Electric car in the city

After the Pandemic, Use EVs to Absorb Spare Utility Capacity

Before the coronavirus pandemic hit, demand for electricity had already been flat or declining on most utility grids in the United States for a decade. But with 297 million people—90 percent of the US population—now under “shelter in place” or “stay at home” orders, the load on utility systems is declining even more. And that creates a significant challenge for the US utility sector, whose business model is essentially based on growth. Fortunately, the need to decarbonize our economy presents new opportunities to increase electricity demand beneficially. And doing that—particularly by electrifying transportation—has never been cheaper or easier to do than it is now.

Over the past several years, policy recommendations for combating climate change have started to converge around a prescription to “electrify everything,” including transportation, space heating and cooling, water heating, and cooking appliances. This is because energy transition—shifting energy demands from individual devices that directly burn oil products and natural gas to the power grid—creates a pathway to decarbonizing everything: As we decarbonize grid power by replacing fossil-fueled power plants with wind, solar, and other renewable generators, we decarbonize everything that uses that power.

Electrifying everything would obviously increase demand for power. But we wondered: Does the decline in grid power demand create a new opportunity to accommodate these new loads?

Crunching the Numbers on the Changing Demand

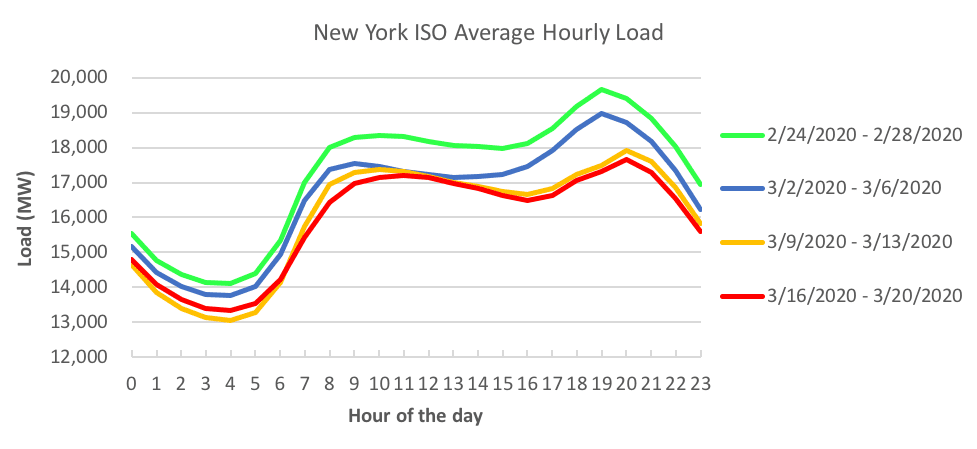

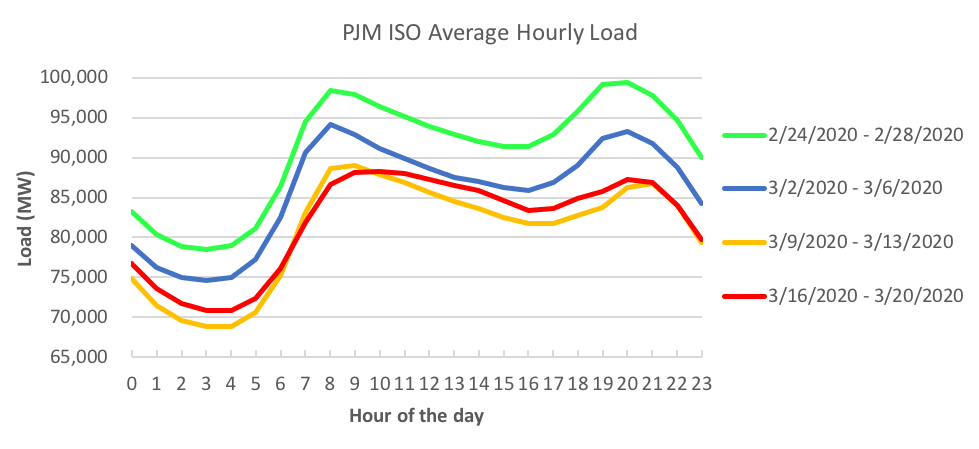

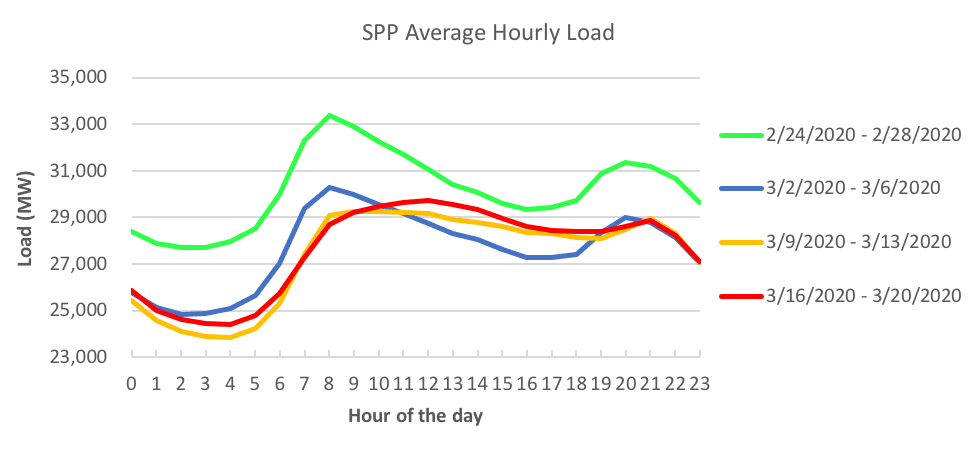

We crunched the numbers on the average hourly load on six of the largest wholesale electricity markets (ISOs and RTOs) in the United States, to see how demand changed week by week since we started staying home. All six of these markets showed three consistent trends. First, total electricity demand clearly fell over the course of the four weeks we analyzed, which would be consistent with reduced business activity. Second, the daily curve of power demand in each market flattened somewhat, with the recent load curves showing less difference between the peaks and valleys than they did before the lockdown orders. The reason for this is not immediately clear, but flatter load curves are easier for utilities to manage, and so they result in lower costs to customers. And third, the overall load curves for each system shifted slightly, with the morning and evening peaks occurring slightly later in the day in the fourth week than in the first. This could be an effect of people simply shifting their activities to later in the day during the lockdown than before it.

The most significant observation we can make, however, is simply that power demand fell significantly during the outbreak, both week-over-week during our study period, and year-over-year. Which raises the question: Will power consumption return to pre-pandemic levels when the pandemic is past us?

It’s clearly too soon to answer that question, since the US infection rate has yet to peak. We don’t know how extensive the damage to the US population and economy will be from this pandemic. But given the extent of lost jobs, and the millions of US businesses that have announced layoffs or furloughs, it may be years before the US economy, and electricity demand, recovers to its pre-pandemic levels.

Effects of Excess Capacity on the Grid

One thing is certain: The coronavirus shutdown will increase the spare capacity (known as “reserve margin” in utility jargon) on utility grids. That spare capacity was already excessive in many of the markets we studied, because although load growth generally has been flat or declining for a decade, most utility systems continued to expand their capacity throughout that period.

This fact alone will have wide-ranging effects. Regulated utilities are likely to shelve capacity expansion plans, and a reduced expectation for fresh investment in generation, transmission, and distribution assets will likewise reduce their expectations for revenue growth. Utilities operating in deregulated markets will see their revenues decline along with declining load as they enter a heretofore unprecedented period of austerity. All of these effects will make utilities eager to capture any increase in load.

Increasing Load by Electrifying Everything

Electrifying everything presents an obvious opportunity to provide new load to utilities. Electrifying transportation and space heating will be the two largest opportunities for electricity load growth, by far, as the US begins to recover from the pandemic. Replacing all light-duty vehicles in the United States with electric vehicles (EVs) would require about 1,000 TWh of additional electricity per year under a generally accepted estimate, or an increase of about one-quarter of total US electricity demand. Suddenly, the essential question before us is not when or whether to electrify everything, but rather, how to best integrate the new loads on the electricity grid—particularly the loads of electric vehicles and space heating—so that they act as flexible assets on the grid, and don’t increase peak demand, which is expensive to serve. Our reports identify several best practices for beneficial EV-grid integration.

Utilities and their regulators should be thinking now about changing strategies, from ones focused on capacity expansion, to ones focused on electrifying everything and stimulating the growth of these emerging sectors. Investments in charging infrastructure can also serve as stimulus programs for states trying to recover economically. This is particularly true for electrifying transportation, which can be done much more quickly and easily than retrofitting the built environment and all of its appliances. As we begin to think about how to restore economic health after the pandemic, making investments in residential, workplace, and public charging infrastructure for electric vehicles is a no-brainer centerpiece for any utility recovery and investment plan.