Report | 2022

Market Structures

Global Energy Transformation Guide: Electricity

The design and rules of wholesale, retail, and local electricity markets impact which, when, and how resources are purchased, sold, and utilized by system operators. Markets can generate efficient pricing for energy, capacity, and other ancillary grid services. Today, expanding and maturing markets are supporting investment in generation and grid infrastructure, putting new stress on the economics of coal, and improving the economics of renewables. In response, market parameters are evolving to support electricity reliability and affordability as systems accommodate higher levels of variable and distributed energy resources.

Through research and interviews with experts around the globe, RMI has compiled examples and data to describe how power sector leaders are leveraging market structures to make progress on energy transition priorities. Specifically, this report:

- Highlights why innovation in markets is critical to the energy transition

- Explains emerging global trends and associated challenges and opportunities

- Describes how market structures can advance the seven key outcomes for successful global energy transformation

- Articulates the edge of innovation for different countries and where attention is needed most

- Spotlights case studies to better illustrate what is being attempted across the industry and to share the experiences of practitioners

This report is part of RMI’s Global Energy Transformation Guide.

Related Spotlights

Market-Based Economic Dispatch for Wholesale Electricity in India

Driving Decarbonization and Energy Access in the Sahel through a Regional Market

Great Britain’s Forward-Thinking Ancillary Markets

Enabling DER Market Access in Australia

Enhanced Wholesale Market Design in the Philippines

Market-Based Economic Dispatch for Wholesale Electricity in India

Exhibit 1: Priority Outcomes for Global Energy Transformation

India has proposed a market-based economic dispatch (MBED) mechanism that is a step towards creating a power sector that operates efficiently with an integrated pan-India approach for scheduling and dispatch of generators. Suboptimal scheduling and dispatch of generators contributes to the distribution companies’ economic strain at the wholesale level. By addressing inefficiencies in day-ahead dispatch, MBED can lessen system costs and reduce renewable curtailment risk, making further renewable investment more attractive.

MBED will ensure that the cheapest generating resources across the country are dispatched to meet the overall system demand and will thus be a win-win for both the distribution companies and the generators.

Indian Ministry of Power, June 2021

The project spotlight

The Indian power sector has evolved rapidly over the past few decades. The country has electrified every village and transformed from a power-deficit to a power-surplus nation, led by remarkable growth in renewable energy deployment. Moreover, continued rapid economic growth is anticipated to maintain a high rate of electricity demand growth over the coming decade. Demand growth, coupled with India’s declared target of meeting 50 percent of its power generation capacity from non-fossil fuel-based sources by 2030, will necessitate a paradigm shift in India’s electricity market.

India’s distribution sector continues to face many challenges, including financial distress and large cumulative debt. A fiscally healthy distribution sector is necessary to ensure robust growth of the renewable sector and meet projected electricity demand growth. Suboptimal scheduling and dispatch of generators contributes to the distribution companies’ economic strain at the wholesale level. To resolve this issue, India’s Ministry of Power (MOP) has proposed a market-based economic dispatch (MBED) mechanism to optimize the day-ahead scheduling of power generators.

The full RMI report on this topic, Transforming India’s Electricity Markets, can be accessed here.

Insights

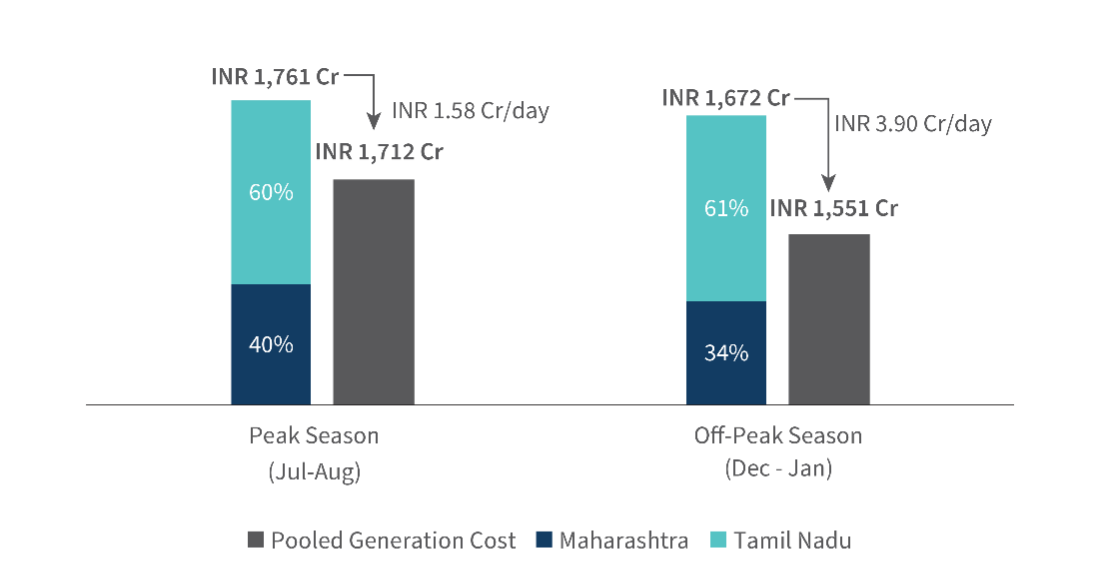

- The efficient dispatch of a pooled generator proposed through MBED can result in potential cost savings of ₹1.5–4 crore (US$182,800–609,600) per day;

- MBED can minimize the risk of renewable curtailment by expanding the geographic area of dispatch;

- By broadening the scope of coordination from state level to national, balancing reserves can be shared across regions reducing the overall volume of balancing reserves required to meet system demands;

- Essential system enhancements may be required to ensure successful implementation of MBED. These may include energy management systems for scheduling, resource commitment, and dispatch, and monitoring and surveillance systems to ensure a fair, competitive market;

- Fostering mature complementary markets for services such as ancillary services and capacity can help maximize the benefits of MBED.

Existing Scheduling and Dispatch Challenges in India

India’s distribution sector continues to face many challenges. Distribution companies (discoms) are financially distressed and collectively owed more than ₹1 lakh crore (US$12.2 billion) in debt in June 2021, resulting in delayed payments to generators, inadequate investment in grid infrastructure, and insufficient resources for effective operations. These debts contribute to the financial risk faced by renewable generators. A fiscally healthy distribution sector and robust renewable growth are vital for India to meet its rising electricity demand and Nationally Determined Contribution (NDC) targets.

Suboptimal scheduling and dispatch of generators at the wholesale level is contributing to the financial strain faced by discoms. Currently, discoms self-schedule generation at the state/regional level and lack visibility beyond their generation portfolio, resulting in overreliance on inflexible long-term contracts and dispatch of generators with high variable operating costs. Inter-regional trade is hindered by lack of visibility across discom portfolios, which is exacerbated by a lack of consistent and transparent data and results in a system that lacks geographic and seasonal flexibility.

In addition to late payments from discoms, renewable generators in India also face financial risk due to curtailment. Two conditions cause curtailment: insufficient grid availability and when transmission network capacity is not enough to transfer the power generated to consumers. The scale-up of variable renewable generation and its geographic concentration has compelled grid managers to resort to sporadic curtailments. While renewable generators in India have a “must-run” status, and curtailment must be limited to reasons related to grid security or else the curtailed generators may be entitled to compensation, increased curtailment rates still pose a risk for renewable generators’ financial health.

Market-Based Economic Dispatch

Under the MBED proposal, discoms and generators will submit bids to a market operator to create a national merit order bid stack and a day-ahead dispatch schedule. Establishing optimization of scheduling and dispatch on a pan-India basis will have multiple benefits, including reducing renewable energy curtailment events, broadening the scope of balancing, and ultimately, realizing system cost savings.

States with a high concentration of renewable energy generators witness curtailment of electricity, especially during the monsoon season. For example, in 2021 Andhra Pradesh reported approximately 1,350 instances of wind or solar generators being curtailed and over a third of these curtailment events occurred during the monsoon heavy month of July. Andhra Pradesh aims to accommodate 120 gigawatts of renewable energy projects; however, frequent occurrences of curtailment caused by system limitations pose a financial risk that could impact future investments in the sector. MBED can minimize the risk of renewable curtailment by expanding the geographic area of dispatch from the state level to national.

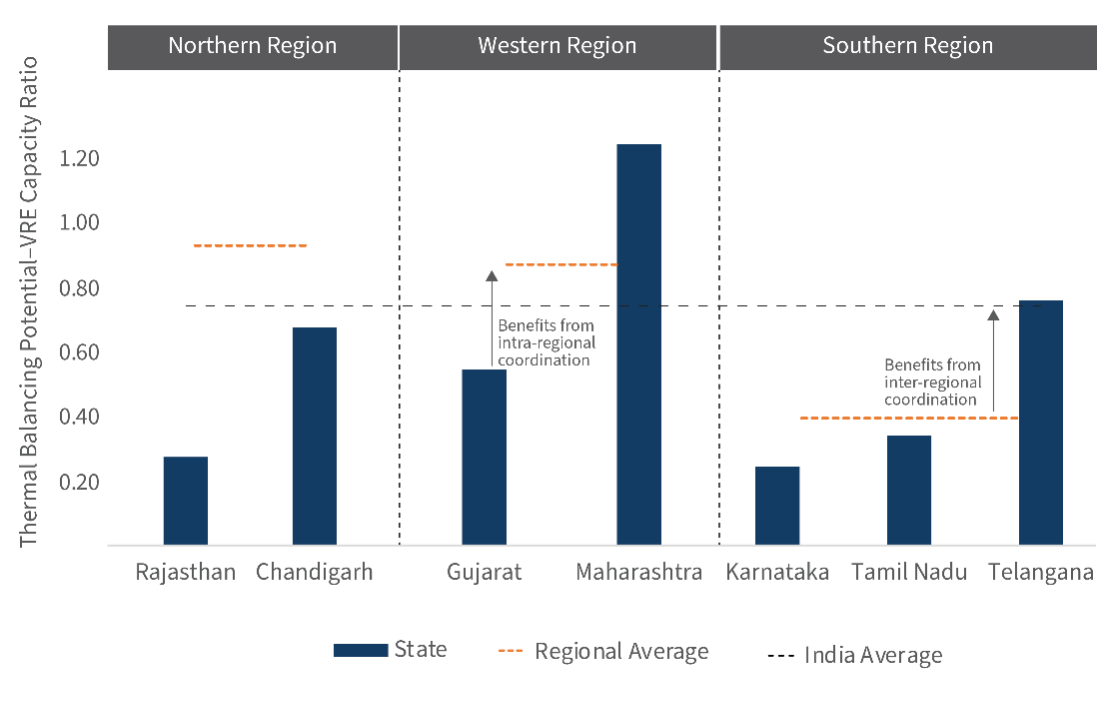

The power grid must be kept within specific frequency parameters to maintain balance. Through MBED, the scope of the balancing area can be broadened, which can address challenges in States with growing concentration of renewable energy generation. The regional and national balancing potential is significantly higher than most of the individual state’s balancing potential. By broadening the scope of coordination from state level to national, balancing reserves can be shared across regions reducing the overall volume of balancing reserves required to meet system demands. Renewable energy-rich states such as Karnataka and Tamil Nadu will benefit from having access to balancing resources beyond their state borders and potentially lower the discoms’ investments in necessary reserve capacities.

Exhibit 2: Thermal Balancing Potential at State and Regional Level

Centralized scheduling and dispatch under MBED can have additional benefits for system operations. By reallocating from the highest to the lowest cost generation on a pan-India basis, MBED may lower the average cost of supply of plants. Based on RMI’s analysis, the efficient dispatch of a pooled generator proposed through MBED can result in potential cost savings of ₹1.5–4 crore (US$182,800–609,600) per day. These savings are impacted by technical and operational constraints and will vary across states.

Exhibit 3: Assessment of Variable Cost Savings During Peak and Off-Peak Seasons for Maharashtra and Tamil Nadu

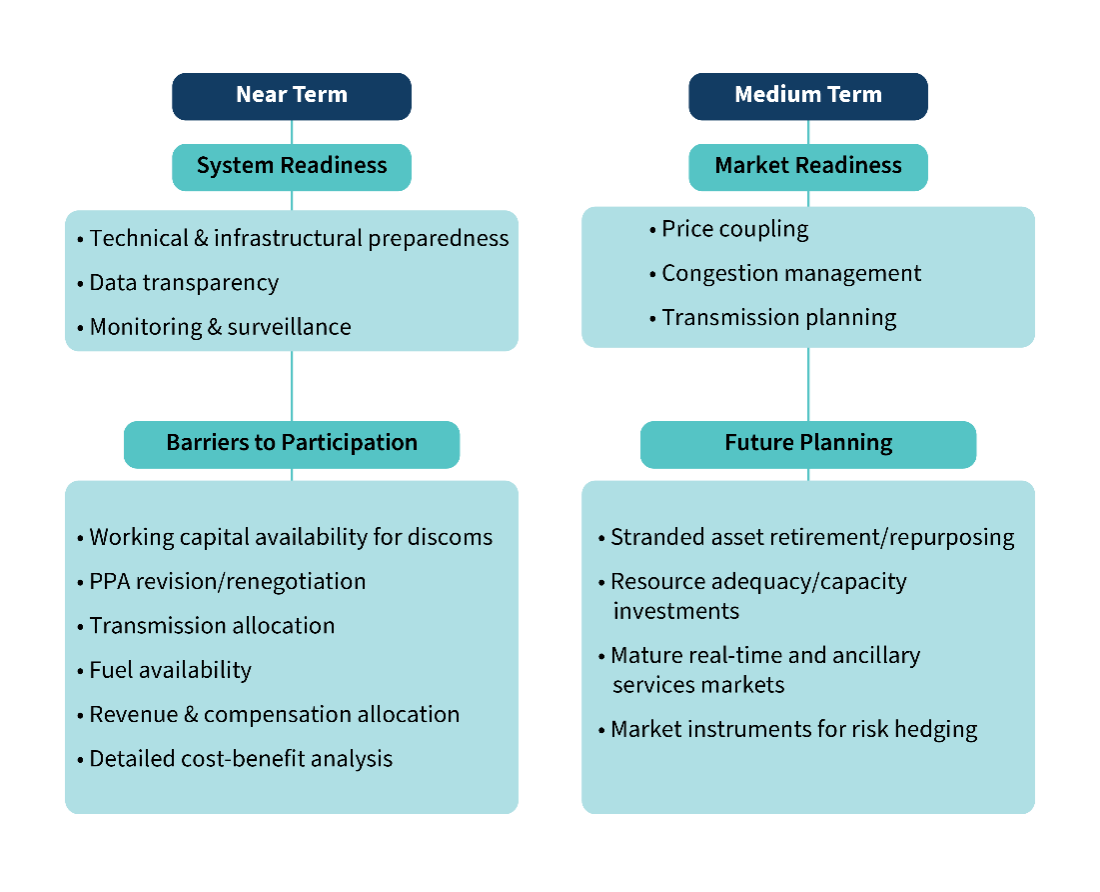

The Pathway Forward

The savings projected from MBED are consistent with the findings of the security-constrained economic dispatch (SCED) pilot conducted by Grid-India since 2019, which aimed to optimize scheduling and dispatch of participating thermal interstate generation stations. As of February 2022, 49 plants were participating, and the pilot successfully demonstrated savings of close to ₹2 crore (US$243,800) per day. The success of the pilot has resulted in the MOP expanding SCED to regional thermal plants, including implementing day-ahead scheduling. SCED can potentially evolve into MBED as it promises the creation of an integrated wholesale market where generators and discoms across India can participate.

The successful transition to MBED requires carefully addressing stakeholder interests and system enhancements. A smooth transition warrants aligning diverse stakeholder interests by taking into account concerns about stranded assets and impact on existing contracts and financial settlements. Essential system enhancements may need the MOP to assess system preparedness to implement a centralised dispatch. For example, the absence of consistent and transparent data hinders the discovery of the actual system marginal cost.

Exhibit 4: Challenges and Barriers to implementation Highlighted in Stakeholder Consultation Process

MBED is in its early days. As we track the progress of this example of market restructuring, we will look for the following priority action steps from India’s Ministry of Power:

- Proposing a robust transition plan outlining the structure and responsibilities of the market operator, pathway for assessing and meeting technological readiness needs, and process for the financial transition for discoms;

- Establishing a public data portal to assess wholesale market operations;

- Updating the transmission planning process to reflect shifts in generation resulting from optimizing dispatch pan-India and minimising the risk of increased costs associated with congestion and market splitting events; and,

- Developing a roadmap for complementary wholesale markets to maximise the benefit of the MBED mechanism and ensure adequate reserve margins at the state level.

Conclusion

MBED is a step towards creating a system that operates efficiently with an integrated pan-India approach for generators. Building off two decades of evolution, India needs to ensure that the right electricity market operational structure is in place to develop a reliable, flexible, and cost-effective power sector. Markets well suited to integration of variable renewable generation will be key for making India a global leader in this innovative sector and maximizing the economic and environmental benefits.

Driving Decarbonization and Energy Access in the Sahel through a Regional Market

This spotlight primarily advances the priority outcomes highlighted below. These outcomes are further described in the complementary Points of Progress and Market Structures reports.

Exhibit 1: Priority Outcomes for Global Energy Transformation

This Desert to Power project is timely in this post-COVID-19 era, which clearly highlighted the importance of reliable energy services…. It is an important milestone in addressing renewable energy investment gaps in the region and will reduce the adverse effects of climate change and [diversify] the energy mix, leading to energy security.

— Dr. Workneh Gebeyehu, Intergovernmental Authority on Development (Utilities Middle East, April 2022)

In 2018, the African Development Bank (AfDB) initiated the Desert to Power (DtP) Initiative to deliver clean electricity to 250 million people through grid extensions and off-grid solutions. The initiative also aims to add up to 10 GW of solar generation capacity by 2030. The project’s impact will reach 11 countries across the Sahel region in Africa: Burkina Faso, Chad, Djibouti, Eritrea, Ethiopia, Mali, Mauritania, Niger, Nigeria, Senegal, and Sudan. The initiative will leverage a combination of public and private interventions and will provide the foundation for a regional electricity market, where power can be traded across borders to expand energy access and improve resource utilization. The regional market will also help reduce the risk of investment in the region’s electricity infrastructure, both for generation and transmission. Specifically, the project aims to:

- Build a pipeline of regional solar projects, both grid-connected and decentralized off-grid solutions, as well as cross-border transmission projects

- Strengthen the capacity of utilities to integrate solar energy in power systems

- Streamline and harmonize off-grid regional policy, planning, and regulatory frameworks and capacity-building initiatives led by regional bodies

- Regional power markets can yield economies of scale for infrastructure and generation costs, which are particularly important in regions that struggle to afford adequate transmission, distribution, and generating capacity. Regional markets also can help increase grid flexibility and smooth variability of renewables, both of which are essential for grid decarbonization.

- In addition to funding physical assets, financing can be helpful in supporting capacity building and creating an enabling environment for private investment. These two types of projects make up almost 30 percent of the DtP’s initial phase of projects.

- The DtP Initiative identified transmission infrastructure as a critical enabler to developing a regional market and placed a specific focus on deploying transmission in tandem with expanding solar capacity.

Context on the Sahel Region

The DtP Initiative focuses on the Sahel region of Africa, which is just south of the Sahara Desert and stretches from the west coast on the Atlantic to the eastern coast at the Red Sea. The region has a very hot and dry climate, which creates challenging living conditions and limits agricultural production, both of which will likely worsen due to climate change.

Many of these countries have limited access to electricity and expect demand growth in the coming years, which could result in an annual demand increase of 10 percent in some countries. For example, only 11 percent of the population in Chad has access to electricity. Rapid urbanization throughout the region is also creating electricity demand centers. For example, Ouagadougou, the capital of Burkina Faso, has more than doubled in size since 2000. However, the installed generation capacity is insufficient to meet this expected load growth, severely limiting socioeconomic opportunities.

Generation in the region is primarily provided by small oil-based power plants, which make up 75 percent of total generation. Hydropower plants supply the vast majority of current renewable generation, with very little penetration of wind or solar. However, the region has high levels of solar irradiation, with some locations seeing upward of nine hours of peak sunlight. This solar resource potential, among the highest in the world, is largely untapped. The region’s underdeveloped transmission infrastructure compounds issues by making it difficult to expand electricity access and install new renewable generation.

Moreover, significant political instability and rising insecurity within the region has resulted in a number of violent conflicts. This inhibits the Sahel countries in developing and providing services, including electricity, and increases the risks for project development.

These issues heighten the barriers to creating robust and sustainable markets, but there remains vast untapped potential and a significant opportunity to sustainably develop an area that has not been a significant contributor to climate change but will likely suffer some of the worst effects.

Pilot Phase Focused on the G5 Sahel Region

The initial phase of the DtP Initiative primarily focuses on the G5 Sahel region (Burkina Faso, Chad, Mali, Mauritania, and Niger). This phase is expected to deploy over 3,000 MW of solar power and provide electricity access to almost 20 million people by 2030. A joint DtP Implementation Taskforce hosted by the AfDB has developed both national and regional DtP roadmaps to guide these investments, which have informed the G5 Sahel project pipeline. The G5 Sahel countries have validated the roadmaps, including the 85 priority projects identified.

Beyond investing in solar, grid infrastructure, and decentralized solutions, the G5 Sahel priority projects aim to create an enabling environment and reform the participating utilities, both of which are critical to ensuring project success. These projects are focused on enabling private-sector participation in power wheeling arrangements and in a regional solar market, implementing knowledge and learning initiatives, creating enabling policy frameworks, and facilitating the move away from the current model of nationally–owned, vertically integrated utilities.

The DtP Initiative has also set up an innovative financing facility to help create a private-sector-friendly investment environment and de-risk individual projects. The US$967 million financing facility is structured to support three project components: (1) grid investments to enable additional solar generation; (2) independent power producer solar generation; and (3) technical assistance. Funding will come from the African Development Fund, the AfDB, and the Green Climate Fund. The financing facility is also expected to mobilize cofinancing from other third-party development finance institutions, commercial banks, and private investors.

Another part of the DtP Initiative, the West Africa Regional Energy Program – Phase 1 (WAREP 1) project, aims to finance the Western African Power Pool’s prefeasibility studies to accelerate regional-scale development of on-grid solar, off-grid solar, and transmission interconnection across the Sahel, as well as improving regional trade. The Western African Power Pool (WAPP), an institution within the Economic Community of West African States (ECOWAS), was created to support regional power system integration and the development of a regional electricity market. WAPP comprises public and private generation, transmission, and distribution companies involved in the operation of electricity systems in West Africa.

Conclusion

Regional markets can provide unique value to the Sahel and other regions that are confronting expected demand growth, supply and infrastructure constraints, and significant renewable potential. By providing least-cost, reliable electricity, while also prioritizing equitable electricity access, the DtP initiative is expected to deliver:

- A significant increase in electricity access across the Sahel region through expanded solar power penetration

- Fit-for-purpose transmission infrastructure

- Increased economic development

- Resilience to climate impacts

- Stronger regional ties through the shared benefits of a regional power market

- Significantly improved energy security

Great Britain’s Forward-Thinking Ancillary Markets

This spotlight primarily advances the priority outcomes highlighted below. These outcomes are further described in the complementary Points of Progress and Market Structures reports.

Exhibit 1: Priority Outcomes for Global Energy Transformation

The growth in renewable sources of power, with record levels of wind and solar, means there will be enough zero-carbon generation to meet demand. A key challenge is ensuring the electricity system is ready to accommodate that power. Our engineers are deploying innovative, world-first approaches to transform how the power system operates, such as removing the need to draw on fossil fuel–based generation for critical stabilizing properties.

—Fintan Slye, Executive Director (National Grid ESO, June 2021)

The National Grid Electricity System Operator (ESO), which operates Great Britain’s electricity system, has developed a strategy for designing a grid that can operate with 100 percent zero-carbon electricity by 2025, with the aim of operating a fully decarbonized grid by 2035. Although grid decarbonization and market modernization have been under way for years, National Grid ESO’s Markets Roadmaps, published in recent years, provide clarity and transparency on the grid operator’s market reform plans.

Providing adequate ancillary services, which are required to maintain grid stability, reliability, and resilience, is a critical part of operating a zero-carbon grid. National Grid ESO has made systematic reforms to the ancillary services that will be required and has developed special markets to provide them, which has entailed defining service needs, establishing procurement processes, and implementing procedures for operations and performance monitoring. In undertaking this process, National Grid ESO has regularly engaged with market participants and Britain’s energy regulator in forums, workshops, and consultations to ensure new ancillary service markets meet their intended objectives.

Insights

- Ancillary services are critical to ensuring grid stability and reliability, particularly with increased levels of variable renewable energy and dynamic loads from electrification. Understanding how different resources can deliver these services and creating processes to ensure they are procured at least cost is crucial to supporting an affordable energy transition.

- Ancillary markets can be designed to leverage the capabilities of new carbon-free technologies. For example, National Grid ESO changed Britain’s grid code in 2022 to allow renewable technologies to provide inertia and frequency support.

- National Grid ESO’s forward-thinking approach to the design of ancillary service markets has been inclusive and iterative, creating opportunities for a variety of market participants to think expansively on how to best utilize resources on both transmission and distribution networks. This collaborative approach has yielded sustainable market-based strategies to address long-standing and emerging grid challenges.

Why Do Ancillary Services Matter?

As grids around the world decarbonize, and as they become more vulnerable to climate impacts, they increasingly require sufficient ancillary services to maintain grid stability and reliability. More variable generation and less synchronous generation on the grid, as well as changing demand patterns from technologies such as electric vehicles and grid-connected appliances, will require electricity system operators to explore how a wider range of resources can provide these critical services.

Great Britain’s Ancillary Markets

Ancillary services generally fall into six categories: frequency response, reserve, thermal, voltage, stability, and restoration. Exhibit 2 shows National Grid ESO’s ancillary operational requirements and associated markets for each of these categories.

Frequency

Electricity systems have a prescribed frequency, which is the rate of oscillations per second of alternating current (AC) . It is important to keep frequency as close to the prescribed level as possible: if frequency is too high, it can damage electrical equipment, and if it is too low, it could lead to blackouts. System operators need to manage frequency on a second-by-second basis due to constant fluctuations of supply and demand.

Frequency Response

National Grid ESO has unbundled the market procurement of frequency response services from its energy market. The grid operator has also updated procurement rules to facilitate greater participation in the market, including reducing the minimum unit size and increasing the granularity of settlement windows. Additionally, National Grid ESO expects that procurement of complementary products over different timescales will deliver the most efficient outcomes for frequency, with an aim of developing dynamic frequency products as close to real time as possible. National Grid ESO procures frequency services through auctions and tenders, with price caps for some products.

National Grid ESO launched a new frequency response product suite in 2021. The products are broadly split into pre-fault (continuous regulation of frequency) and post-fault services (containment of frequency after large events or faults). Notably, a valuable attribute of post-fault services is the fast reaction time required of resources, which has resulted in a significant reliance on battery storage.

Reserve

Reserve products are required to ensure adequate system flexibility and to increase or decrease energy within a specified timescale. National Grid ESO is designing two new reserve products, Quick Reserve and Slow Reserve, with the primary objective of creating competitive markets that are standardized with shorter provision periods (sub-daily) to enable greater participation of carbon-free technologies. Legacy reserve products were typically provided by thermal generators.

Thermal

There is a physical limit to the amount of power that can be transmitted through any piece of equipment on a grid. Often that limit is set to ensure that equipment does not become overloaded and overheat. This can create thermal constraints on transmission when the amount of power exceeds these physical limitations due to flows across the network. This becomes more apparent in congested transmission networks, particularly where large volumes of wind and solar generation are located far from electricity demand centers.

In Great Britain, National Grid ESO is managing these constraints through the Balancing Mechanism or via trades using an auction mechanism. However, National Grid ESO is developing a coordinated approach and fostering increased competition to manage rising thermal costs. For example, National Grid ESO is planning to implement competitive local constraint markets utilizing distributed energy resources (DERs) and Regional Development Programs to unlock additional network capacity and open new revenue streams for market participants. National Grid ESO is also investigating the technical feasibility of energy storage at the most constrained areas of the grid to reduce costs.

Voltage

The maintenance of planned voltage levels at various locations on the grid is typically provided by the injection or absorption of reactive power where required. Maintaining voltage levels is important for reliability because voltage fluctuations outside of tolerance limits can result in outages or damage to equipment.

National Grid ESO is trying to determine the most efficient way to provide reactive power services in parallel with introducing more competition to lower costs. Reactive power is highly locational and cannot be provided over long distances, so National Grid ESO is opening access to more providers and clearly signaling locations where the service is required. This service is currently provided by a mix of obligations through National Grid ESO’s Grid Code and Voltage Pathfinders. The Voltage Pathfinders take a market-based approach to voltage procurement, enabling competition between network owners and commercial entities. National Grid ESO procures these services via pay-as-bid tenders, with the contracted start date usually coming a few years after the tender, which allows time for participants to build and commission new assets.

Stability

Stability services usually take the form of inertial services, which helps to keep the electricity system running at the right frequency. The kinetic energy in the spinning parts of large thermal generators have traditionally provided inertia.

Under National Grid ESO’s new approach, market participants can provide inertia without having to provide electricity — allowing more renewable generation to operate and ensuring system stability at lower costs. National Grid ESO procures these services through a mix of National Grid ESO’s Balancing Mechanism and dedicated Stability Pathfinders. The Pathfinder approach is a premarket competitive process in which commercial enterprises and network owners competitively bid to develop a solution to a network problem identified by the system operator. The Stability Pathfinders will allow carbon-free technologies to participate and will likely allow grid-forming inverters in the future. National Grid ESO procures availability for the Pathfinders a few years ahead of the delivery date via pay-as-bid tenders. There is currently no short-term stability market, but the Stability Market Design innovation project is investigating its viability, potentially through a day-ahead market.

Restoration

After a significant loss of power, restoration services ensure that the grid can get back up and running as quickly as possible.

Restoration usually takes the form of Black Start services, which National Grid ESO procures through a combination of legacy bilateral agreements and, more recently, Electricity System Restoration tenders. The tenders are pay-as-bid based on availability payments and are submitted two years ahead of delivery. The most recent tenders included submissions from batteries and wind projects for the first time. Notably, National Grid ESO is undertaking a project called Distributed ReStart, which coordinates DERs to re-energize the system, instead of relying on a large single generator.

We have one of the world’s most reliable electricity networks, but our role is to be prepared for the most extraordinary of scenarios, including a nationwide power outage. This trial is a breakthrough moment for our Distributed ReStart project, which stands to improve system resilience and security of supply in a cleaner and cheaper way. We are always innovating for a greener future, and the huge growth of green energy sources on distribution networks presents an opportunity to reduce our reliance on fossil fuels and coordinate a system restoration process using renewables. The concept of meeting our grid restoration needs by renewable generation alone has become closer to reality as a result of this trial.

—Julian Leslie, Head of Markets (National Grid ESO, May 2022)

Notably, National Grid ESO has designed some of these services to be stackable, so that one asset can participate in multiple ancillary markets at the same time. This portfolio of ancillary market reforms will improve clarity and transparency of services required by National Grid ESO to ensure a reliable and resilient grid. Importantly, these reforms are also producing the market mechanisms necessary to adequately value and compensate for the capabilities of these services, with an eye to a future grid with increased levels of carbon-free technologies and products designed to enable and incentivize their participation.

Conclusion

Great Britain’s electricity system has transformed over the past decade with a significant increase in wind and solar. This increase in variable renewable energy has required new procurement approaches for securing critical grid services to ensure system stability and reliability. National Grid ESO’s innovative strategy in developing ancillary markets provides a valuable model to other countries facing high renewable penetration in the coming years. This example is especially valuable in demonstrating how to clearly define which services are needed to ensure reliability in a decarbonized grid and how to pursue market-based solutions that ensure services are provided at least cost to consumers.

Enabling DER Market Access in Australia

This spotlight primarily advances the priority outcomes highlighted below. These outcomes are further described in the complementary Points of Progress and Market Structures reports.

Exhibit 1: Priority Outcomes for Global Energy Transformation

Project EDGE aims to build understanding of and inform the most efficient and sustainable way to integrate DER into the electricity system and markets, allowing all consumers to benefit from a future with high levels of DER.

—Violette Mouchaileh, AEMO chief markets officer (PV Magazine, September 2011)

Australia leads the world in the deployment of distributed energy resources (DERs), with nearly one in four homes nationwide featuring rooftop solar, and as many as 40 percent in the states of South Australia and Queensland. Given these high penetration rates, consumer-owned DERs will play a pivotal role in system operations going forward. While this has created challenges for Australia’s Energy Market Operator (AEMO) and Distribution Network Service Providers (DNSPs) in balancing the grid, it also opens up a new opportunity for consumers to create value through supporting Australia’s energy transition with their DERs.

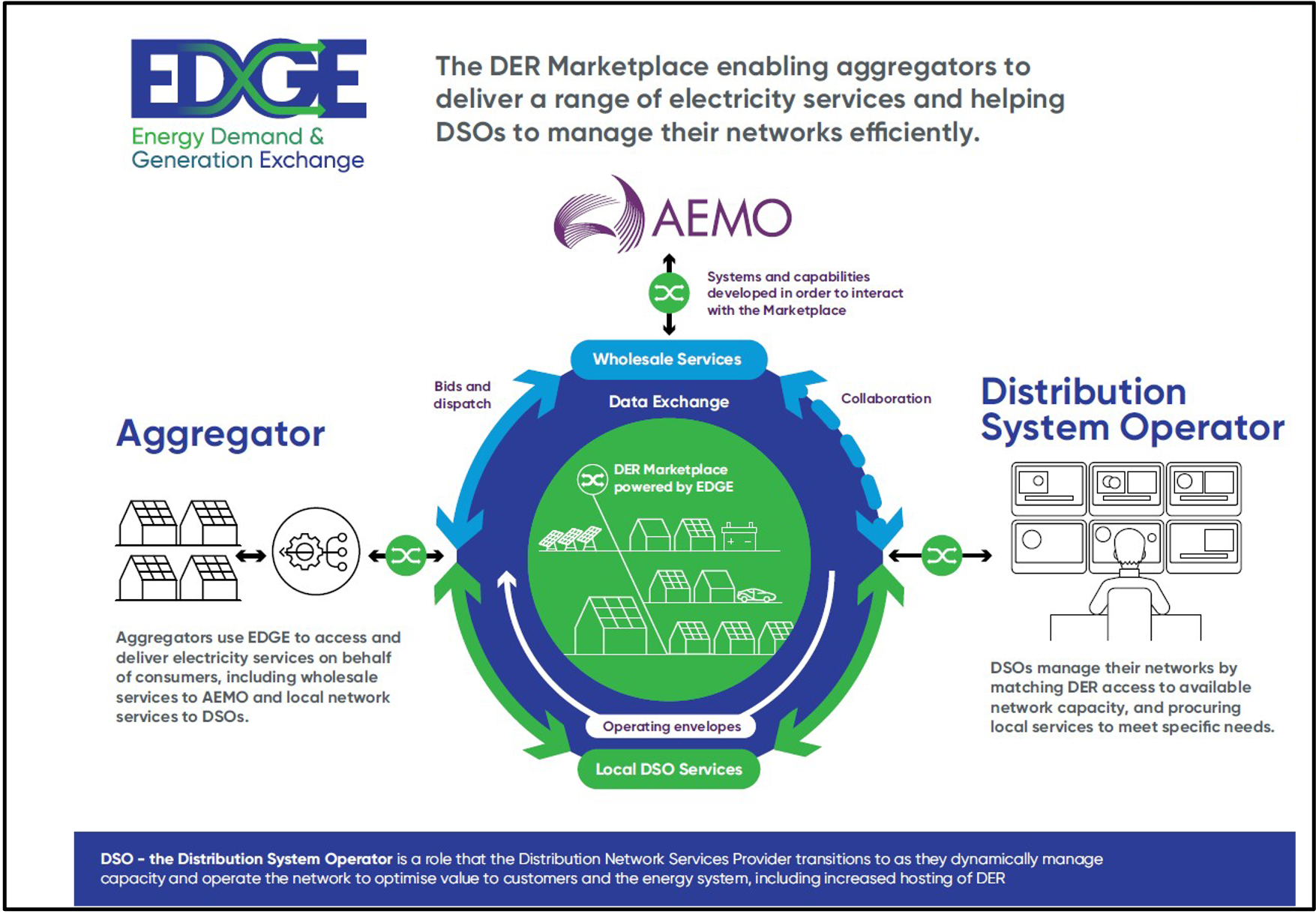

To leverage this opportunity, Project Energy Demand & Generation Exchange (Project EDGE) is demonstrating in the Hume region of Victoria, Australia, how a DER marketplace can enable the trade of both wholesale and local market services. The effort, which started in the fourth quarter of 2020, incorporates many functions required to effectively utilize aggregated DERs for system operations, including communication protocols from DNSPs to aggregators, wholesale market interactions, and the data exchange required to facilitate various transactions.

Insights

- Scalability and customer experience are two core aims embedded throughout Project EDGE. To unlock the full value of DERs, it will be critical to consider customer motivations and preferences in program design and operations.

- Project EDGE is testing an approach to a “two-sided marketplace,” where all types of users can actively buy and sell energy. Trust, transparency, and coordination will be paramount in ensuring ease of data sharing and transactions.

- Results and evidence from the project are informing and supporting wider market reforms in Australia. One key reform package focuses on integration of DERs and flexible demand under Australia’s NEM 25.

Project Participants and Objectives

The AEMO is implementing Project EDGE along with AusNet Services, a large DNSP, and several DER aggregators. Other partners in the project include Microsoft for cloud services, PXiSE for market logic software, and Energy Web for a public, open-source operating system that connects market participants and assets. The Energy Web Decentralized Operating System (EW-DSO) establishes digital identities for all assets and market participants and facilitates secure, efficient exchange and validation of DER data.

The objectives of Project EDGE are to:

- Demonstrate how DER fleets could participate in existing and future wholesale energy markets at scale

- Demonstrate different ways to consider distribution network limits in the wholesale dispatch process

- Demonstrate how to facilitate standardized, scalable, and competitive trade of local network services

- Demonstrate how data should be exchanged efficiently and securely between interested parties to support delivery of distributed energy services

- Develop a proof-of-concept integrated software platform to facilitate delivery of objectives 1–4 in an efficient and scalable way

- Develop a detailed understanding of roles and responsibilities for each industry actor

- Conduct comprehensive cost-benefit analysis to provide an evidence base for future regulatory decision-making

- Conduct a customer-focused social science study to understand customer opinions on the complexities of DER integration

- Deliver best practice stakeholder engagement throughout the project with a commitment to knowledge sharing

- Deliver recommendations, supported with evidence, on how and when the concepts demonstrated should be implemented operationally

The intent of Project EDGE is to demonstrate DER capabilities that can be replicated across other areas of the Australian National Electricity Market (NEM). The project commenced field trials in May 2022 and how has multiple aggregators participating in the DER Marketplace with their own systems and customers.

As part of the project, an aggregator engages a customer with a DER system to deliver electricity services within the DER marketplace in exchange for monetary compensation. The AEMO and the DNSP determine the services required in the market, which could include capex deferral and peak demand reduction.

Exhibit 2: Project EDGE’s DER Marketplace

Source: Nambiar et al., Project EDGE (Energy Demand & Generation Exchange)Project EDGE is testing three core functions, all centered around customer experience and participation: the integration of DERs into the wholesale market, data exchange, and local services exchange.

Thus far, the project has found that building trust at a community level is key for recruiting prospective customers and requires education on both financial and nonfinancial benefits of DERs.

Preliminary findings within the data exchange function indicate that achieving efficiency at scale requires an agreed-upon communication standard for dynamic operating envelopes (DOE) . Further consideration of DER service definitions, network connections, and value measurement will be key for both wholesale integration of DERs and utilizing DERs for local services.

Challenges

An overarching challenge identified within the project is how compliance will be enforced. One of the options being considered by pilot participants is constraining wholesale market bids to the level of volume available, based on real-time validation of aggregated dynamic operating envelopes (DOE) within the DER aggregator’s portfolio. Other compliance incentives are also under consideration. One of the options being considered by pilot participants is constraining wholesale market bids to the level of volume available, which would be based on real-time validation of aggregated DOEs within the DER aggregator’s portfolio.

Another challenge within the wholesale integration function is determining the level at which DOEs are located, whether at an asset level or at the connection point to the network (multiple assets of different types can be located behind one connection point.) Participating DNSPs and DER aggregators have varying perspectives on this technical question and are actively seeking out a long-term solution, as is the wider industry.

Consumers are already participating in the electricity market through their use of things like solar panels, electric vehicles, and smart devices — but this information is largely hidden, making it very hard for AEMO and other market participants to know whether supply will meet demand. A two-sided market will change all that because consumers and those who participate in the wholesale market on their behalf will be active in responding to price … Because this behavior will be transparent and in real time, the information itself becomes a tool to keep the power system operating securely and reliably and can fill gaps when the sun isn’t shining and the wind isn’t blowing.

—Dr. Kerry Schott, Energy Security Board chair (AEMC, April 2020)

Conclusion

As the world leader in the installation of rooftop solar, Australia continues to explore innovative applications for DERs. Given the high levels of expected DER penetration, DERs will likely play a large role in the provision of wholesale and local grid services. Project EDGE is navigating the challenge of how to co-optimize wholesale and local services from DERs, identifying the actor best suited to this role and determining which services are prioritized.

Robust stakeholder engagement, including case studies trialed throughout, has shaped project implementation at every stage. AEMO and its partners have also regularly shared their experiences by publishing lessons learned and sharing data. Project EDGE will generate important insights on how to effectively integrate DERs at scale into the modern electricity grid.

Enhanced Wholesale Market Design in the Philippines

This spotlight primarily advances the priority outcomes highlighted below. These outcomes are further described in the complementary Points of Progress and Market Structures reports.

Exhibit 1: Priority Outcomes for Global Energy Transformation

Having improved market projections will allow (participants) to make better decisions in their commitments in terms of generation … and requirements.

—Edward I. Olmedo, IEMOP manager of operations planning and modeling (BusinessWorld Online, July 2021)

The Philippines power generation market has evolved over the past 20 years into a competitive market, with most assets privately owned and operated. Transactions are largely based on economic dispatch through the Wholesale Electricity Spot Market (WESM), operated by the Independent Electricity Market Operator of the Philippines (IEMOP).

IEMOP implemented the Enhanced WESM Design and Operations (EWDO) effort in 2021 to move the Philippines’ WESM to a real-time market by shortening dispatch intervals, with the intention of improving forecast accuracy and enabling more strategic power trading decisions. Previously, gate closure (the time at which electricity trading is no longer allowed) was determined in one-hour increments, which effectively meant that trading was halted up to two hours ahead of delivery. Gate closure is typically designed to provide time for the system operators to ensure that generation schedules and demand forecasts are aligned, and to allow generators time to finalize outputs based on contracted volumes of electricity. Given that there are many intra-hour deviations in both supply availability and demand, shortening the dispatch interval can make grid operations more efficient and send more accurate price signals to market participants.

The EWDO initiative also aimed to incentivize greater transparency, and renewable development, given that operating markets closer to real time increases system flexibility and reduces reserve requirements.

Insights

- The EWDO’s transition from one-hour to five-minute settlement has led to a noticeable increase in forecasting and pricing accuracy, resource efficiency, and market competition.

- Removal of minimum load constraints from generation has been shown to reduce the technical and economic challenges to increasing renewable penetration.

- Clear objectives, early engagement and collaboration with market participants, and transparent standards for operational readiness significantly contributed to EWDO’s success.

Context on the Philippines Power Market

The Philippines power market is made up of three grids (Luzon, Visayas, Mindanao) that are interconnected through a subsea cable. Privatization of the country’s electricity industry has made the Philippines one of only two countries (along with Singapore) in Southeast Asia with a liquid spot market. Increased competition and more efficient use of resources have led to a general decrease in wholesale prices over the past decade. While coal still has the biggest share of the country’s generation mix, mandated renewable portfolio standards, as well as the creation of the spot market, have increased development of renewable resources in the country. Renewable generation capacity in the Philippines increased by 600MW between 2020 and 2021, driven primarily by solar and biomass additions — the first time that the net increase in renewable capacity exceeded that of nonrenewables.

Enhanced WESM Design and Operations (EWDO) Reforms

Despite the successes of IEMOP’s previous one-hour spot market, a market operations audit found a lack of compliance by some participants and consistent issues with dispatch forecasting accuracy. Improved forecasting allows market participants to better plan dispatch and can lead to lower system balancing costs. A shorter forecasting horizon also can incentivize faster ramping capabilities, where flexible assets, such as batteries, can leverage rapidly changing prices.

In sum, the key changes implemented through the EWDO were:

- Shortening of dispatch intervals from one hour to five minutes, which applies to scheduling, pricing, dispatch, and settlement

- Exclusive adoption of ex ante pricing (pricing used from just before delivery due to shortened intervals)

- Economic scheduling of minimum stable loading, removing the automatic commitment of generators (most relevant to self-commitment of fossil fuel plants)

- Automatic pricing reruns, meaning fast publication of settlement-ready prices

- Hour-ahead projections, which provide indicative results for the next hour at five-minute resolution

The impact of five-minute granularity versus the previous hourly granularity can be seen on the chart below. The additional volatility with five-minute pricing is more representative of grid conditions and acts as a clear signal for market participants, incentivizing more efficient allocation of resources across the grid.

IEMOP rolled out the EWDO reforms in stages. In May 2021, the five-minute dispatch intervals were implemented through limited operations, involving 21 percent of market participants. This approach enabled participants to test their systems before commercial operations.

Enabling a Successful Outcome

Three main factors contributed to a successful outcome for the EWDO project:

Clear Goals and Early Engagement

Once IEMOP developed clear goals for what it wanted to achieve, the market operator hired a consultant to conduct a study of market readiness and ensure feasibility of the project. IEMOP rolled out implementation training in 2017 to make participants fully aware of new responsibilities and requirements.

Collaboration

Collaboration was critical to the success of the EWDO. IEMOP engaged market participants and other affected entities in the development of market rules through several working groups. IEMOP also spoke to grid operators in Australia and New Zealand to gain information that helped IEMOP conduct market assessments and better understand generator data from the two countries after similar reforms were implemented in their markets.

Operations Readiness

A significant change to electricity trading requires updating operational practices, such as scheduling and trade execution. In preparation for commercial operations, IEMOP created a market readiness checklist with seven criteria that market participants needed to meet. IEMOP also implemented changes in stages, with relaxed rules and penalties over three months prior to full commercial operations to ensure that all parties were comfortable and adapted to the operational changes under the new market structure.

Conclusion

Following the launch of its five-minute WESM last year, IEMOP has already observed an improvement in demand projections, more accurate and responsive wholesale market prices, fewer inter-hour dispatch deviations, and simpler settlement mechanisms. The market reforms will play a critical role in supporting increased demand and renewable growth in the country, while ensuring reliability and cost efficiency.