Sustainable Aviation Fuel Targeted Opportunity Region – Great Lakes Region

Access the whole Great Lakes Investment Strategy series here.

Introduction

The world is demanding that the aviation sector adopt sustainable aviation fuel (SAF), creating a unique opportunity for the Great Lakes region. Of the many industrial hubs in the United States, the Great Lakes region displays the relevant industrial networks and SAF scaling opportunities that could drive US aviation fuel targets. The region in focus consists of seven states: Illinois, Indiana, Michigan, Minnesota, Ohio, Pennsylvania, and Wisconsin.

Previous learning gleaned from the SAF industry along with a stronger vision of future demand have shown positive signals for the Great Lakes states. The region can handle the entire SAF value chain, which will spur economic growth along with localized environmental benefits. As the SAF value chain scales in the region, these benefits can expand to international markets and compete with global SAF manufacturers.

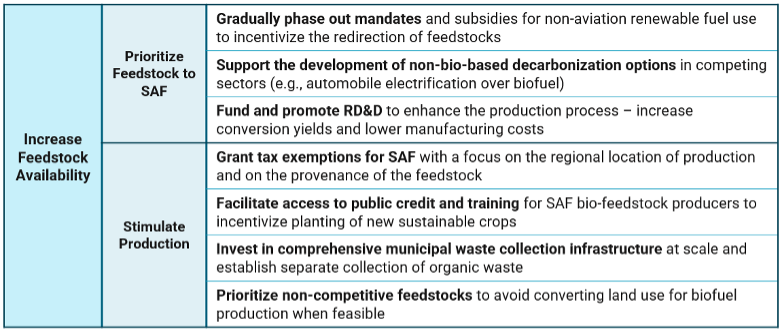

If the Great Lakes is to compete internationally in this rapidly growing sector, it cannot rest on its laurels. Included in this brief is a unique industrial policy gap analysis, which, as shown in Figure 1, finds that no Great Lakes state has a comprehensive or coordinated approach to addressing the demand and supply challenges of nurturing an SAF sector. The federal government, primarily through the recently passed Inflation Reduction Act (IRA) of 2022, is providing leadership in this space that regional actors should be looking to complement and coordinate around.

Figure 1: SAF Policy Gap Analysis in the Great Lakes

This brief provides an introduction to SAFs, trends in the sector, and why the Great Lakes has unique strengths in feedstock availability, infrastructure, transport, and demand that could translate into a globally competitive industry. It also provides an overview of the economic impacts and unpacks some of the key policy levers that could unleash SAF’s potential in the Great Lakes.

SAF 101

What Is Sustainable Aviation Fuel?

Jet fuel, which accounts for the lion’s share of the aviation fuel market, has stringent requirements on composition and performance, making it critical that the fuel is made from new sources and production pathways meet those same standards. SAF is a drop-in replacement for petroleum-based jet fuel. It can be used in existing fuel delivery infrastructure and existing aircraft engines and reduces emissions now while technological leaps for new fuels take time to develop, such as in the cases of hydrogen- or electric-powered aircraft. Blending limits of SAF with conventional jet fuel can range from 5% to 50% depending on the feedstock and production process used.

The International Civil Aviation Organization (ICAO) describes SAF as “a renewable or waste-derived aviation fuel that meets sustainability criteria.”[i] Although the sustainability criteria can be complex and differ between methodologies, the widely accepted core characteristics of SAF include (1) Generating fewer emissions than fossil jet fuel on a life-cycle basis, and 2) In case of biobased SAF, the biomass was not sourced from land with a high carbon stock. In addition to these rules, SAF produced after 2024 will be bound by even more stringent rules on land use, food security, and human rights among others.

Jet fuel can be considered sustainable when it meets the criteria set forth by a standard-issuing body. There are currently two accepted forms of analysis used to account for the life-cycle emissions of SAF: the Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA) and the Greenhouse Gases, Regulated Emissions, and Energy Use in Transport (GREET). The GREET modeling and methods were developed by Argonne National Laboratory[ii] and direct the accounting of biofuel life-cycle emissions across the United States.

SAF, with a lower carbon intensity than fossil jet fuel, can already be produced through several conventional pathways. ASTM International approves nine technologies for creating commercial-scale SAF, with hydroprocessed esters and fatty acids (HEFA) as the most immediately accessible.[iii] Of the nine, HEFA is the only commercially deployed pathway for producing SAF. HEFA can be derived from tallow, crop residues and oils, woody biomass, and even municipal waste. These supply a consistent feedstock to be refined into SAF but are limited and will not be the only solution needed to meet projected future demand.

Fuel produced from the power-to-liquid (PtL) process is called e-SAF, a drop-in synthetic fuel that can significantly lower carbon intensity when it is produced with renewable energy. Tried-and-true PtL processes, like Fischer-Tropsch, are being repurposed to fill the technology gaps present in the SAF industry.

Hydrogen and carbon dioxide (CO2) are key inputs for SAF production in the pathways mentioned. Waste CO2 utilization keeps the aviation fuel within sustainability criteria, while the hydrogen can be produced with near-zero carbon when renewable energy is sourced. More pathways and innovations will likely develop as new industrial hubs improve our understanding of these processes.

Though the outlook for SAF has upward potential, barriers to deployment still exist. Currently, SAF production expenses result in market prices two to four times greater than traditional fossil jet fuel, limiting the potential for market-driven scaling. Long-term demand signals for SAF from airlines are increasing, but this price premium remains a major barrier for scaling up SAF.

Nonetheless, opportunities for stakeholders are emerging as production costs continue to drop. Pioneering retrofits of existing systems and industrial symbiosis that optimizes assets are mitigating the high up-front costs of developing SAF projects. Key feedstocks like hydrogen and renewable energy are decreasing in price, which will lower operating costs and build a more robust supply chain for production.

Shifting from Conventional Jet Fuel to SAF

The benefits of SAF cascade through the value chain and local environment. The most tangible benefit is air quality improvement. SAF contains fewer aromatic components than conventional jet fuel, helping it burn cleaner while reducing life-cycle carbon emissions. We may notice immediate changes as fumes at the airport wane, but the advantages will lift the Great Lakes region through a variety of levers.

The resulting growth of the bioeconomy will allow jobs in certain sectors to transition into similar roles, while opportunities for new advanced jobs will open to the current and future workforce.

Broader uses for agricultural feedstocks create a more dynamic and robust revenue stream for farmers. Growing techniques endorsed by GREET and CORSIA require responsible stewardship of land use, further promoting soil quality benefits and longevity.

Regional by-products and waste streams can be converted into value-generating fuels – a net positive for the economy rather than a burden to be managed.

Trends in Sustainable Aviation Fuel

The SAF market has recently experienced a series of shifts in the form of positive commitments and legislation from major biofuel-producing countries. The United States, European Union, and United Kingdom carved out their own pathways for SAF development, including how to position demand in favor of domestic supply chains.

The EU and UK have mandates in place that are positioned to meet a portion of the SAF demand by 2030. With the adoption of the IRA, the United States also has the incentives for competitive low-carbon SAF through sections 40B and 45Z, hydrogen through 45V, and carbon capture through 45Q. Even with these commitments, more will be required to fulfill the full need for a global SAF market.

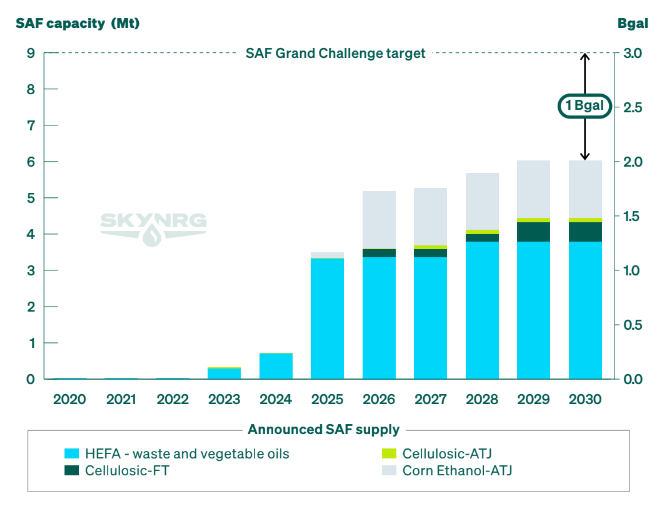

On a global scale, blending mandates and production goals could see the SAF market dealing with 4.5 billion gallons of fuel by 2030, an over 50-fold increase from 2023. However, SAF production today remains well short of these demand projections.[iv]

The US SAF market will have similar upward trends in supply and demand, with the latter expected to exceed production supply. Domestic SAF facilities aim to produce 3 billion gallons of drop-in fuel by 2030, according to the Biden Administration’s Sustainable Aviation Fuel Grand Challenge. Current announced SAF projects are expected to support only 2.2 billion gallons by then. Today’s SAF production levels will need to scale severalfold across all technologies to approach the 27 billion gallons that could be in domestic demand by 2050.[v]

A majority (66%) of announced SAF projects will use HEFA derived from vegetables oils, waste oils, and other fats. Most of the remaining projects (27%) will use alcohol-to-jet (ATJ) processes for SAF. The near-term allocation of biomass feedstocks is therefore integral for SAF to proliferate in the United States.

[i] ICAO. 2005. CORSIA Sustainability Criteria for CORSIA Eligible Fuels. Annex 16 Vol IV –CORSIA.

[ii] Argonne National Laboratory. 2023. GREET® Model. web

[iii] ICAO. 2023. Approved Conversion Processes. ICAO Environment. www.icao.int/environmental-protection/GFAAF/Pages/Conversion-processes

[iv] SkyNRG 2023. Sustainable Aviation Fuel Outlook – May 2023. https://skynrg.com/safmo2023/

[v] ICAO. 2023. ICAO SAF Facilities Dashboard. www.icao.int/environmental-protection/GFAAF/Pages/Production-Facilities

Great Lakes Strengths and Industrial Capabilities

The emerging SAF opportunity could further contribute to the Great Lakes’ potential as a center of innovation and future industry. Its existing network of infrastructure and industry can make the region one of the vital hubs for meeting SAF targets. Its foundations in manufacturing and adjacent industries, agriculture, and technology, along with its high feedstock availability, can transition into a successful bioeconomy network.

Feedstock Availability

SAF can be produced through a variety of technologies using a wide range of feedstocks such as biomass, renewable fuels and electricity, hydrogen, and waste CO2. To be viable for SAF, feedstocks need to be effective in cost, sustainability criteria (including carbon content), and scalability. The Great Lakes has the capacity to compete in a wide range of feedstocks, but it will require sustained and strategic investments in supply chain development to mature those pathways.

Biofuel is produced abundantly in the Great Lakes and Midwest regions, with most of the focus on ethanol produced from corn. The Great Lakes region accounts for over 35% of US ethanol production capacity, and Illinois alone generates over 10%.[vi] This is just a part of the United States’ total production of 15 billion gallons of ethanol, or over 55% of the world’s ethanol.[vii]

The significance of corn and soy as feedstocks has driven the ATJ and HEFA pathways to maturity, leaving less room for advancement. However, these crops’ entrenched supply chains do not negate the food versus fuel dilemma often vocalized by biofuel opponents. Still, new opportunities for biofuel feedstocks continue to emerge as regulation and agricultural science improve knowledge on land management.

Agricultural residues and food waste are considered second-generation feedstocks, which are effective sources because of their lower life-cycle carbon and land-use competition compared with first-generation crops like corn and soy. Biomass feedstocks separated from edible agriculture supply chains are considered third generation and include sources like forest residues and other woody waste. These third-generation feedstocks have high potential for SAF refinement because their soil carbon benefits often attribute a negative carbon intensity.

Renewable natural gas (RNG) is a promising feedstock that can be captured and repurposed for SAF production. RNG is used to produce synthetic gas in the refining process, replacing the role of natural gas but with far less fossil carbon. RNG has a diverse and growing supply chain, sourced from landfills, wastewater treatment facilities, agricultural residues, livestock, and other biomass waste.

The high population density of Great Lakes cities creates a trove of potential RNG. Large population centers generate municipal waste that must be managed effectively. It is common today for landfills to recover methane leakages and abate the gases through either flaring or recovery. As a better alternative to flaring, recovered landfill gas can be processed into RNG and sold. The region currently boasts a high capacity of landfill gas recovery because over 95% of annual landfill waste is sent to a facility equipped for gas recovery. Minnesota and Pennsylvania have already invested heavily in municipal waste incineration, making the region’s other states more likely to adopt RNG through landfill gas recovery.[viii]

Many other feedstocks exist, and new sources in the region may become apparent as SAF pathways mature. The abundance of feedstocks is only a part of a successful SAF value chain. Resources and crude wastes must be managed effectively down the value chain to have a viable SAF pathway.

Existing Infrastructure

SAF plants require specialized infrastructure to ship, store, and process feedstocks into jet fuel. Developing new pipelines and refineries is capital intensive — a similar obstacle to expanding many energy transition technologies. One of the key advantages of SAF is its versatility to fit into established supply chains. The need for new infrastructure and capital is lessened, while the value of current systems is stretched.

The vast network of ethanol supply chains in the Great Lakes and Midwest can be tapped for SAF refinement. The ATJ pathway benefits from its maturity and ethanol’s economy of scale. Key infrastructure and learnings used in ethanol refinement can be leveraged for a more profitable SAF production pathway. Incorporating SAF into the jet fuel mix requires a series of transport modes, storage, and blend points that are currently used for ethanol-derived SAF. Aside from up-front capital to finance these operations, regulatory standards are in place at each point, adding further burden to the startup costs and timeline.[ix] These types of correlated relationships between supply chains can help leapfrog solutions and expedite the scaling of SAF in the Great Lakes.

Financial incentives depend on individual state policies, while geographic location will determine access to feedstocks and supply chains. Energy supplier World Energy Paramount capitalized on the concept of converting well-located refineries into biofuel plants. Its California facility is built on existing refinery infrastructure with a turnkey-like quality for many of the processes. Fuel storage, truck loading bays, rail connections, and pipelines were all transitioned to SAF and biofuel production.[x] Fuel is now shipped and sold to airlines at the Los Angeles International Airport to support local SAF demand.

Illinois is home to O’Hare International Airport in Chicago – the fourth-busiest airport in the United States by passenger volume in 2022.[xi] Aside from being a major source of demand, the scale of O’Hare means existing infrastructure can accommodate more SAF. A study by the National Renewable Energy Laboratory (NREL) suggests a successful dynamic between Great Lakes SAF production and supply for O’Hare’s fuel needs. The study found that a combination of local feedstocks could replace up to 55% of conventional jet fuel at O’Hare with SAF. Carbon reductions compared with a specific type of jet fuel known as Jet A could be 86% lower, making Great Lakes SAF a competitive fuel on the market.

Two experienced names in biofuel, LanzaJet and Marquis SAF, have keyed into the region’s ethanol supply chain to produce ATJ and biodiesel in Illinois. When completed, the facility will supply 120 million gallons of biofuel annually, with much of the SAF portion sold to O’Hare as well as Chicago’s other international airport, Midway. The location was a strategic move by developers, not only because of the proximity to local demand centers but also because of access to waterways, railroads, and highway systems for transport.[xii]

Transportation

Each stage of transporting feedstocks to biorefineries and SAF to aircraft introduces embodied carbon, reducing eligibility for financial incentives while introducing higher logistics costs. The NREL study on O’Hare feedstocks reflects this by using parameters of 50, 100, and 200 miles from the airport to determine feedstock viability. Carbon intensity–based incentives can be diminished because spatially unfavorable feedstocks add to the life-cycle carbon. The IRA incentivizes lower-carbon SAF through Section 40B, which includes a tax credit of $1.25 per gallon of SAF produced with life-cycle carbon savings of 50% or greater compared with conventional jet fuel (89 grams CO2e per megajoule), plus $0.01 for every percentage above the minimum.[xiii] SAF plants deal with millions of gallons of biofuel annually, making every opportunity for supply chain decarbonization a valuable lever.

The Great Lakes is already host to an advanced network of shipping and logistics that can be used to support competitive SAF production. The St. Lawrence Seaway allows for goods to be shipped in bulk to the Atlantic market with less carbon intensity than ground options. The same is true for the Mississippi River system, which would connect biorefineries to the massive petroleum networks in the Gulf Coast and ultimately through the Panama Canal to the Asia-Pacific market.

There are numerous ports along the Great Lakes (Figure 2) that are equipped to accommodate 1 million tons or more of commodities per year. Two ports, in Duluth, Minnesota, and Toledo, Ohio, contain grain elevators that could be used for handling biomass feedstock from suppliers.[xiv] The Great Lakes ports have historically had the capacity to deal with fuel commodity exports. The region shipped 1.3 million short tons of diesel and gasoline in 2019, up from levels in the 1990s but still far lower than the 3 million recorded almost 45 years ago in 1979. The gap from previous highs shows that the fuel shipping capacity of the region could meet initial export demand for finished products if needed.

Figure 2: Major Great Lakes ports and the type of commodities handled

Connecting feedstocks and fuel to value chain partners also relies on extensive ground freight. The Chicago regional freight system is a hub for shipping, with $3 trillion of goods passing through every year. Its location bridges eastern and western railroads where 50% of all intermodal trains and 25% of all freight trains travel annually.[xv] Rail is a relatively low-carbon means of shipping and should be prioritized for long freight distances in the SAF value chain. When the tracks end, trucks can utilize the 10 interstate highways in Illinois connecting to regions of high feedstock potential.

Offtake Agreements Can Ripen Great Lakes SAF Potential

Airlines are setting their own targets for introducing SAF into their portfolios and securing their supply lines through offtake agreements. Offtake agreements take place between fuel producers and buyers to establish a source of supply and demand. Delta Air Lines announced a target of 10% SAF in its flights by 2030, translating to 400 million gallons per year. Delta secured an offtake agreement with biofuel company Gevo Inc. for 75 million gallons of SAF per year to prepare for the 2030 target, just a fraction of Gevo’s total annual agreements worth 375 million gallons.[xvi]

O’Hare Airport hosts an SAF procurement venture led by United Airlines. Its partner bioenergy producers, helped by an injection of $50 million venture funding, aim to produce 135 million gallons of SAF annually to supply the Chicago–Denver flight hubs.[xvii]

The global growth in SAF demand toward 2050 compared with limited geographies producing SAF illustrates the need for a market-based system to deliver fuel benefits across the world. Registries for accounting SAF certificates (SAFc) are in place to solve the connection challenge and are quickly maturing as more SAF comes to market. SAF certificates are produced per ton of drop-in fuel and ideally consumed in local airports closer to the fuel blending point. Commercial and private customers can purchase these SAFc to reduce their Scope 3 emissions from flights, even if the journey itself does not use SAF. The market-based concept is similar logic to renewable energy credits: produce renewable energy in regions with the best availability of resources (hydro, wind, solar) and allow market players to purchase blocks for their own accounting. The system incentivizes efficient SAF production by removing the geographic boundaries from customer demand.

[vi] US Energy Information Administration. 2023. U.S. Fuel Ethanol Plant Production Capacity. https://www.eia.gov/petroleum/ethanolcapacity/

[vii] US Department of Energy. 2021. Global Ethanol Production by Country or Region. Alternative Fuels Data Center. https://afdc.energy.gov/data

[viii] US Environmental Protection Agency. 2023. Landfill Technical Data. https://www.epa.gov/lmop/landfill-technical-data

[ix] Moriarty, Kristi, and Allison Kvien. 2021. U.S. Airport Infrastructure and Sustainable Aviation Fuel. National Renewable Energy Laboratory. https://www.nrel.gov/docs/fy21osti/78368.pdf.

[x] Los Angeles County Economic Development Corporation. 2022. Advanced Alternatives: World Energy Paramount Renewable Fuels Project. Institute for Applied Economics. laedc.org/wpcms/wp-content/uploads/2022/06/LAEDC_AlpineReport_FINAL_rvs-06.20.2022

[xi] Federal Aviation Administration. 2023. Preliminary CY2022 Commercial Service Airports, Rank Order. faa.gov/sites/faa.gov/files/2023-06/preliminary-cy22-commercial-service-enplanements

[xii] LanzaJet. 2022. LanzaJet and Marquis Sustainable Aviation Fuel (SAF) partner to build an integrated Sustainable Fuels Plant in Illinois. www.lanzajet.com/category/news/

[xiii] Internal Revenue Service. 2023. Sustainable Aviation Fuel Credit; Registration; Certificates; Request for Public Comments. www.irs.gov/pub/irs-drop/n-23-06.pdf

[xiv] Congressional Research Service. 2023. Shipping on the Great Lakes and St. Lawrence Seaway: An Update. https://crsreports.congress.gov/product/pdf/R/R47550

[xv] Chicago Metropolitan Agency for Planning. 2018. Maintain the region’s status as North America’s freight hub. https://www.cmap.illinois.gov/2050/indicators#mobility-indicators

[xvi] International Civil Aviation Organization. 2023. Tracker of SAF Offtake Agreements. https://www.icao.int/environmental-protection/GFAAF/Pages/Offtake-Agreements.aspx

[xvii] United Airlines. 2023. United, Tallgrass, and Green Plains Form Joint Venture to Develop New Sustainable Aviation Fuel Technology Using Ethanol. www.united.com/en/aw/newsroom/announcements/cision-125256

Economic Impacts

SAF development can present economic benefits for the community and region. The value chain to deploy SAF provides a long-term fixed revenue stream and employment for regional stakeholders. While the emerging bioeconomy may partially drive its own development, meeting SAF deployment targets will require a skilled workforce, public–private partnerships, and unique industry collaborations.

Job Creation Potential and Workforce Development Opportunities

The US Department of Energy’s Bioenergy Technologies Office (BETO) assists in promoting awareness of and addressing gaps in the current workforce. The expertise that already exists in certain sectors can translate to many of the operations of SAF production.

The value chain to produce SAF is extensive and will require new job creation that expands across the economy. The new jobs created will be available for the broader workforce, with positions needed from early and mid-level careers to advanced roles and specialists. BETO expects some of the highest job growth in the areas of:

- Biomass and hydrogen production and logistics

- Facility operation and quality control

- Research and development

- Feedstock production in farming communities

- Construction, engineering, and manufacturing

An examination of the job market in the biorefinery sector shows that the Great Lakes and Midwest are above the average location quotient compared to the rest of the country (Figure 3). States that fall below the national average, such as Michigan and Wisconsin, will need to scale their biorefinery workforce to fully experience the benefits of a Great Lakes bioeconomy.

Figure 3: Biorefinery employment statistics compared to the United States averge

Job figures for biorefineries vary based on the technological pathway for SAF (Figure 4). Employment projections for each pathway focus on upfront labor for development and fixed labor for operations and management. The ATJ refinery can provide the most job opportunities during both development phase and post completion.

Figure 4: Projected job creation depending on SAF plant design and delineated by support sector

Public-Private Partnerships and Research Institutions Driving SAF Innovation

A skilled, SAF-producing workforce needs an entire network of collaborations to scale. Public research partnerships are being used to drive innovation and knowledge centers for the industry. In 2007, the US Department of Energy endorsed a joint effort between the University of Wisconsin and Michigan State University with a $125 million grant for the formation of the Great Lakes Bioenergy Research Center (GLBRC). The GLBRC conducts a plethora of biofuel research and tool development, building knowledge centers around an emerging bioeconomy. Prospective SAF developers can even use the center’s Biomass Utilization Superstructure tool to evaluate new and existing biofuel strategies.[xviii]

Since the Agriculture and Food Research Initiative is a grant program of the National Institute of Food and Agriculture, over $183 million has been awarded for Coordinated Agricultural Projects (CAPs). The CAPs are targeted toward rural regional development for, among other things, biofuel production from non-food-competitive agriculture. Of the several CAPs supported by the USDA, three span states within the Great Lakes.

Figure 5: Map of the CAPs funded through the USDA

The Integrated Pennycress Research Enabling Farm & Energy Resilience (IPREFER) project includes public–private collaborators from Illinois, Minnesota, Ohio, and Wisconsin. The CenUSA project includes Midwestern states and research perennial grasses as biofuel feedstocks. The Northeast Woody/Warm Season Biomass Consortium (NEWBio), hosted by Pennsylvania State University, includes partnerships with institutions in New York and Ohio.

SAF developers at Fulcrum Bioenergy have started groundwork for the Centerpoint refinery in Gary, Indiana, to produce SAF from municipal waste. The company expects 700,000 tons of waste to be diverted to the facility every year. The plant will use one feedstock processing facility in Illinois and one in Indiana, while the main fuel plant will be in Gary’s industrial zone. Annual SAF production is estimated at 31 million gallons. The project is expected to support 1,000 construction jobs followed by 200 permanent jobs when completed in 2026. Total economic investment is anticipated to weigh in around $800 million.

[xviii] Great Lakes Bioenergy Research Center. 2023. GLBRC Data and Tools. https://www.glbrc.org/data-and-tools

Policy Landscape and Supportive Measures

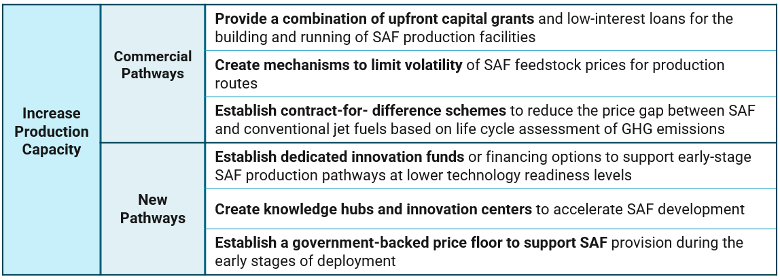

Public policy has significantly influenced the growth of biofuels for transportation and the scaling up of renewable energy industries like wind and solar. In the United States, at the federal level, two policies are critical for an SAF market at scale: the Renewable Fuel Standard (RFS) administered by the US Environmental Protection Agency and the IRA. The RFS has no provisions for power-to-liquid SAF and has mechanisms that lead to intersectoral competition. The IRA, when stacked with other credits, would narrow — though not completely close — the premium gap with conventional jet fuel. At the state level, only a handful of states have low-carbon fuel standards (LCFSs) that are conducive to the development and growth of an SAF market. More states are considering adopting similar standards; however, intersectoral competition is a key issue in these standards.

Figure 6: States with active SAF policy support and those with policies under consideration

Four of the Great Lakes states are considering LCFS policies that would include support for SAF (Figure 6). Illinois has enacted an SAF purchasers’ credit (SAFPC) that can be combined with other incentives. From July 2023 to December 2032, the SAFPC provides $1.50 per gallon of SAF used or purchased in Illinois.[xix]

Other favorable SAF policies have been enacted through bipartisan legislation in the Great Lakes region. The most recent of these policies was led by Senators Tammy Duckworth (D-IL) and Deb Fischer (R-NE), backed by other senators, to put forth the Sustainable Aviation Fuels Accuracy Act of 2023. The act endorses the use of GREET as the accepted way to account for life-cycle emissions of SAF fuel — a methodological win for domestic agriculture and industry.

Regional and State-level Initiatives Supporting SAF

To effectively incentivize SAF deployment, state-level interventions must go beyond demand-side support mechanisms like the LCFS. Interventions should promote supply-side development as well as demand-side, while keeping to a framework for a predictable SAF market. Increasing SAF supply will require investments in infrastructure and legislation to lay out standards and expedite permitting. Other than financial incentives, demand-side support comes from government mandates and procurement.

This research provides a unique policy gap analysis of selective policies focusing on the SAF industry at the federal level and in the Great Lakes region to better understand what regional policymakers can do to ensure local workers and communities are not left behind. It utilizes a typology of industrial policies used globally in similar technology transitions, relying especially on a novel framework developed by the Organisation for Economic Co-operation and Development.

Broadly speaking, “industrial policy” refers to any goal-oriented state action whose “purpose is to shape the composition of economic activity,” in this case with specific reference to the SAF supply chain. Although there is a range of policy instruments that can be used to improve strategic or economically important sectors, these policies can be grouped into four primary domains: strategic coordination, production instruments, demand-pull mechanisms, and cross-sectoral interventions. Within each domain, the policy instruments are grouped based on their similarities:

- Strategic coordination: Any effort of policy governance such as coalitions and sectoral competitiveness assessments. Often, policymakers choose to commission industry strategy or technology roadmaps to guide and complement the other categories of industrial policy intervention. These would usually be accompanied by a vision statement and a set of objectives and targets.

- Production instruments: Affect the economics of firm-level production and investment decisions for individual firms within the target sector. This can include a range of financial incentives — such as subsidies, grants, or tax credits — to promote research, development, and demonstration (RD&D) activities or otherwise facilitate additional investment, particularly in novel technologies. Production instruments can also affect firm performance through the provision of key inputs, such as skilled labor, or through addressing supply chain gaps.

- Demand-pull mechanisms: Apply to the consumption of the product(s) produced by the industry. These can include tax breaks and rebates, mandates, public procurement, and certain product standards and definitions.

- Inputs: Affect the whole industry through regulations governing the allocation of production factors, including land, capital, and labor. These interventions can also include cross-sectoral policies that affect the target industry, such as competition or trade policy; policies that affect supply chain segments that bookend the industry; and the development of enabling technologies crucial to SAF.

Figure 1: SAF Policy Gap Analysis in the Great Lakes

As in other emerging sectors, like the EV supply chain and near-zero-emissions steel, the federal government is far ahead of Great Lakes states in developing a coordinated industrial strategy for SAF. Within the region, no state stands out, but rather different states have different strengths. Illinois is a leader in incentives to assist facility operation, for example, thanks to the Invest In Illinois Act which creates an additional $1.50/gallon incentive for SAF in the state. Meanwhile, Minnesota is leading in its incentives to expand supply infrastructure due to its zero-interest loan program to small businesses for biofuel capital expenses. Every state in the region has holes it should be looking to plug if it wants to be internationally competitive in this sector, and each should look to its neighbors and the federal government for inspiration and coordination opportunities in this process.

[xix] Illinois Department of Revenue. 2023. New Sustainable Aviation Fuel Purchase Credit Enacted. tax.illinois.gov

Challenges and Next Steps

The Sustainable Aviation Fuel Grand Challenge is aptly named due to the hurdles that need to be addressed to build this industry. Aside from the price premium incurred by SAF production, other barriers range from investment opportunities to moral arguments of food versus fuel.

Identification and Analysis of Economic and Industrial Challenges to SAF Development in the Great Lakes Region

Several SAF feedstocks come from primary sources rather than waste or by-products. Corn that could otherwise be used as food is a key ingredient in many SAF blends and will continue to play an important role in ATJ fuel. There are also fears that arable, food-producing land could be converted for biofuel. These concerns unite environmentalists questioning land-use changes and agricultural producers worried about the impacts on their animal feed supply.

Competition among sectors for sources of low-carbon feedstocks will be a hurdle for incentivizing SAF. Currently, the road sector uses the majority of renewable fuels. Higher production costs associated with SAF output and more limited demand uptake are disincentives for producers to redirect feedstock to aviation. Nationally, and in many states, there is typically little intersectoral coordination — often reflected in their respective renewable fuel–related policies, which compounds the challenge.

Pathways for refined SAF vary greatly in terms of technology-readiness levels, with HEFA and ATJ already in production while many others await certification from ASTM. HEFA, using a more limited feedstock like waste fats, oils, and greases, can fill supply to an extent, but ultimately other technologies like PtL are needed to expand along with their respective supply chains.

The transition to SAF requires major investment. Although existing infrastructure may reduce some capital investment, it may be necessary to build or remodel entire processing facilities and develop entire supply chains. Current investments represent a fraction of the required annual investment, and current announced investments are not on track to meet SAF Grand Challenge targets (Figure 7).

Figure 7: Announced SAF supply by megaton (Mt) and billions of gallons (Bgal) through four pathways

Strategies to Mitigate Risks and Address Challenges

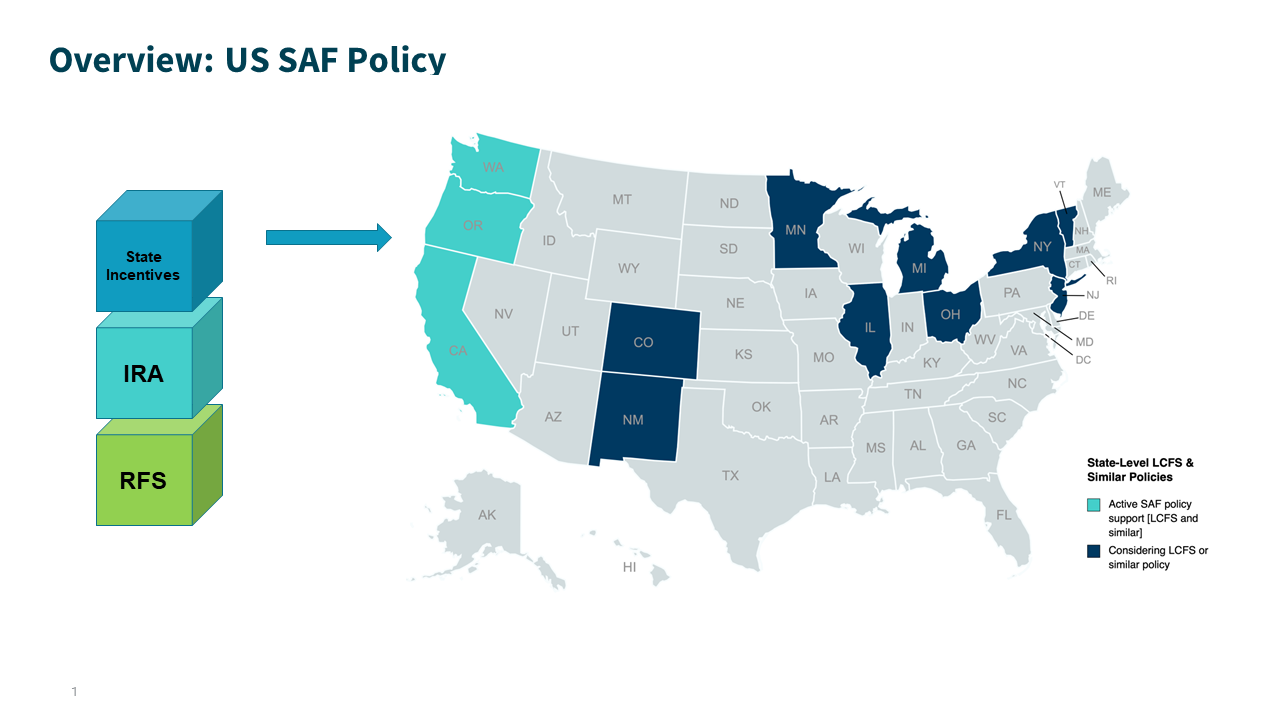

The assorted challenges to SAF deployment can be met through levers that increase availability of feedstock and production capacity. On the supply side, prioritizing feedstocks toward SAF while stimulating production incentives can ensure enough feedstocks are available to meet future refining demands.

Prioritizing SAF development requires a balance of removing mandates that incentive non-SAF fuel pathways using the same feedstocks, while providing another path forward for those pathways. Road transport is a common example where feedstocks are used to refine biodiesel as a drop-in fuel but would be more effective to allocate toward industries with fewer alternatives for decarbonization, such as aviation.

Stimulating the production of feedstocks will ensure that SAF is produced at quantity, but also able to scale with increasing demand. Financial mechanisms can be drafted to target regional feedstock development and incentivize growing crops that support a more sustainable SAF blend. When shifting crops into a SAF feedstock, it’s vital to prioritize feedstocks that aren’t currently in competition for food production. Agricultural land conversion will need upfront training and assurances for farmers that there will be a market for their crops. Assurances go beyond mandating market demand because the chain of custody for SAF feedstocks must be traceable back to the farm. Creating a digestible yet robust method for tracking feedstock attributes, such as carbon intensity, has been a challenge that the private sector is starting to fill.

Production capacity gains can be made through concretizing the near-term commercial pathways and supporting development of new pathways for scaling beyond 2030. Triggering the growth of commercial pathways requires upfront assurances on the financial prospects. Low-interest loans or grants coupled with fuel tax credits can help improve the chances of commercial SAF plants reaching fruition.

New pathways for SAF are being carefully explored as the market reveals more demand in the future. Nascent technologies can be matured through innovation funding and the establishment of knowledge hubs (i.e., IPREFER). Financial support mechanisms for novel refineries are crucial to ensure scalability while competing not only with conventional and renewable fuels, but with possibly other more reputable SAF technologies as well.

Conclusion

The identification of potential growth areas and emerging opportunities for SAF within the Great Lakes region has highlighted pivotal factors that will shape the trajectory of the industry.

The significance of hubs boasting accessible infrastructure capable of integrating transportation and industrial facilities cannot be overstated because they underpin the marketability and distribution efficiency of SAF.

The regional availability of feedstock is equally crucial in terms of both quantity and strategic placement, rendering the region’s SAF competitive on a broader scale. Moreover, the alignment of regional biofuel legislation with the necessary feedstock incentives and demand-side mechanisms provides a robust foundation for SAF scalability in the region.

Looking forward, the recommendations for future actions, investments, and policy support underscore the potential to harness existing systems to propel a cost-effective and sustainable bioeconomy. By leveraging the RD&D capabilities of knowledge hubs, a bridge can be built between innovative research and successful project development.

In the face of these prospects, stakeholders must collaborate synergistically to steer the course of SAF development within the Great Lakes. The convergence of favorable conditions, supportive legislation, and proven technologies offers a unique opportunity to not only transform the aviation sector but also catalyze positive environmental and economic impacts on a regional and global scale.