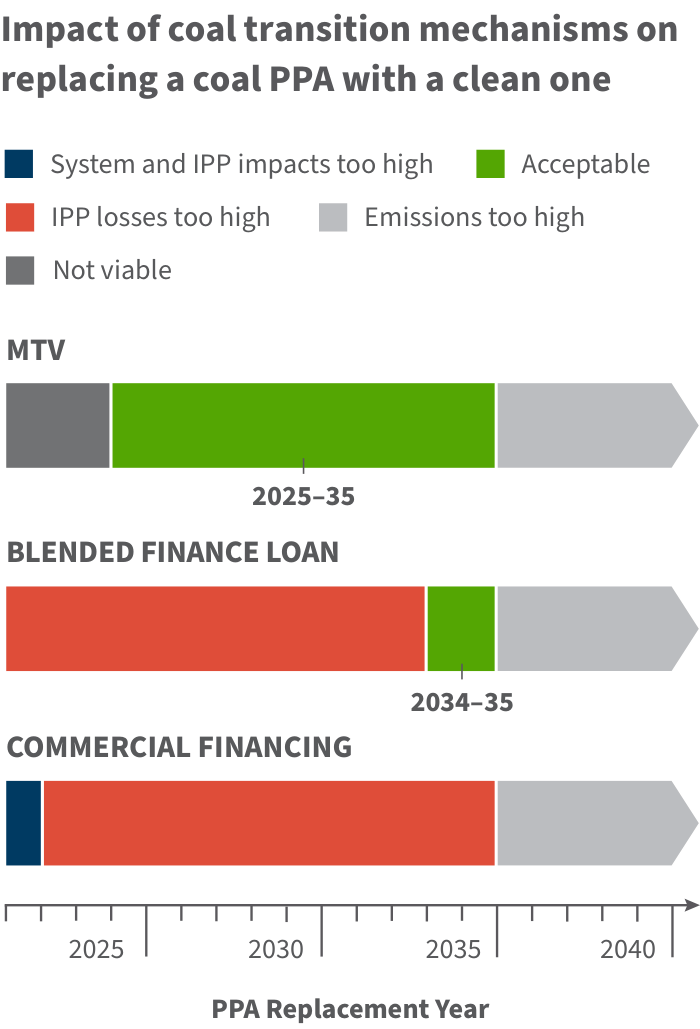

For coal-to-clean replacement, for example, a blended finance loan creates a 2034–35 window for transition, while another CTM called a managed transition vehicle (MTV) creates an even larger window from 2025 to 2035 — driving 80 percent emissions reduction (see Exhibit 2).

Policy changes open up new possibilities, and when considered with CTMs, could attract coal plant owners to the transition, increasing earnings by up to 30 percent.

Exhibit 3 shows how smaller and larger policy shifts could enable commercial financing of a clean PPA replacement. Combining these changes with CTMs further widens the window for the transition and could cut emissions by up to 90 percent.

Scaling the coal PPA transition will need thoughtful planning to ensure grid reliability, affordability, and support for affected people; but the solutions to begin that transition are ready to be explored and implemented today.

This work includes a short brief for those making decisions about coal PPAs (policymakers, financial institutions, plant owners) and a full technical report for those implementing those decisions (utilities, regulators, project financiers).

RMI is grateful to Bloomberg Philanthropies for their generous support of this work.