Report | 2024

The Great Reallocation

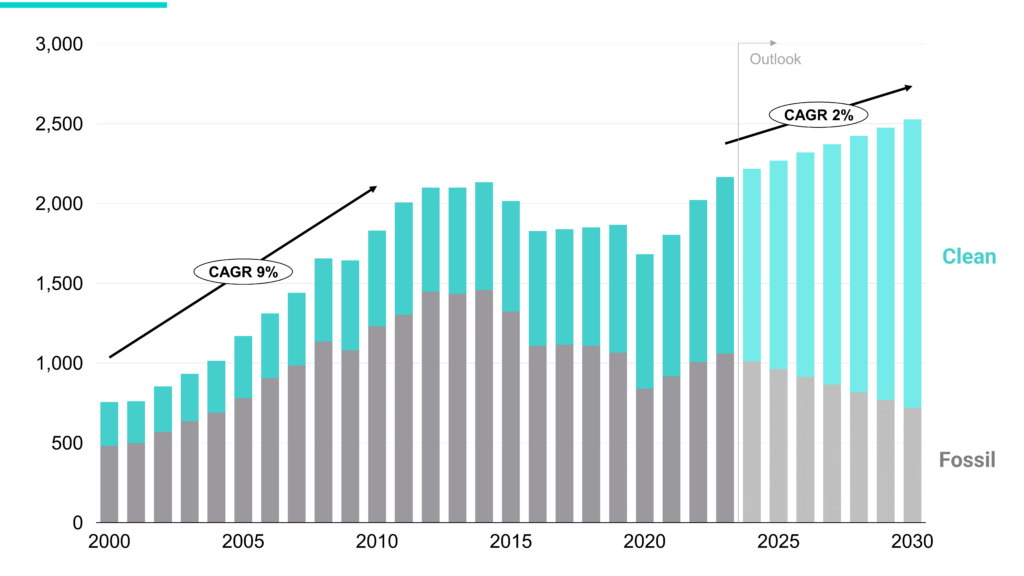

Capital expenditure on energy production

In The Great Reallocation, RMI shows that contrary to popular belief, the buildout of renewable energy supply does not require a surge in capital expenditure (capex). As fossil fuel capex falls, the net growth in capex is only 2 percent per year, in line with the past seven years, and much lower than in the decade after 2000.

Financing the energy transition is a story of capital reallocation. Over the next seven years, renewable capex will roughly double and fossil fuel capex will roughly halve under core IEA scenarios. Falling fossil fuel capex will therefore provide half of the growth in renewable capex.

This capital reallocation is very achievable. The required growth in energy supply capex of 2 percent is lower than expected global GDP growth of 3 percent, and lower than the annual increase in energy supply capex from 2000–2010 of 9 percent. Given that the capital formation in 2022 was $27 trillion, the additional capex on energy supply would constitute only 1 percent of global capex.

Achieving the achievable still requires work. The key now is to ensure that capex moves from generation to grids, and from developed markets to emerging markets. The primary impediments to change are policy and expertise rather than the volume or availability of capital.

Investment in energy supply under IEA’s APS (billion $)